Table of Contents

Global Market Highlights

China Cuts Bank Reserve Ratios

Greece Identifies $427M in Budget Cuts

Higher Prices Pinch Shoppers, Constrain Fed’s Options

Obama Urges Congress to Reward Technology Companies That Keep Jobs in U.S.

Germany drawing up plans for Greece to leave the euro

Dow nears psychological milestone: 13,000

S&P 500 nears 3-year high amid Greece bailout optimism

Global Stock Indices (Dow Jones Index) Weekly Chart

On the weekly chart, the Dow is nearing major resistance, which coincides with the psychological level of 13,000. Get ready to short on signs of weakness, or wait for a breakout pullback setup.

Forex Markets (EUR/USD) Daily Chart

Currently, for the Euro, the major trend is down, although the minor trend for the past month or so has been up. After breaking above the support-turned-resistance, the breakout has failed and prices have pulled back below that level. It is now preferable to go short, unless the failed breakout fails and becomes a breakout pullback, in which case be prepared to go long.

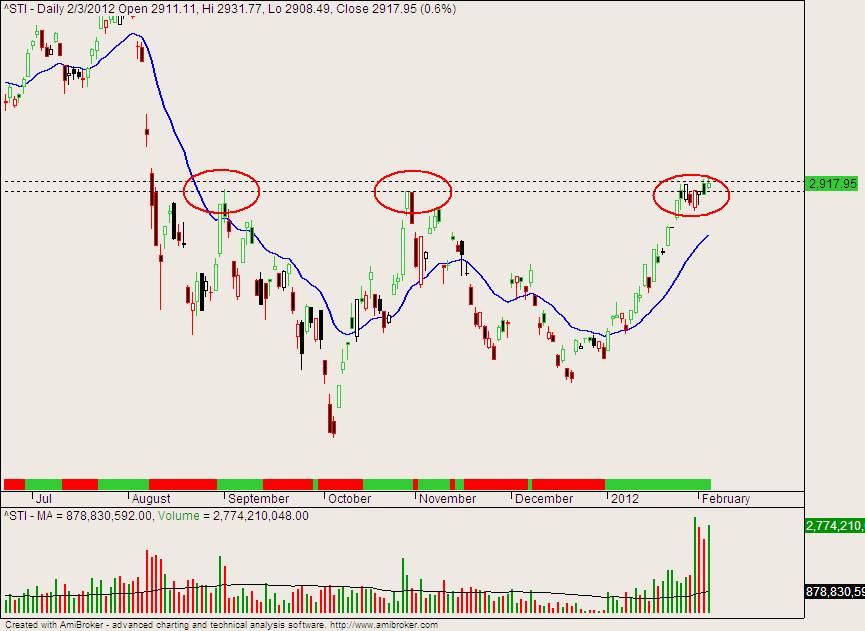

Singapore Stocks (Straits Times Index)

After clearing the key support-turned-resistance level, the STI has surged up to test the psychological round number of 3,000. Since there has been no significant pullback, this could be a chance for the STI to pullback before it resumes climbing up. On the other hand, prices have closed above 3,000 on Friday, and if it holds above that level, we could see higher prices.