Confirmation bias refers to a type of selective perception that emphasizes ideas that confirm our beliefs, while devaluing whatever contradicts our beliefs. This can be thought of as a form of selection bias in collecting evidence to support certain chosen beliefs.

For example, you may believe that more red cars drive by your house during the summer than during any other time of the year; however, this belief may be due to confirmation bias, which causes you to simply notice more red cars during summer, while overlooking them during other months. This tendency, over time, unjustifiably strengthens your belief regarding the summertime concentration of red cars.

To describe this phenomenon another way, we might say that confirmation bias refers to our all-too-natural ability to convince ourselves of whatever it is that we want to believe. We attach undue emphasis to events that corroborate the outcomes we desire and downplay whatever contrary evidence arises.

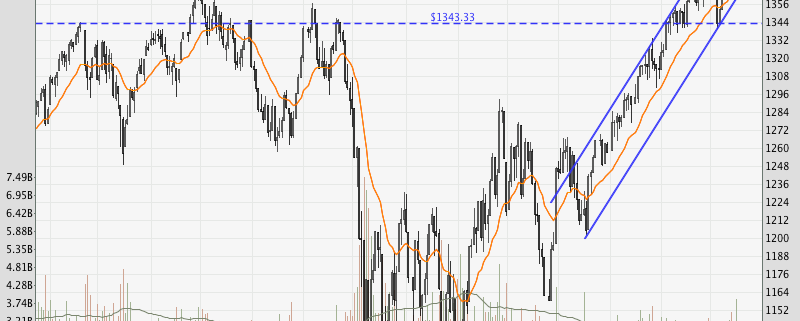

For traders, this is dangerous because traders who are entrenched in their opinion will only actively seek out information that confirms their opinion, while ignoring those that do not. This is especially true for traders who rely heavily on indicators, since many indicators will give conflicting signals, and it is not hard for a trader to find those indicators which support a chosen viewpoint.

Another hazard comes in the form of marketing gimmicks and market gurus, who like to make a lot of (absurd) forecasts based on their “sure-win” trading method or system. To newbie traders, they may appear to have a very high success rate, mostly because people want to believe the guru, hence they will celebrate his successful predictions while ignoring his less-accurate (or completely off) forecasts.

What is the best solution for this?

Once again, objectivity is necessary to see both sides of the coin, and the best way if you want to test if a method works is to record every signal (whether it is a gain or loss), and not just record those instances where it worked, while ignoring those times when it did not.

“It is the peculiar and perpetual error of the human understanding to be more moved and excited by affirmatives then by negatives.”

– Francis Bacon

If you would like to learn more about trading psychology, also check out: “The Complete Guide to Investing & Trading Psychology”