Weekly Market Wrap: Successful Launch of Bitcoin ETFs!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Subscribe for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Market Recap & Upcoming Week

Last week’s financial markets were abuzz with discussions on inflation and the Federal Reserve’s monetary policy, as well as the surge in Crypto prices due to the approval of Bitcoin ETFs.

The Consumer Price Index (CPI) indicated a slight uptick to 3.4% year-over-year in December, signaling a challenging road ahead to the Fed’s 2% inflation target. Core CPI, excluding food and energy, showed a modest decline. Notably, services costs, particularly shelter and car insurance, were significant inflation drivers.

Despite these pressures, the overall trend in inflation continues to decline, with expectations that it will normalize over the year. Moreover, positive indicators like slowing rent increases and declining job openings hint at a downward trajectory for inflation.

However, a recent surge in shipping costs due to disruptions in the Suez Canal could pose a risk, potentially impacting consumer prices if prolonged.

In response to the inflation data, expectations around the Federal Reserve’s rate cuts have become a focal point. The bond market anticipates a high likelihood of rate cuts starting as early as March, but this may be overly optimistic.

The Fed is likely to maintain a cautious approach, with more data on inflation and job reports due in the coming months. This cautious stance could introduce market volatility, but the broader expectation is a shift towards easing monetary policy in the latter half of the year.

Alongside these macroeconomic developments, the stock market has shown resilience. The rebound in forward earnings and new market highs suggest a continuing uptrend in stocks.

Opportunities are seen in buying potential pullbacks and diversifying into underperforming market segments, with an eye towards extending investment duration in anticipation of an easing Fed cycle.

This week in the financial markets starts with a pause as markets are closed on Monday, January 15th, in observance of Martin Luther King Jr. Day.

Simultaneously, the annual World Economic Forum in Davos begins, bringing together a global assembly of business and political leaders. This event could provide key insights into the global economic outlook and potentially influence market sentiment.

Upon reopening on Tuesday, the markets will shift focus to the banking sector with Morgan Stanley and Goldman Sachs releasing their earnings, which could set the tone for market performance.

Housing market data, including housing starts and existing home sales, will be closely watched as key indicators of economic health. Additionally, remarks from Federal Reserve Governor Christopher Waller and Atlanta Fed President Raphael Bostic will be pivotal in shaping expectations around monetary policy.

Updates on U.S. retail sales, industrial production, and consumer sentiment throughout the week will provide further clarity on the economic landscape.

Lastly, a critical deadline looms on Friday for Congress to fund certain U.S. government agencies, with a potential government shutdown hanging in the balance.

Daily Trading Signals (Highlights)

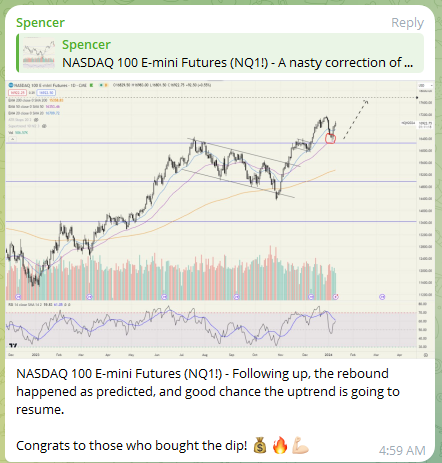

NASDAQ 100 E-mini Futures (NQ1!) – Following up, the rebound happened as predicted, and good chance the uptrend is going to resume.

Congrats to those who bought the dip! 👏🔥👍

Ethereum (ETHUSD) – Strong breakout after the news, heading to test the $2900/3000 level! 💰🔥💪

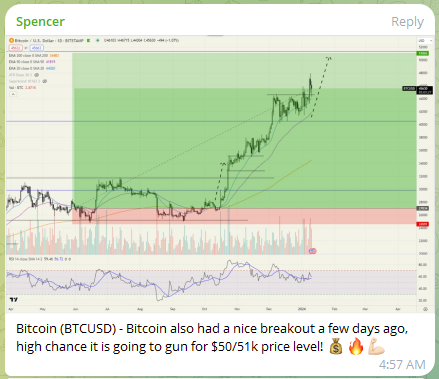

Bitcoin (BTCUSD) – Bitcoin also had a nice breakout a few days ago, high chance it is going to gun for $50/51k price level! 💰👍💪

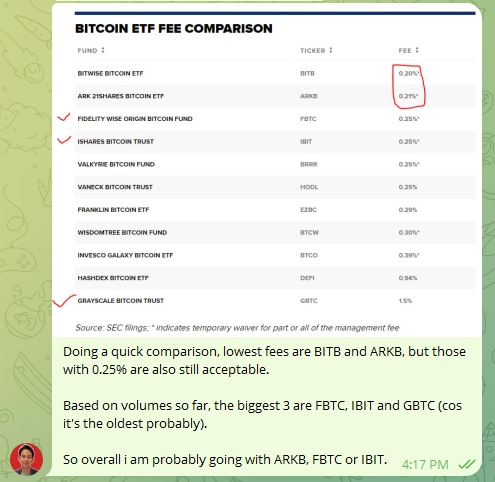

Doing a quick comparison, lowest fees are BITB and ARKB, but those with 0.25% are also still acceptable.

Based on volumes so far, the biggest 3 are FBTC, IBIT and GBTC (cos it’s the oldest probably).

So overall i am probably going with ARKB, FBTC or IBIT.

Ripple (XRP) ETF a possibility?

Join our community for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!