A big thanks to all our new graduates who made it such a great learning and sharing session, as well as those previous graduates who came back for the free re-sit and helped out the new traders. After looking at the big move today, I must say all of you are very lucky, because you all mastered the skills just in time to capture this big move!

Of course, this is just the start, as now that you have learn the secrets of behavioral analysis and the trading skills, it is time to put it into practice! There are a lot more great opportunities coming up, because we have the daily forum discussion, and free monthly workshops for graduates to continue learning until they become consistently profitable.

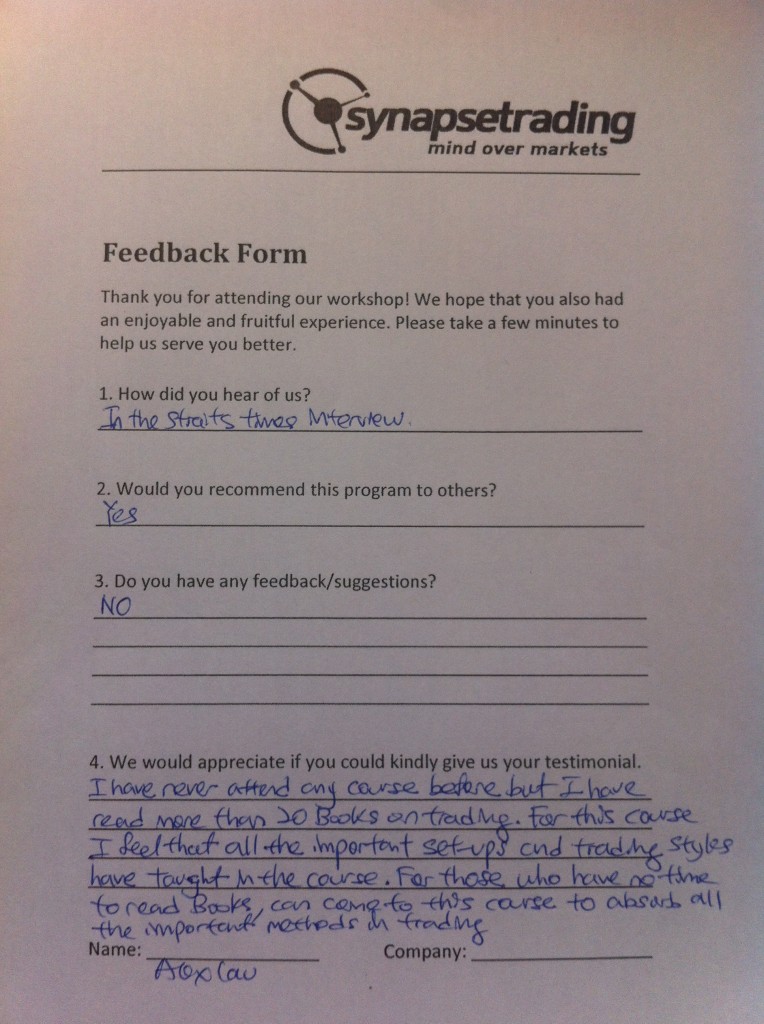

I have read through all your feedback (both the good and bad), and shared it over here. I take this feedback very seriously, and will be working to improve the next intake by adding in more content and more examples (we will definitely see more live examples during the workshops). Of course, with this new improvements, we will be revising our course fees slightly (don’t worry it is still one of the most affordable professional courses out there).

https://synapsetrading.com/testimonials/

Find out more: https://synapsetrading.com/the-synapse-program

Goodie bag! #bundle of joy

Goodie bag! #bundle of joy