Weekly Market Wrap: Inflation Fears are Back!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Stocks declined after January’s producer price index, which is another inflation gauge, increased by 0.7% in the month, higher than the expected 0.4%.

This follows reports that January’s consumer price index and retail sales were both higher than anticipated, suggesting that the Federal Reserve may need to do more to curb inflation.

In addition, initial jobless claims unexpectedly dropped in the week ending Feb. 11, according to the Labor Department’s report.

The decline in jobless claims indicates a tight labor market, while comments from Federal Reserve Presidents James Bullard and Loretta Mester advocating for an interest rate hike in March also weighed on stocks.

Investors should be aware that inflation may not return to normal levels quickly, which could result in more volatility in the market.

Stay tuned for real-time trading opportunities in our “Daily Trading Signals” Telegram channel!

[Photo: Khujand, Tajikistan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (12 February 2023)

After December’s inflation data was adjusted upwards, the market has been extra jittery, so next week’s CPI date release on Tuesday is going to have a very large significance on the stance of the Fed.

Portfolio Highlights

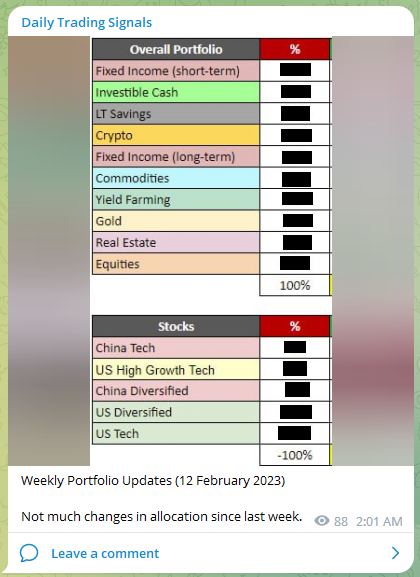

Weekly Portfolio Updates (12 February 2023)

Not much changes in allocation since last week.

Forex & Commodities Market Highlights

ERUCAD – Following up on this trade, congrats to all those who followed and shorted! The profit is currently about 200+ pips. 💰🔥💪🏻

The current price momentum looks very strong, and has a good chance of going further.

EURCHF – After the false breakout, the bears are back in control. This looks like a good shorting opportunity.

NZDCAD – Took longer than expected, but it finally hit the TP for about 300+ pips profit! 💰🔥💪🏻

USDSGD – Formed a small bull flag, which means good chance of another bullish leg.

Congrats to those who took this rebound trade! 💰🔥💪🏻

Gold (XAUUSD) – Following up on Gold, this is how it could play out. Wait for a good pullback to take a low risk short with the tight stop.

Stock & Bond Market Highlights

Wow the 6-month T-bills have hit 5% returns. This means the expected terminal rate of interest rates have gone up.

This was the smallest 12-month increase since the period ending October 2021.

Dow closes 400 points lower as hot inflation report, comments from Fed’s Bullard raise rate hike fears.

Cryptocurrency Highlights

Ethereum (ETHUSD) – How it breaks out of this most recent consolidation will most likely determine its fate for the rest of the year.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!