This is the last video in this tutorial series, which means, it’s now time to put into practice what we’ve learned so far.

So, let’s explore how to place your first trade and the different ways you can do it. This is an order ticket. When you look at the order ticket, you’ll usually see two prices: the bid price on the left and the ask price on the right. The ask price is usually higher than the bid price, and the difference between the two prices is known as the spread. If you want to buy a stock, you’ll have to buy at the ask price, and if you want to sell, you’ll have to sell at the bid price.

There are four main types of orders which traders use to buy and sell stocks in the market.

The first is the market order, commonly referred to by traders as hitting the market. This means that you buy or sell immediately using the bid ask price that is currently offered by the market.

The next order is the limit order, which means you queue to buy at a better price or queue to sell at a better price. For example, if you think that this stock is going to drop to $3.70, then instead of buying at the current ask price of $3.80, you can place a limit buy order at $3.70, which will kick in once the stock reaches that price and make the purchase.

Next up, we have the stop order, which as its name suggests, is useful for placing your stop-loss and very important for applying the 2% money management rule. For example, if you have bought this stock at $3.80 and you want to cut your losses once the stock drops below $3.70. You can place a stop sell order at $3.70, which will kick in once the stock reaches that price and sell off the stock.

Lastly, we have the OCO, or one cancels the other bracket order, which is basically a combination of one limit order and one stop order, which will cancel the other when either is triggered. This is commonly used when traders place their stop-loss and target profit.

These order types might seem confusing at first, but once you’ve placed a few trades, it’ll soon become second nature, and you’ll stick to the order types that suit your trading style and gives you the best results. That’s it!

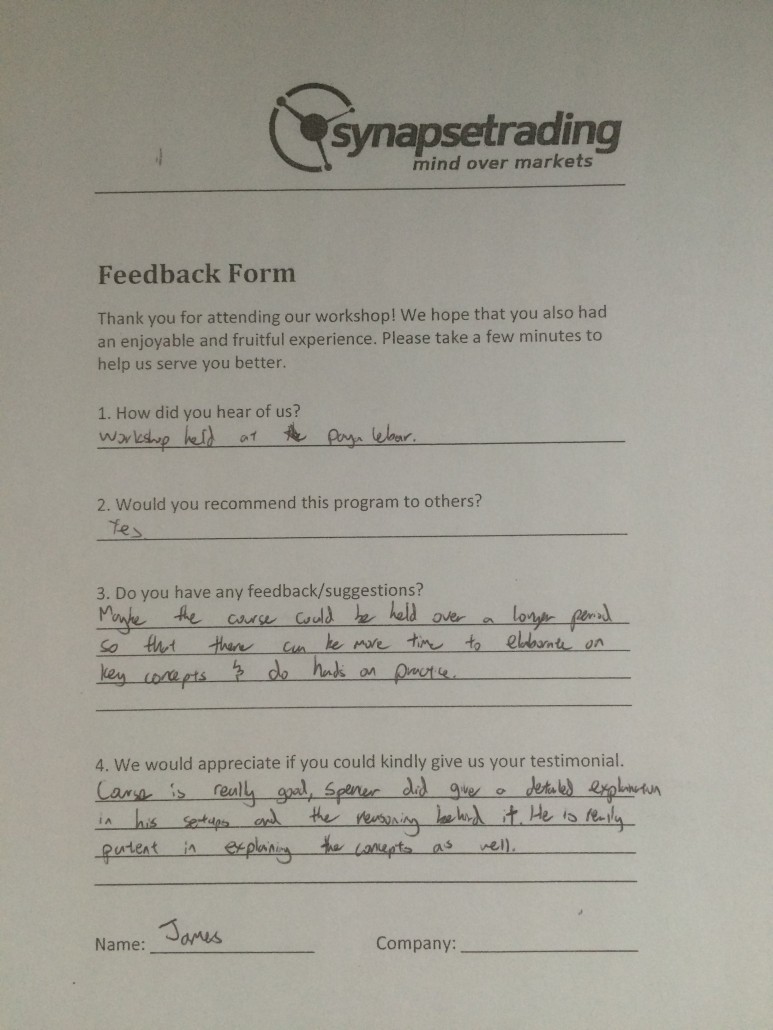

Congratulations on completing the video tutorial series. We hope you’ve had an enjoyable and enlightening journey into the world of trading, but remember this is just the first step to becoming a successful trader. We encourage you to read up more, attend some workshops and most importantly, put what you have learned into practice. Good luck!

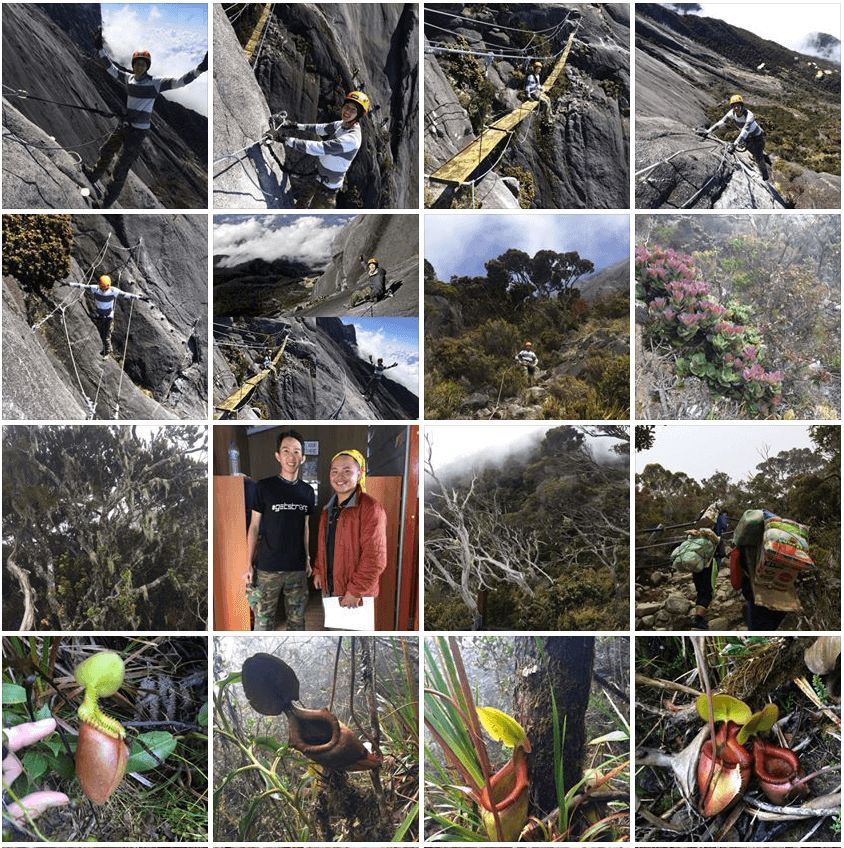

Some cool pitcher plants. (See more in the full album link below!)

Some cool pitcher plants. (See more in the full album link below!) Just in time to check out the markets. What can beat trading on a mountain top with the sun rising in the foreground? 😀

Just in time to check out the markets. What can beat trading on a mountain top with the sun rising in the foreground? 😀