Weekly Market Wrap: Rates Remain High But Stocks Remain Bullish?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Subscribe for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Market Recap & Upcoming Week

Last week’s economic updates presented a mixed picture, with January’s CPI and PPI data coming in higher than expected, causing concern among investors.

Despite this, the overall trend still points towards a favorable direction for inflation, with headline CPI at 3.1% year-over-year, slightly above forecasts but lower than the previous month.

Core inflation remained sticky at 3.9%. On the other hand, PPI inflation showed a year-over-year increase, suggesting that while producer prices are above expectations, they’ve decreased from the highs of 2022.

The data suggests inflation is moderating, albeit with complexities such as the significant role of shelter and rent in CPI figures.

Amid these inflation trends, the market’s expectations for Federal Reserve rate cuts have been adjusted, now anticipating fewer cuts starting possibly in June.

This adjustment aligns more closely with the Fed’s cautious approach, waiting for clearer signs of sustained inflation reduction.

Despite initial market reactions to the inflation reports, there’s a sense of stability as the focus shifts to the upcoming PCE inflation data, the Fed’s preferred inflation metric.

This data, along with the ongoing strength in the labor market and consumer spending, albeit with some signs of slowing, will be crucial in shaping the Fed’s policy direction in the coming months.

This week promises significant developments for investors and policy watchers, starting with a pause on Monday due to the Presidents Day holiday.

Post-holiday, the financial landscape buzzes with anticipation for a series of earnings reports from major companies such as Nvidia, Walmart, Home Depot, and Palo Alto Networks, alongside Intel’s inaugural conference highlighting its foundry business expansions.

These events are poised to offer fresh insights into corporate health and industry trends, potentially influencing market directions.

Adding to the week’s importance, the Federal Reserve is set to release the minutes from its January policy meeting, a move eagerly awaited for clues on future interest rate decisions.

This disclosure, along with speeches from Fed officials, will shed light on the central bank’s current economic assessments and monetary policy outlook.

Furthermore, the government’s discussions on new student loan repayment schemes are on the agenda, potentially impacting broader economic perspectives and consumer sentiment.

Daily Trading Signals (Highlights)

Coinbase (COIN) – After correcting almost 40% in the last few weeks, prices have reach a major support level.

Seems like a good low risk entry opportunity with a stoploss around $110, and first target around the previous high.

Coinbase (COIN) – Wow this is one of our best trades this year, in just 7 trading days, we made 50% returns!

Congrats to everyone who took this trade with us! 👏🔥💰

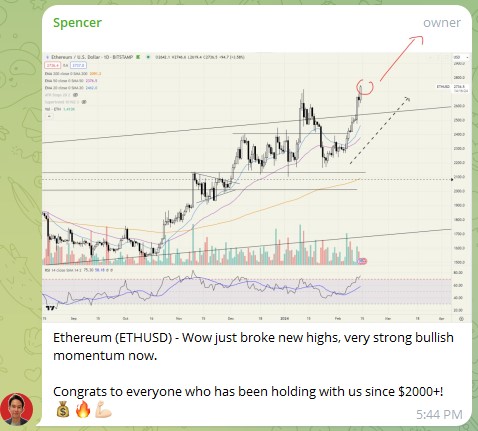

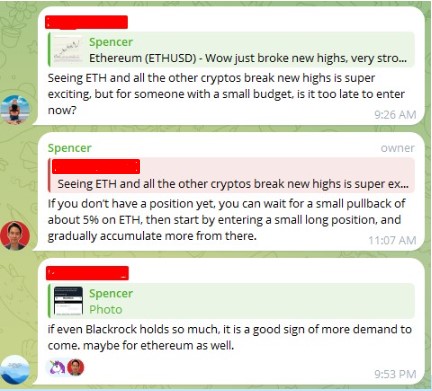

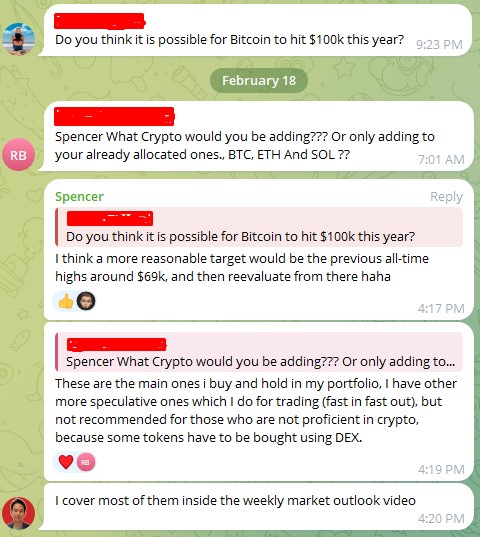

Ethereum (ETHUSD) – Wow just broke new highs, very strong bullish momentum now.

Congrats to everyone who has been holding with us since $2000+! 💰🔥👍

Join our community for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!