Weekly Market Wrap: Is the Market Rebound Running out of Steam?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

While we saw some strong rebound in the markets due to lower inflation numbers (and hope of a pivot), I feel it is only a matter of time before the relief rally runs out of steam.

The recent news headlines do not seem bullish:

- UK officially entering a recession

- Japan seeing the highest inflation in 40 years

- Many tech companies laying off large numbers of staff

- US retail sales higher than expected (sign of inflation not coming down)

- US initial jobless claims decreasing

Hence, the chance of a Fed pivot seems unlikely at this point.

However, the market is always right, so I will still trade based on the price action as it unfolds.

I have placed price triggers at various critical levels, so we will receive the alerts once the opportunity arises.

Join us in our Daily Trading Signals Telegram channel to receive these real-time alerts!

[Photo: Chong-Kemin Valley, Kyrgyzstan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (13 November 2022)

After the CPI showed slowing inflation, the stock markets shot up drastically, but this does not necessarily mean a reversal of the long-term trend.

2 ways to trade this market:

1. Wait for short-term momentum to weaken and run into strong S/R levels, then enter in the direction of the LT trend

2. Ride the short/medium-term momentum by entering on pullbacks on smaller timeframe

Portfolio Highlights

Weekly Portfolio Update (13 November 2022)

Not much changes.

Forex & Commodities Market Highlights

Very nice inverse H&S reversal for EURCAD, plus it broke the bear trendline at the same time.

Can look to go long on pullbacks.

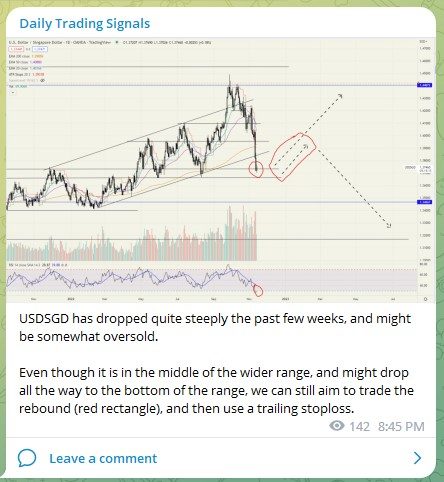

USDSGD has dropped quite steeply the past few weeks, and might be somewhat oversold.

Even though it is in the middle of the wider range, and might drop all the way to the bottom of the range, we can still aim to trade the rebound (red rectangle), and then use a trailing stoploss.

Following up on USDSGD, we have seen 4 doji bars (with 1 being a bullish hammer), which suggest a slowing in the bearish momentum.

The RSI is also in the extreme oversold zone.

Odds of a rebound are high.

I would suggest taking a long position with a SL at around 1.36.

Stock & Bond Market Highlights

Critical zone here for the NASDAQ 100 (US100), whether it can muster enough strength for a larger move up, and break past the trendline.

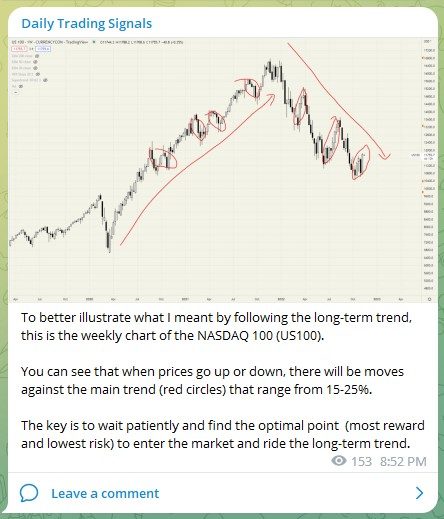

To better illustrate what I meant by following the long-term trend, this is the weekly chart of the NASDAQ 100 (US100).

You can see that when prices go up or down, there will be moves against the main trend (red circles) that range from 15-25%.

The key is to wait patiently and find the optimal point (most reward and lowest risk) to enter the market and ride the long-term trend.

So far we have seen one shooting star (bearish pinbar) on the NASDAQ 100 (US100), when it tried to break above the trendline.

Now, it is at a crucial point because it is at the top of the LT bearish trendline, but the ST price action recently just broke above the small consolidation (yellow rectangle).

If prices fall back into the small consolidation (break the red line), then i would consider adding back my short positions.

Similar situation for the Global REITs ETF (REET) which is a benchmark for global real estate.

https://www.wsj.com/articles/the-inflation-cooldown-is-finally-here-11668097915

Crypto Market Highlights

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!