Weekly Market Wrap: Stock Market Surges on Strong Jobs Data!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

For subscribers of our “Daily Trading Signals”, we now also include a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technicals, economics, and portfolio management:

Click here for last week’s market report (29 May 2023)

Click here to subscribe for the latest market report (05 June 2023)

Click here to see the archives of all our past market reports

Market Recap & Upcoming Week

The past week in the financial world was marked by key developments across the US and Chinese stock markets, significant corporate milestones, and noteworthy trends in the labor market. Trading was halted on Monday, May 29th, as the US observed Memorial Day, with the New York Stock Exchange, Nasdaq, and US bond market all closed.

Amid this quiet start to the week, chip manufacturer Nvidia made headlines by becoming the sixth US company to reach a $1 trillion market capitalization, largely thanks to the growing demand for its AI-optimized chips. This achievement illustrates the wider market trend of big companies growing bigger, with investors increasingly betting on dominant market leaders.

Conversely, Chinese shares entered a bear market, indicating increasing pessimism about the country’s economic recovery, despite earlier hopes fueled by government efforts to revive the property sector and the lift of strict Covid-19 restrictions.

Meanwhile, the US labor market showed signs of resilience, with job openings reaching a seasonally adjusted 10.1 million in April, despite the recent collapse of Silicon Valley Bank. The US stock market saw significant gains following a strong jobs report that exceeded Wall Street expectations, signalling robust hiring amidst slowing inflation. This, coupled with a late deal to avert a government default, sparked a major uptick in the market.

As we move into the upcoming week, investors should be prepared for a potentially calmer trading period, following last week’s surge in response to a deal to raise the debt ceiling. The week is set to commence with the worldwide developer conference hosted by Apple, where the tech giant is anticipated to reveal new releases.

Market watchers should keep a keen eye on the various economic indicators slated for release in the coming days, including updates on U.S. factory orders, non-manufacturing services, the U.S. trade deficit, and consumer credit data. These figures will provide insights into the health and trajectory of the U.S. economy amid global inflation concerns and recovery from the pandemic.

In terms of corporate earnings, the week will bring reports from an eclectic mix of companies, encompassing various sectors. Names to watch include J.M. Smucker, GameStop, Brown Forman, DocuSign, and Seneca Foods. The performance of these businesses, particularly retail sector players like GameStop, could offer a barometer for consumer sentiment and sector trends.

Daily Trading Signals (Highlights)

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

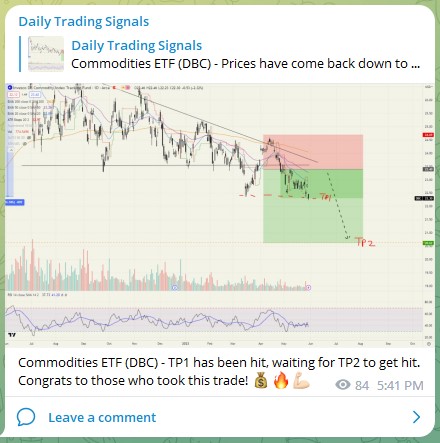

Commodities ETF (DBC) – TP1 has been hit, waiting for TP2 to get hit. Congrats to those who took this trade! 💰🔥💪🏻

Sea Limited (SE) – Great chance to take some profits on the short position after the stock has dropped 22%!

Can continue to hold some for TP2.

NASDAQ 100 (US100) – Prices broke higher than I expected, but now it is even more overbought and we are seeing an island shooting star, so perhaps there might be some pullback.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!