Weekly Market Wrap: Review of 2022 & Outlook for 2023

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

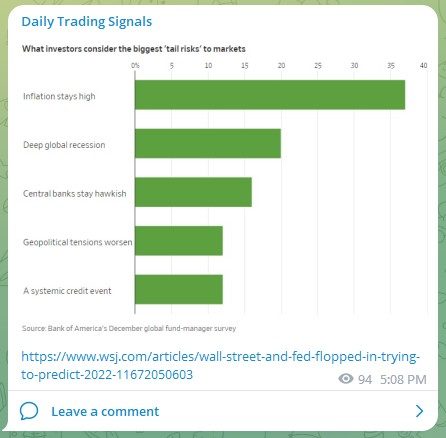

Looking back, 2022 has been challenging for the stock market and many analysts do not have high expectations for 2023.

There is a growing consensus among analysts that there will be a selloff in the first half of next year due to negative estimates for future performance.

However, some believe that the next year could present a good opportunity to buy before the Federal Reserve (Fed) potentially needs to lower interest rates in 2024 in order to support the economy during a recession.

To protect from downside risk, the more prudent approach is to hedge by investing in inflation-related themes, or by using fixed income products such as T-bonds or T-bills.

When the yields start turning down, it would be an early indicator to rotate back into the stock market, in time for the next major bull market.

To kickstart your 2023 trading & investing journey, join our “Daily Trading Signals” Telegram channel!

[Photo: Kolsay Lakes National Park, Kazakhstan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Special Report: Review of 2022 & Outlook for 2023

The global stock market has seen a significant decrease due to high levels of inflation and aggressive actions taken by central banks, particularly the U.S. Federal Reserve, to increase interest rates.

While the energy sector has performed well, some companies that benefited from the pandemic, like DocuSign, Roku, and Peloton, have struggled. The NASDAQ Composite index, which is heavily focused on technology, has dropped by about 33% this year.

The Fed has raised interest rates by 4.25% this year and Chair Jerome Powell has indicated that more work needs to be done to reduce inflation.

Goldman Sachs analysts predict that the Fed will further increase the benchmark interest rate to between 5.0-5.2%. Goldman strategists have also stated that they do not expect the Fed to lower the interest rate until the economy is at risk of entering a recession, which they do not expect to occur next year.

Even well-known companies like Meta Platforms, Tesla, and Amazon have seen significant declines in their stock prices this year, with declines of 65%, 65%, and 50% respectively.

While the decrease in the S&P 500 index this year has primarily been due to inflation and actions taken by central banks, analysts believe that negative estimates for future performance will contribute to further declines.

Currently, the consensus among analysts is that the S&P 500 will earn around $216 in 2023, but some more optimistic analysts predict earnings of around $220, representing only slight growth compared to 2022.

On the other hand, a group of bearish analysts believe that earnings per share (EPS) will decrease by about 10% to $200. Morgan Stanley and Bank of America have been particularly bearish, stating that the bear market in stocks will not end until the S&P 500 reaches a range of 3000-3400 later this year.

The current average price target for the S&P 500 for 2023, based on forecasts from 23 analysts, is 4,080.

Weekly Market Outlook Video

Weekly Market Outlook (25 December 2022)

Market is likely to be quiet this week due to Christmas and New Year holidays.

Watch out for any Santa Rally (last 5 days of the year and first 2 days of the new year), which might give a good shorting opportunity in the stock market.

Portfolio Highlights

Weekly Portfolio Updates (25 December 2022)

Added more short positions for stocks and REITs, and will continue adding more on any pullbacks.

Forex & Commodities Market Highlights

EURAUD – Watch to see if some consolidation zone forms here, followed by bullish price action.

USDCNY – With China opening up, the Yuan is strengthening, and this pair looks like it will be heading lower after breaking out from the bear flag/pennant pattern.

USDSGD – Looks like this is going to continue heading down to test the major support level, which is the bottom of the wide range.

CADJPY – And the downtrend continues, congrats to those who are also holding short positions! 💰🔥💪🏻

Stock & Bond Market Highlights

US100 (NASDAQ 100) – After dropping about 12% from the recent swing highs, it is now testing major support.

Currently, there is a good chance it will test previous lows and even break new lows.

If it manages to make a U-turn and break above the previous swing high of aounrd 12400, then there is a good chance of a market reversal.

https://www.wsj.com/articles/wall-street-and-fed-flopped-in-trying-to-predict-2022-11672050603

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!