Subscribe for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Market Recap & Upcoming Week

Last week’s Federal Reserve meeting and subsequent press conference, alongside the release of updated economic projections, reinforced a dovish tilt in monetary policy.

Keeping the fed funds rate steady, the Fed signaled a multiyear rate-cutting cycle starting this year, with expectations to lower the rate to around 3.1% by 2026.

This announcement was met positively by the markets, driving stocks to new highs and softening Treasury yields.

The Fed’s upgraded economic outlook for 2024-2026 and continued assertion that inflation will gradually decrease bolstered confidence in a stable financial environment.

Additionally, global central banks, including the Bank of Japan’s historic rate increase, highlighted a global shift towards adjusting monetary policies.

This broadening market leadership, spurred by the anticipation of rate cuts and improved economic growth, suggests a healthy dynamic for continued investment opportunities.

This week, amidst a shorter trading period due to the Good Friday holiday, the financial markets are poised for a series of important updates.

Key among these are new inflation figures, insights into consumer sentiment, developments in the housing market, and a selection of significant corporate earnings reports.

Despite the holiday closure, the late-week release of the Personal Consumption Expenditures (PCE) index will be closely watched.

This data, crucial for the Federal Reserve’s interest rate decisions, will indicate if inflation is continuing its expected decline.

Additionally, the spotlight will be on earnings announcements from notable companies, including GameStop, Walgreens Boots Alliance, Cintas, Carnival, and Jefferies Financial Group, providing a pulse on various sectors of the economy as investors gauge market health and future trends.

Daily Trading Signals (Highlights)

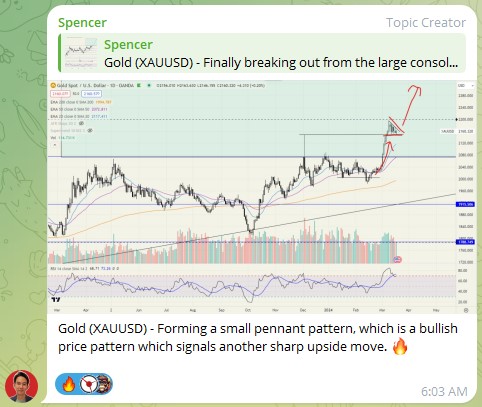

Gold (XAUUSD) – Just 2 days after i posted this, we saw an impressive 3% breakout!

Congrats to those who bought! 💪🏻🔥💰

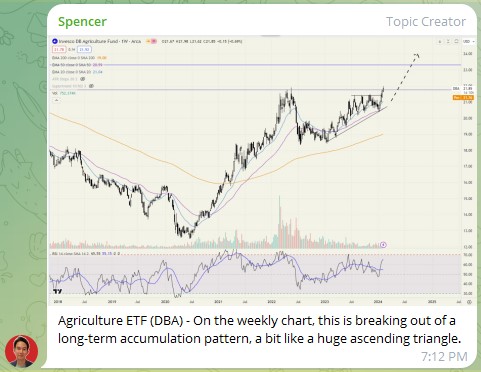

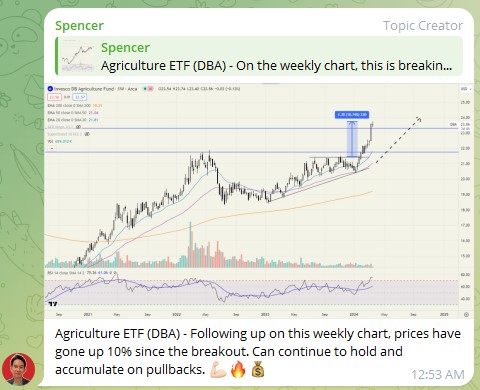

Agriculture ETF (DBA) – Following up on this weekly chart, prices have gone up 10% since the breakout. Can continue to hold and accumulate on pullbacks. 💪🏻🔥💰

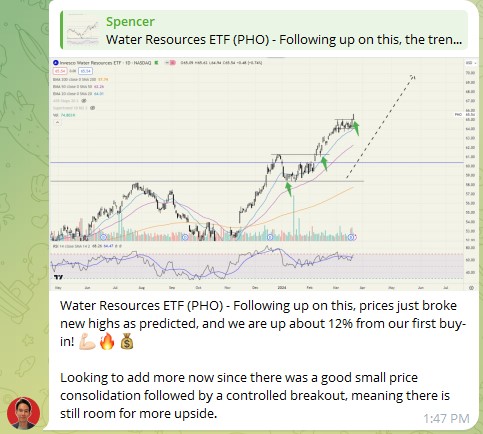

Water Resources ETF (PHO) – Following up on this, prices just broke new highs as predicted, and we are up about 12% from our first buy-in! 💪🏻🔥💰

Looking to add more now since there was a good small price consolidation followed by a controlled breakout, meaning there is still room for more upside.

Stock picks from our members:

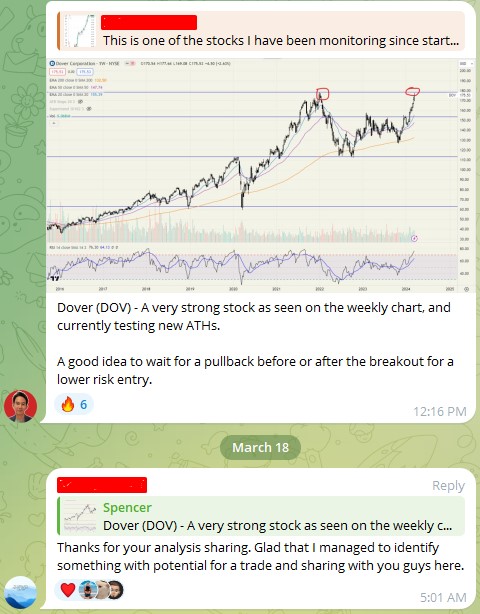

Dover (DOV) – A very strong stock as seen on the weekly chart, and currently testing new ATHs.

A good idea to wait for a pullback before or after the breakout for a lower risk entry.

Join our community for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.