Weekly Market Wrap: The Bears are Back!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last week, it was an eventful week filled with exciting news release, such as the CPI (Consumer Price Index) and the FOMC rate announcements.

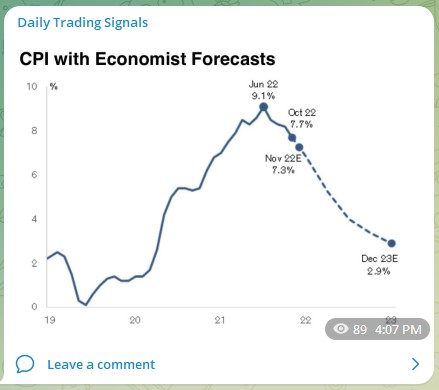

The CPI showed a lower than expected rate of inflation, so the markets rallied, but it turned out to be a false breakout as prices closed back down by the end of the day.

The next day, the FOMC announced rate hikes in line with expectations, but showed no signs of pivoting any time soon, so the bear market resumed (as we predicted), and prices started heading south.

There is a good chance of prices hitting new lows before the end of the year, so I will gradually accumulate more shorts as my profits (buffer) increase.

If you missed out on the excellent shorting opportunity last week, fear not, because there will be more pullback opportunities to short soon.

Join us for real-time updates and daily trading opportunities in our “Daily Trading Signals” Telegram channel!

[Photo: Iskanderkul Lake & Waterfall, Tajikistan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (11 December 2022)

2 major pieces of news this week:

13 Dec – CPI data

14 Dec – FOMC

Stock market indices are at crucial points, so I have placed price triggers so that we will know the moment any breakout occurs.

Portfolio Highlights

Weekly Portfolio Updates (11 December 2022)

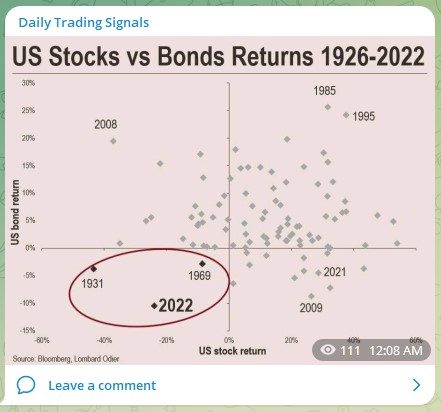

With unclear direction on the stock market, the best strategy now is to hold bonds for high yields.

Forex & Commodities Market Highlights

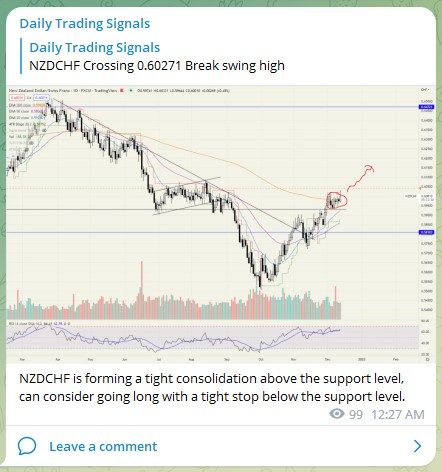

NZDCHF is forming a tight consolidation above the support level, can consider going long with a tight stop below the support level.

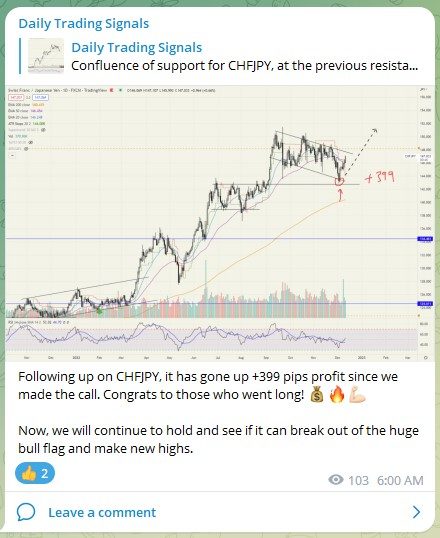

Following up on CHFJPY, it has gone up +399 pips profit since we made the call. Congrats to those who went long! 💰🔥💪🏻

Now, we will continue to hold and see if it can break out of the huge bull flag and make new highs.

Exactly as predicted for EURAUD, congrats to those who went long! 💰🔥💪🏻

Following up on EURCAD, it is up +673 pips profit since our call! Congrats to those who went long! 💰🔥💪🏻

Strong rebound on USDSGD as predicted, congrats to those who traded the bounce! 💰🔥💪🏻

Stock & Bond Market Highlights

A market poll we did last week, and it seems almost 1/2 thought that the market will make new highs, while about 1/3 thought the market would make new lows.

After a false breakout a few days ago on the CPI data, all the 3 US stock indices (Dow Jones US30, Nasdaq 100 US100, S&P 500 US500) are now resuming the downtrend.

I have added more short positions. Will we see new lows before the year is over?

CPI with economist forecasts

https://www.calculatedriskblog.com/2022/12/fomc-preview-50bp-hike-increase.html

https://www.cnbc.com/2022/12/14/fed-rate-decision-december-2022.html

US Stocks vs Bonds Returns 1926-2022

Crypto Market Highlights

US prosecutors consider filing criminal charges against Binance and CZ for possible money laundering and sanction violations

Those with money in Binance, might want to start moving it out just in case:

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!