Weekly Market Wrap: Is the Banking Crisis Just the Tip of the Iceberg?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last week saw an array of significant events unfold in the global banking and financial sectors, with concerns over Deutsche Bank, rising inflation, and China’s economic recovery dominating headlines.

Deutsche Bank’s shares slid 8% after a sudden spike in default insurance costs raised concerns among investors. While analysts insisted that Deutsche Bank was not the next Credit Suisse, panic spread throughout the markets, leading to a short banking crisis. As a result, $100 billion was pulled from banks, though the overall banking system was deemed sound and resilient.

European leaders scrambled to address the banking crisis and stabilize markets. The upcoming week will feature congressional hearings on SVB (Silicon Valley Bank), which have been affected by the same concerns plaguing Deutsche Bank and Credit Suisse.

The Federal Reserve bumped interest rates up by 25 basis points, marking the first rate hike since the pandemic began. Investors weighed the implications of this decision, as well as ongoing bank troubles, leading to mixed market reactions.

The US dollar and Swiss franc were identified as the weakest major currencies, while the yen rose in value. Investors now await a key inflation report (core personal consumption expenditure (PCE) price index) this coming week, as concerns about inflation and its impact on monetary policy persist.

A Chinese Communist Party official stated that the foundation of China’s economic recovery was not solid enough, leading to concerns about the country’s stability. In response, Citi labeled China a relative safe haven amid market uncertainty.

Oil prices fell as the US held off on refilling its strategic petroleum reserve, while gold prices gained on the back of the Federal Reserve’s hint at a pause in rate hikes.

For more market updates and real-time trading opportunities, check out our “Daily Trading Signals” Telegram channel!

[Photo: Kusadasi, Turkey – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

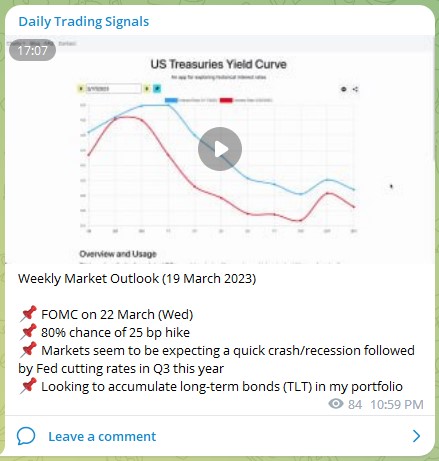

Weekly Market Outlook (19 March 2023)

📌 FOMC on 22 March (Wed)

📌 80% chance of 25 bp hike

📌 Markets seem to be expecting a quick crash/recession followed by Fed cutting rates in Q3 this year

📌 Looking to accumulate long-term bonds (TLT) in my portfolio

Portfolio Highlights

Weekly Portfolio Updates (19 March 2023)

Added some bonds (TLT) and high growth stocks (ARKK) to my portfolio, while adding some shorts to the Dow Jones ETF (DIA).

Forex & Commodities Market Highlights

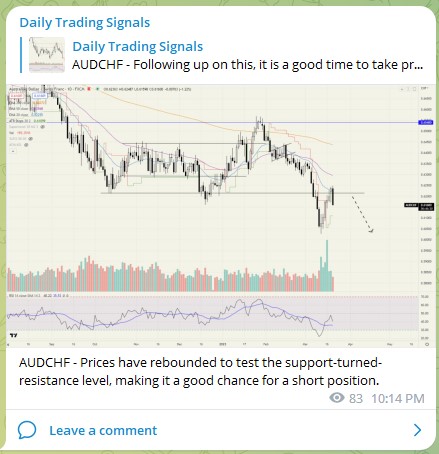

AUDCHF – Prices have rebounded to test the support-turned-resistance level, making it a good chance for a short position.

CADCHF – Nice pullback to test the breakout point, providing a good shorting opportunity.

NZDCHF – Another potential short after pulling back to test the breakout level.

Crude Oil (WTICOUSD) – Looking at the long-term weekly chart, it shows a huge downtrend channel.

Will we really see prices drop to 2020 lows?

Maybe if there is a recession, otherwise it seems unlikely.

Stock & Bond Market Highlights

China tech stocks (3067) – Might be forming a possible bullish inverse head-and-shoulders reversal pattern.

Started accumulating some, but will not take large positions until the neckline is cleared.

NASDAQ 100 (US100) – Yesterday, after the FOMC, prices broke above the previous swing high, but closed lower by the end of the session.

Direction is not very clear but I am more towards the bearish side.

NASDAQ 100 (US100) – It is now 2 days in a row where prices pushed new highs, then closed back down.

From here, prices can either drop back down to test prior lows, or consolidate for a few more bars to accumulate strength to push new highs.

As mentioned before, I am more inclined to the bearish side.

Weekly Chart of Credit Suisse (27 years)

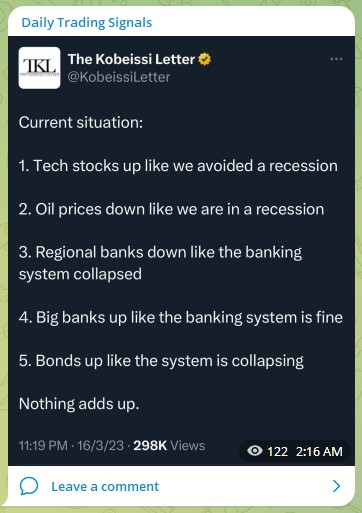

Current situation and nothing adds up.

The “Fed Put” is back with assets on their balance sheet increasing $297 billion over the last week, the largest spike higher since March 2020.

Inflation vs. Recession

While everyone was distracted by SVB they missed Credit Suisse.

While everyone is distracted by Credit Suisse they’re missing Wells Fargo.

1/ With the collapse of Silicon Valley Bank and Signature Bank last week, many investors and savers are wondering which banks could be next?

A thread 🧵

— Spencer Li (Synapse Trading) (@SynapseTrading) March 20, 2023

🧵 1/ Summary of the recent FOMC meeting and its implications for the economy.

Will we face a recession? What's the Fed's plan? #fomc #trading #investing

— Spencer Li (Synapse Trading) (@SynapseTrading) March 23, 2023

Crypto Market Highlights

Bitcoin (BTCUSD) and Ethereum (ETHUSD) – Following up on these 2, prices have broken out strongly as predicted!

Congrats to those who took the trade! 💰🔥💪🏻

1/ 🧵 Bitcoin's epic comeback: What does the future hold for the world's largest cryptocurrency? And how will the Fed's next move affect its trajectory? Let's dive into this fascinating thread! 🚀 #Bitcoin #FOMC pic.twitter.com/JZWmY0tgwx

— Spencer Li (Synapse Trading) (@SynapseTrading) March 22, 2023

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!