There is a general misconception that chart-reading and technical analysis are only for short-term traders, but this is not true. Investors who learn to read charts and adopt long-term trend-following techniques can achieve superior returns to a pure buy-and-hold investor with the added benefit of taking on less risk.

Why the traditional buy-and-hold strategy fails

A buy-and-hold strategy only works in a prolonged bull market, or if you are fortunate enough to buy in at the start of a short bull market. As long as people keep buying a particular stock, the stock price will continue to rise, thus buy-and-hold enthusiasts will sit through minor corrections or occasional bad news, because these small events do not affect the strong fundamentals of the company.

However, when the economy turns bad, and the stock market plunges, all stock prices will plunge together. A stock with stronger fundamentals may plunge to a lesser degree, but losing less money is not the same as making money. In a prolonged bear market, the stock beomes cheaper and more under-valued as prices fall. Many investors go on a buying spree until they run out of capital, and become locked-in, waiting for prices to “revert to true value” while the market continues to fall. It could take years for them to breakeven, let alone profit.

In such scenarios, does it make sense to hold onto long-term investments for the next few years as losses accumulate, or to add more positions since stocks are now “cheaper”? Is there a better way to avoid this pain? This brings us to the new idea of trend-following investing.

Case Study of Buy-and-hold vs. Trend-following Investing

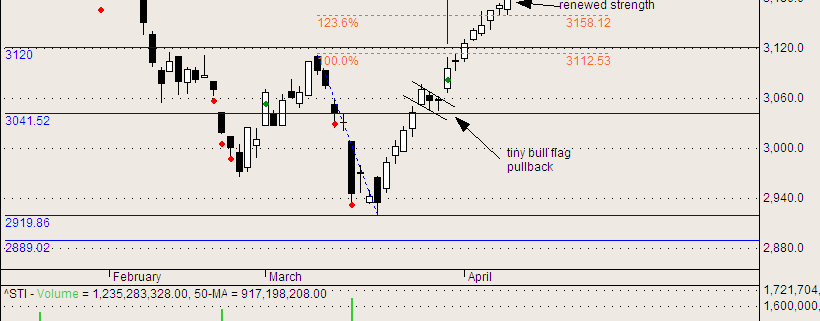

Let us examine the chart below. This is a weekly chart of the Straits Times Index, showing the period from 2003 to 2008. This is a hypothetical case study showing 2 investors – investor A and investor B.

Both investors managed to buy near the start of the bull market, near 2003. Investor A is die-hard Warren Buffett fan, adopting a pure buy-and-hold mentality, believing that “a good company is one that can be held forever.” Note that the Straits Times Index is made up of the 30 strongest blue-chips. Investor B is an investor who uses charts to time the big market trends, willing to take profits based on charts and turn short when the charts give a clear signal.

After 5 years, investor A finds that he has made a measly 10% return, having given back most of his profits while holding on though the decline. I did not include dividends here,because investor B would also have got those dividends, for the sake of fair comparison. Investor B, having locked in a 200% return (this is not picking the top, notice that he did not sell at the exact top), goes short and makes another 50% on the decline,raking in a grand total of 200%.

Since our goal in the market is to make money, it makes sense to adopt the approach that gives us the maximum returns within our time horizon and within our risk appetite. This means acquiring skills that give us an edge over the markets.

“I believe there are no good stocks or bad stocks; there are only money-making stocks.” – Jesse Livermore. Do you agree that for any stock, regardless of its fundamentals or value, if you buy and sell at the right time, you can make money from it?