For our “Daily Trading Signals”, we have now also included a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technicals, economics, and portfolio management:

Click here for our most recent market report (10 April 2023)

Click here to see the archives of all our past market reports

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

[Photo: Neuschwanstein Castle, Schwangau, Germany – See my full travel photo log from trading & travelling!]

Market Recap & Upcoming Week

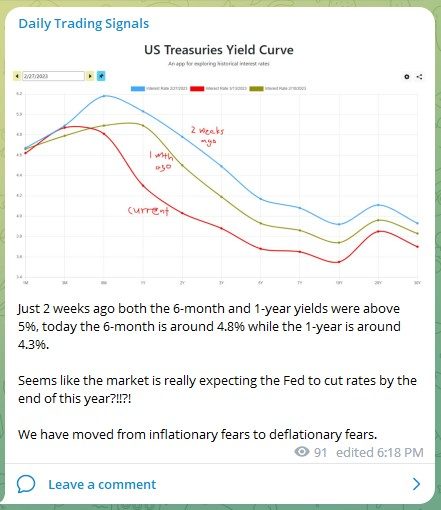

Last week, the S&P 500 and Dow Jones Industrial Average experienced fluctuations as inflation in March dropped to its lowest level in almost two years, increasing optimism among investors. The March CPI report showed falling energy prices, rising services prices, and a slowdown in food inflation. Investors should keep an eye on durable goods prices as their increase could signal more challenges for inflation.

Gold prices surged to their highest level of the year, reflecting a 13% increase year to date. Despite slowing inflation data, investors anticipate the Federal Reserve scaling back its rate-hiking campaign due to concerns about economic weakness. Used vehicle prices, which spiked in 2020-2021, started to drop in early 2022, but the not-seasonally-adjusted CPI for used vehicles increased by 1.0% in March, suggesting the drop in used vehicle CPI may be over.

Ethereum (ETH) broke to news highs, and the Shapella Upgrade successfully boosted the price of ETH, even though it enabled withdrawals from the Beacon Chain. Staking inflows have risen for four consecutive days, reflecting bullish sentiment towards Ethereum after its shift to a Proof-of-Stake protocol.

Singapore’s economy grew by a mere 0.1% year-on-year in Q1 2023 due to a decline in manufacturing, and the country risks entering a technical recession if growth continues to slow in Q2 2023. JPMorgan, Citi, Wells Fargo, and PNC Financial reported their results, with mixed outcomes for their stocks.

The International Energy Agency (IEA) warned of a larger deficit in the oil market due to surprise production cuts from OPEC’s leading members, which could send crude prices higher and worsen inflation.

In the upcoming week, earnings season will be in full swing, with reports from major companies such as Johnson & Johnson, Bank of America, Netflix, Lockheed Martin, Tesla, Morgan Stanley, IBM, American Express, and Procter & Gamble. Updates on the housing market, inflation readings from the U.K., eurozone, and Japan, and Q1 GDP figures from China will also become available.

Daily Trading Signals

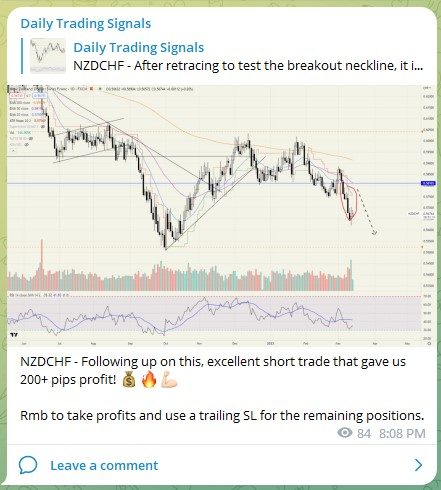

Here are some of the real-time signals and price alerts that were triggered during the week. There were a lot of profitable forex trades, but the biggest profits came from our trade on Ethereum, which has been up by more than 20%!

Ethereum (ETHUSD) – Short-term momentum is still very strong, as prices blew past $2,000.

Congrats to all those who took this trade! 💰🔥💪🏻

Can consider taking half profits and continue riding the uptrend.

Actually will probably go to $2k soon, so can wait a while more.

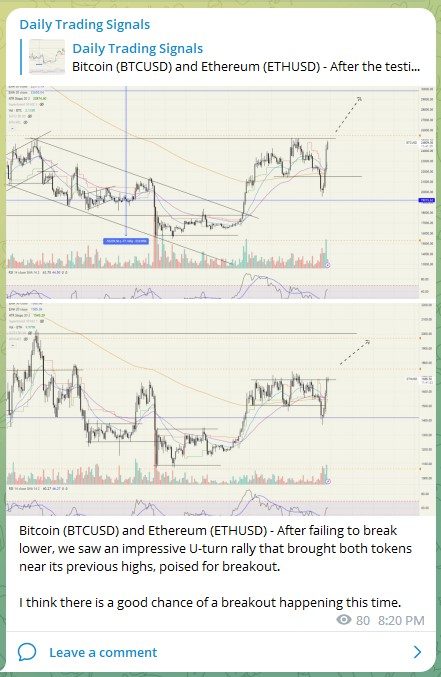

Bitcoin (BTCUSD) – Prices broke out from the symmetrical triangle, and above $30,000, which is an important psychological price level.

Looks like it will continue going higher.

USDCHF – Congrats to those who took this trade, I did not expect the TP to be hit that fast! 💰🔥💪🏻

There is strong support around 0.88, so you might want to consider taking half profits and trailing the rest.

USDSGD – Now that prices have broke down from the bear flag, I won’t be surprised if the prior low gets tested.

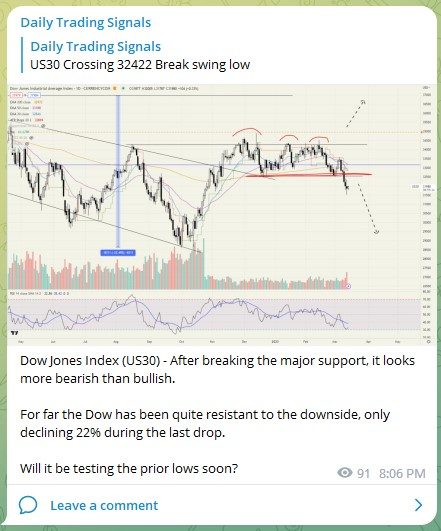

Dow Jones Index (US30) – Long shadows near the trendlines have so far led to price rejections and price moving to the opposite side of the price channel.

CHFJPY – Prices breaking out from a period of consolidation.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.