Yesterday, at the SGX Investment Carnival, I was invited to share with new investors and traders my trading journey of how I achieved financial freedom at 27 starting with just $3,000 at 20, so I focused on the top 3 practical tips which I felt had the most major impact on my success.

3 Practical Tips for Early Financial Freedom

1. Time the Big Market Cycles

You might have heard that it is not possible to time the market. But is that really true?

Because all the millionaires and billionaires know the importance of buying and selling their assets at the right time to multiply their wealth.

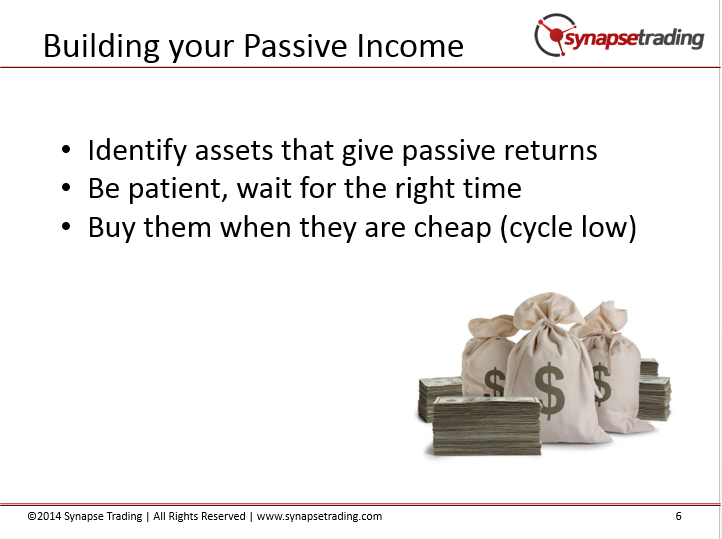

3 simple steps that all millionaires and billionaires use to accumulate their wealth

“Be fearful when others are greedy, and greedy when others are fearful” – Warren Buffett

So the question is, what is at the cycle low (cheap) now?

Let’s first look at the 10-year stock market cycles… 1997, 2007, … What’s next?

Will there be a huge stock market crash in the next 2-3 years? No one can predict that. But I certainly know that now is NOT the low point in the stock market cycle, and it would be foolish to accumulate stocks now.

My money is on commodities like oil, gold and silver.

2. Have your War Chest Prepared

If the market crashes tomorrow, do you have the capital to take advantage of the opportunity?

If your answer is no, then what is the fastest way to build up more capital?

What is the fastest way to build your capital?

The common wisdom is to work hard and save, and while it is a safe option, it will take you about 5-10 years before you have sufficient funds to do any real investing, and by that time you would have missed any good opportunities during those years.

Another option is to start a business, but the failure rate is extremely high, with >80% of businesses going bust within the first year of operations.

My suggestion (which is also what I did for myself), is to allocate a small percentage of your capital to start a small trading portfolio, which can allow you to generate high returns while keeping risk low. And by simply spending 15 minutes a day to manage your trades, you can accelerate the rate of your investment capital accumulation explosively.

3. Learn the Right Skills Early

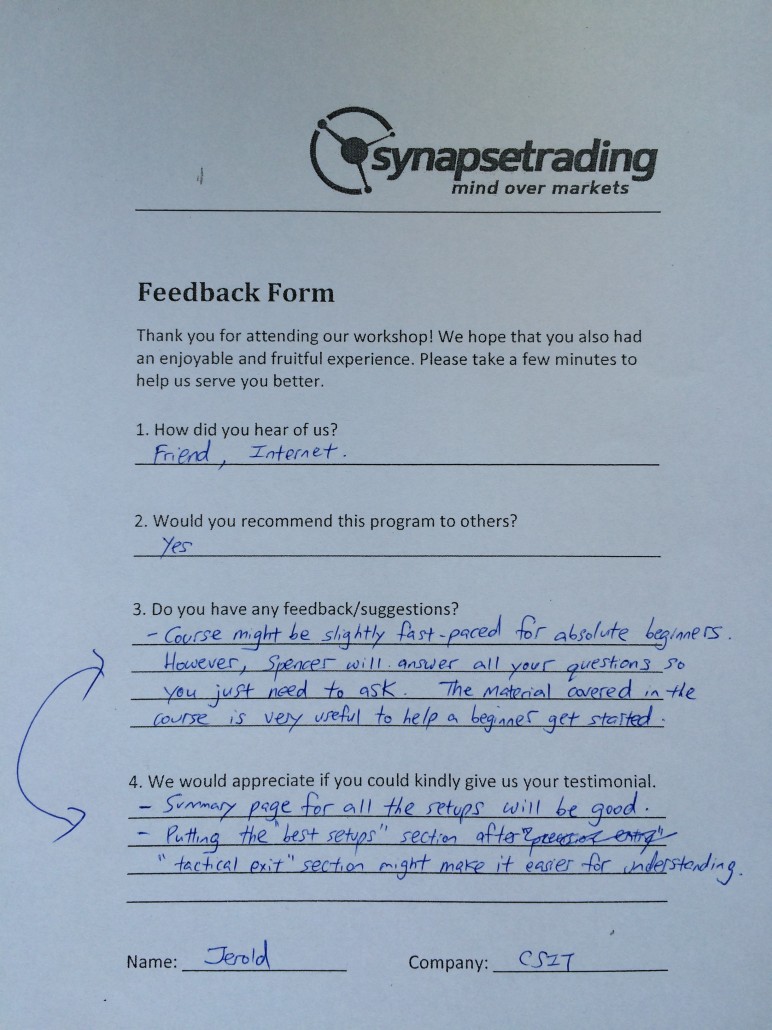

There are many good resources available for new traders and investors to start learning:

Good luck on your trading journey, and remember the key is to take the first step and get started, because the earlier you start, the more powerful the compounding effect is going to work in your favour! 😀

A casual photo with Magnus Bocker, CEO of SGX, and his staff