The morning star candlestick pattern is a bullish reversal pattern that appears after a downtrend in a financial security’s price.

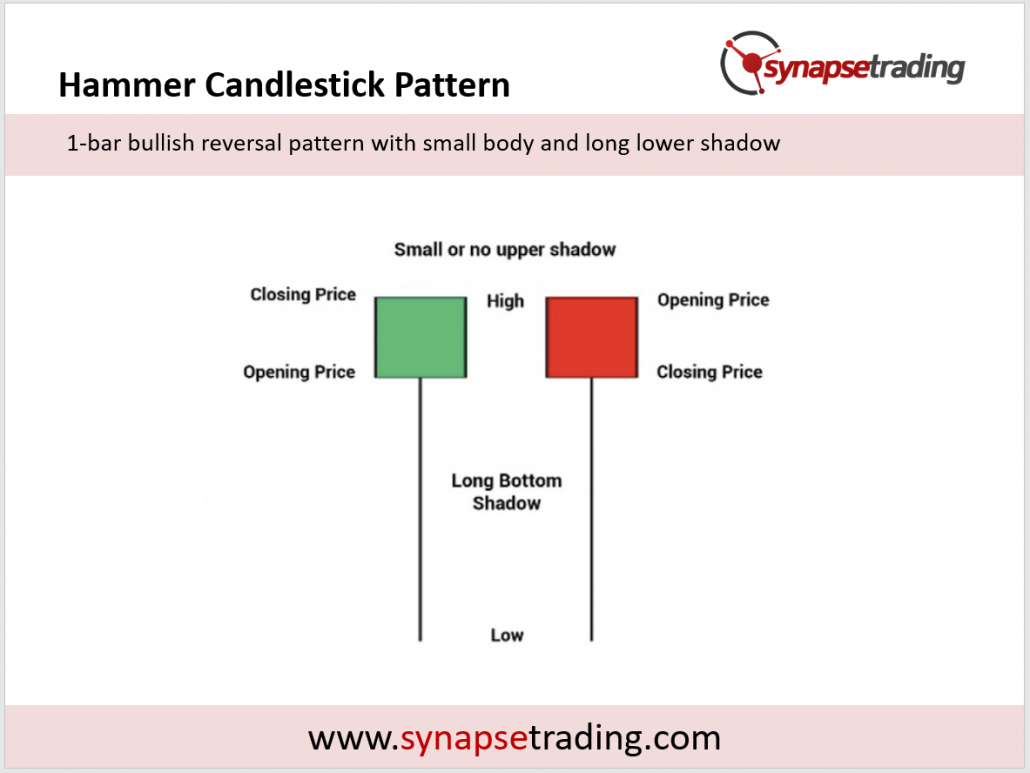

It is characterized by a small real body, which suggests that there was little trading activity during the period, and a long lower shadow, which indicates that sellers tried to push the price lower but failed.

The pattern gets its name from the fact that it looks like a star rising in the morning sky.

The psychology behind the morning star pattern is that it shows a shift in sentiment from bearish to bullish.

During a downtrend, sellers are in control and are pushing the price lower.

However, when the morning star pattern appears, it indicates that the sellers are losing strength and that buyers are starting to take control.

This shift in sentiment can be caused by a variety of factors, such as a change in market conditions, the release of positive news, or the appearance of bullish technical indicators.

To use the morning star pattern for trading, it is important to confirm that it is indeed a valid pattern.

This means looking for the following characteristics:

- The morning star must appear after a downtrend.

- The lower shadow must be at least twice as long as the real body.

- The real body should be at the upper end of the trading range.

If these criteria are met, then the morning star pattern is considered valid and can be used as a signal to buy the security.

There are several trading strategies that can be used with the morning star pattern.

One strategy is to buy the security when the pattern appears and place a stop loss order just below the low of the morning star.

This will protect against any potential downside movement in the security’s price.

Another strategy is to wait for another bullish candlestick pattern to confirm the reversal, such as a bullish engulfing pattern or a piercing line.

When it comes to placing a take profit order, traders can use a variety of techniques.

One approach is to use a fixed take profit level, such as a specific price level or a percentage of the entry price.

Another approach is to use a trailing stop loss order, which allows the trader to lock in profits as the security’s price moves in the desired direction.

There are also some limitations to the morning star pattern that traders should be aware of.

One limitation is that the pattern is not always reliable, as there are times when the security’s price may continue to fall despite the appearance of a morning star.

Another limitation is that the pattern can be prone to false signals, especially in choppy or sideways markets.

To increase the reliability of the morning star pattern, traders can combine it with other technical analysis techniques and indicators.

For example, traders can look for the pattern to appear in conjunction with bullish divergence on a technical indicator such as the relative strength index (RSI).

They can also look for the pattern to appear at key support levels, such as a previous low or a trendline.

In conclusion, the morning star candlestick pattern is a bullish reversal pattern that can be used to trade the financial markets.

To use the pattern effectively, traders should confirm its validity and use appropriate stop loss and take profit orders.

However, traders should also be aware of the limitations of the pattern and consider combining it with other technical analysis techniques and indicators to increase its reliability.

If you would like to learn more about all the different candlestick patterns, also check out: “The Definitive Guide to Candlestick Patterns”

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.