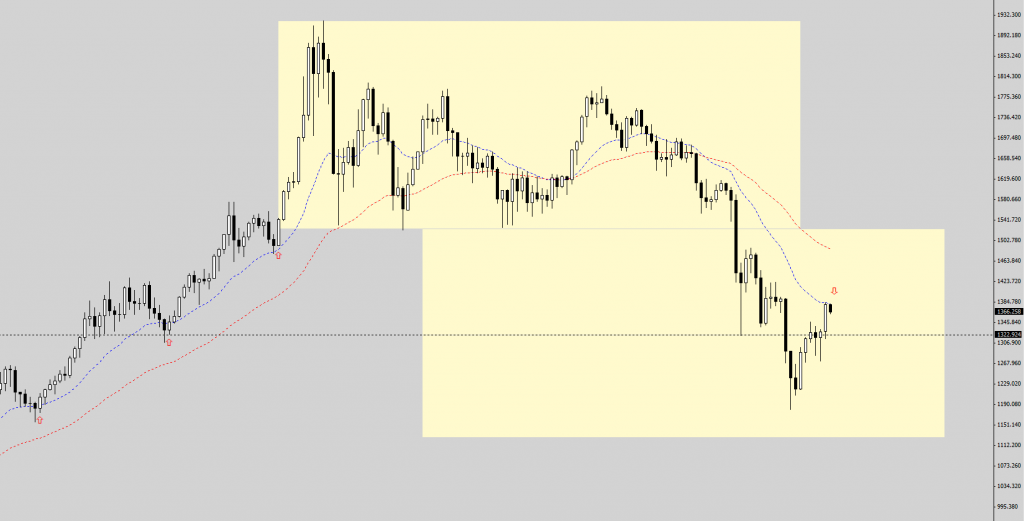

Here are the latest updates on the forex scene, with 2 great trading opportunities presented below. As you can see, these charts are rather blank, because this way it is optimised for reading price behavior and price action, with as little distractions as possible.

My next sharing session is coming up next week, and I have prepared a special surprise; I will be inviting one of my students to speak as well, and he will be able to share how he managed to build 3 streams of income like how I taught, to increase his financial stability and accumulate wealth more quickly.

The last 2 events were sold out pretty fast, and seats are limited, so please sign-up only if you are serious about coming to learn how to take advantage of the recent crash to build up your portfolio of passive income.

https://the-recent-big-crash.eventbrite.com/?ref=ecal

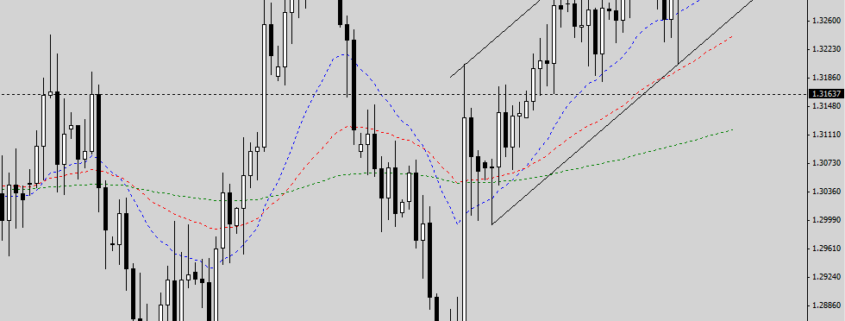

This is the daily chart of the EUR/USD, with an obvious 2B reversal near a key resistance zone. Watch for a good chance to short if the next push fails. Whoever spots the chance, please share in the private forum so that we can all catch this together! (just in case I miss it)

This is the daily chart of the EUR/USD, with an obvious 2B reversal near a key resistance zone. Watch for a good chance to short if the next push fails. Whoever spots the chance, please share in the private forum so that we can all catch this together! (just in case I miss it)

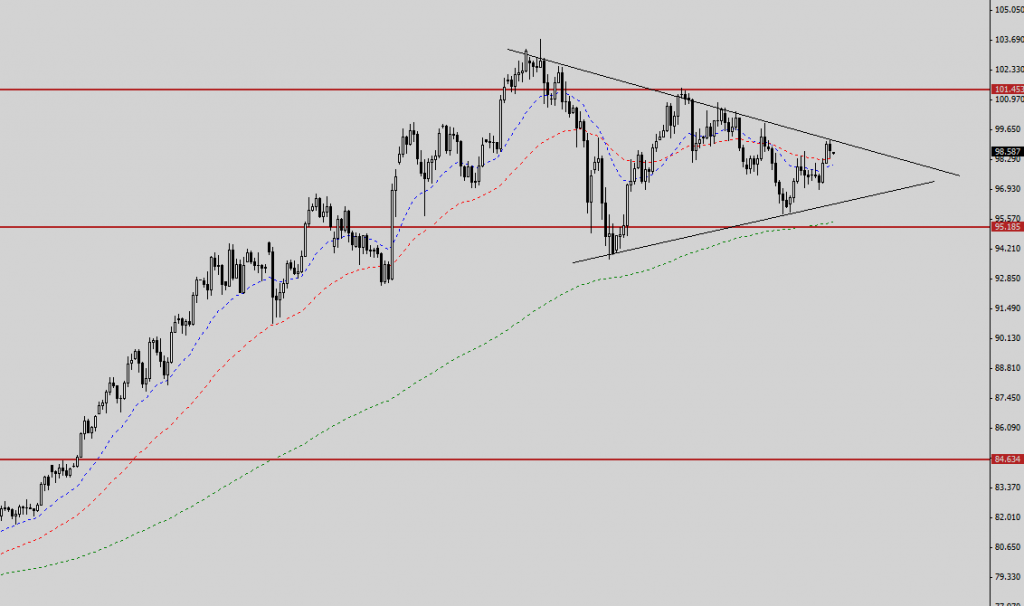

This is the daily chart of the USD/JPY. It is forming a clear triangle pattern, which is possibly a pennant on the weekly, hinting at a sign of strong upside breakout. Price is also compressed by the 2 key zones, building up additional pressure. A good breakout could come soon, so keep watching for the signal bar!

Behavioral analysis of Forex – How to trade forex with price

Behavioral analysis of Forex – How to trade forex with price