Weekly Market Wrap: Small Correction for First Week of 2024

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Subscribe for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Market Recap & Upcoming Week

2023 concluded with a minor pause in the stock market’s robust upward trajectory.

Despite the S&P 500’s moderate decline last week, the year was marked by a notable 16% rally in its last two months.

This pullback is attributed to early-year portfolio repositioning and a natural consolidation after such a substantial climb.

In the broader context, the outlook for 2024 is tinged with optimism, driven by expectations of favorable Federal Reserve interest rate decisions and a steady economic trajectory.

Nonetheless, the spirited rally into the new year has heightened expectations, potentially setting the stage for market sensitivity to any disappointing developments.

Fresh data on Federal Reserve policy intentions and labor market health emerged last week, indicating a resilient jobs market with a significant addition of 216,000 positions in December, maintaining a stable unemployment rate of 3.7%.

Despite this strength, a gradual softening is anticipated, marked by a reduction in job openings and moderated wage growth, which may temper consumer spending without pushing the economy into a recession.

Meanwhile, the Fed’s December meeting minutes suggest that while interest rate cuts are on the horizon, the market’s anticipation for an early-year cut may be overly optimistic, with policymakers erring on the side of caution and potentially postponing cuts until mid-2024.

Such a cautious approach could lead to short-term market volatility, viewed by some as a potential investment opportunity in anticipation of a supportive shift in Fed policy later in the year.

Investors entering the first complete trading week of 2024 should keep an eye on crucial economic indicators, with inflation data taking center stage.

The Consumer Price Index (CPI) from the Labor Department, a key measure of inflation for consumer goods and services, is scheduled for release on Thursday.

This will be closely followed by the Producer Price Index (PPI) on Friday, which provides insights into wholesale inflation and potentially signals future consumer price trends.

In addition to inflation data, the week will be significant for financial sector watchers as major banks begin to disclose their earnings.

Reports from industry heavyweights like JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and BNY Mellon will offer a snapshot of the banking sector’s health and set the tone for the earnings season.

Other important data slated for release include consumer credit figures, the federal trade deficit, wholesale inventories, and the National Federation of Independent Business (NFIB) Small Business Optimism Index, each contributing to a fuller picture of the current economic landscape.

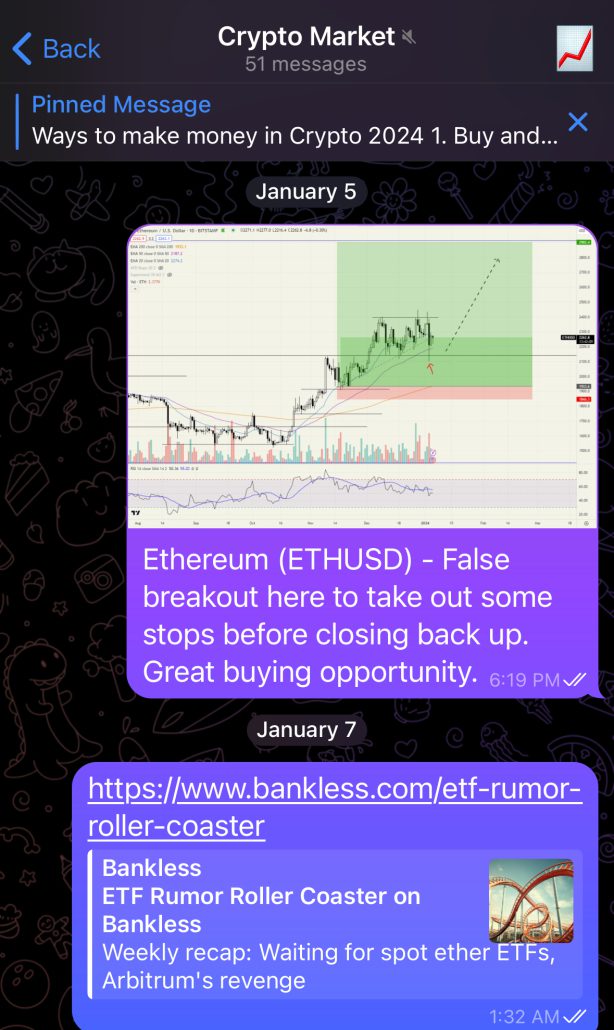

Daily Trading Signals (Highlights)

Join our community for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!