How to Create a Trading Journal (And Discover Your Edge in the Markets)

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Have you ever wondered why you keep making the same trading mistakes over and over again?

As you start your trading journey, one very important habit to cultivate is to have a good trading journal, which is why in this blog post, I’m going to share with you how you can start a trading journal and use it to effectively improve your trading results.

If you would like to learn all the essential elements to kickstart your trading journey, also check out: The Beginner’s Guide to Trading & Technical Analysis

Table of Contents

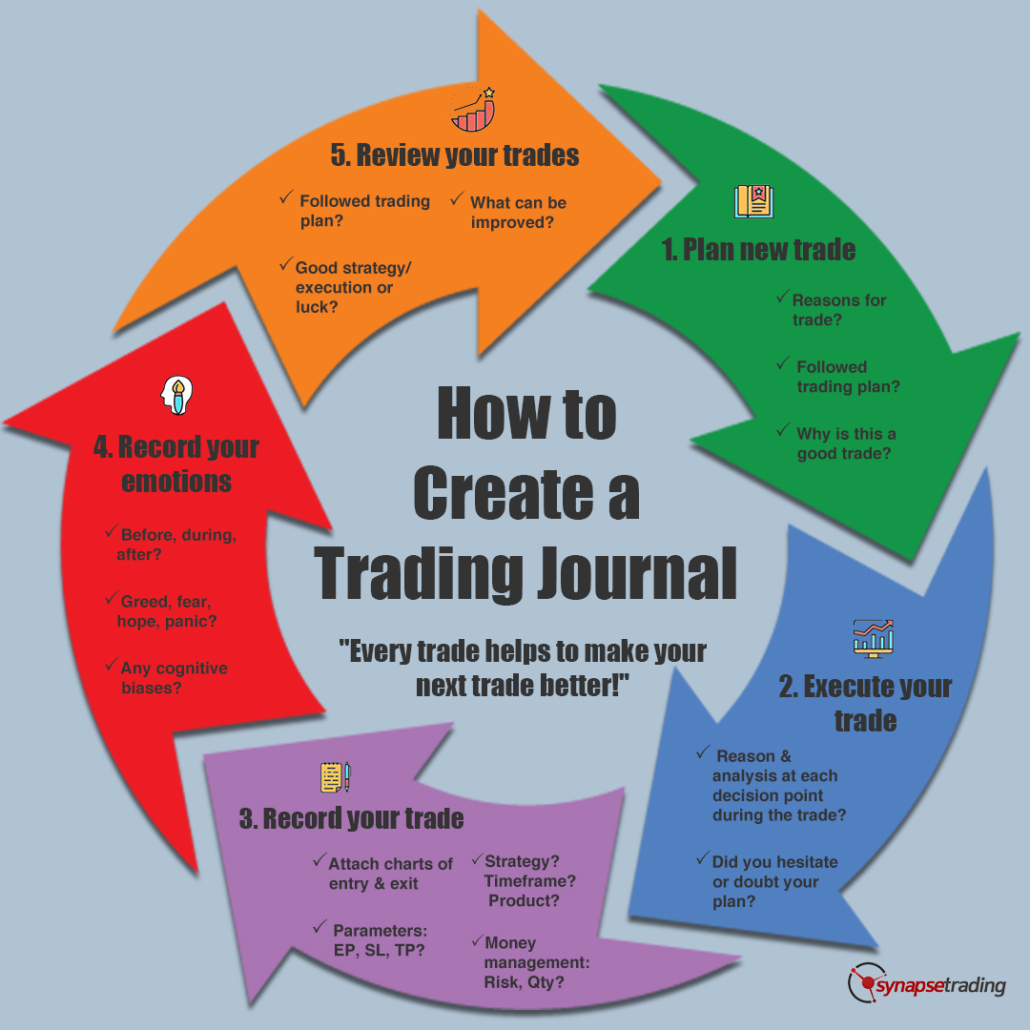

Trading Journal #1 Plan New Trade

The first thing to record is the planning of your new trade.

You should already have a trading plan before you even start trading, but before you actually execute the trade, it is good to record down the trade in your trading journal.

- Why are you taking this trade?

- Why is this a good trade?

- What is the strategy behind it?

- What is the reason or the rationale for you wanting to take this trade?

- What are the pro factors? The negative factors?

Everything should be recorded down, basically your whole thought process of your decision-making of how you come about to decide whether you want to take this trade or you want to pass on this trade.

So all that should be recorded down in your trading journal for future reference.

Trading Journal #2 Execute Your Trade

Next is the execution of the trade.

- What was the reason and analysis of each decision point during the trade?

- For example, when you’re making the entry, why are you entering at this price?

- Why not wait a little bit later?

- Why not enter at a better price or when you are going to exit the trade,

- Why do you want to take profits?

- Why not let the trade run further?

All these things should be recorded down in your trading journal.

Basically, why you make every decision along the way.

Trading Journal #3 Record Your Trade

Next, you’re going to record the trade itself in your journal, meaning all the trade parameters.

You’re going to record:

- What type of trading style was it?

Was it a long-term trade? A medium-term trade, a short-term trade?

So that will correspond to whether it’s position trading, swing, trading, or day trading. - And what was the product that you traded?

Was it forex, a stock, an option or a derivative? - Next, what was the timeframe?

Was it on a 5-minute chart, a 1-hour chart, a daily chart, a monthly chart?

These are all the standard perimeters that should be recorded down in your trading journal.

Next up, you should also record down your entry price, stoploss price, and target price. These are the bare minimum parameters that you need to have for each trade.

- The entry price (EP) is the price that you entered the trade.

- The stoploss price (SL) is the price that you get stopped out.

So if it’s a losing trade, and you got stopped out, then you record the price which you got out or if you didn’t get stopped out, you also record down the stoploss price, because that is the price that intended for it to be the stoploss. - And lastly, the target price (TP) will be the price that you choose to take profit at.

If you actually stagger your trade, for example, you take half profits at certain price or decide to trail, and shift your stoploss or different variations of position management.

All this is useful information to see whether the position management strategy that you’re using is actually effective, or maybe it might be too complicated and decreasing the optimal returns that you should be getting.

Next, you should also attach a chart of your entry and exit in your trading journal.

Ideally the chart should be labeled with as many things as possible. Other than your entry and exit, you can label where you shift your stoploss or scale in or out of positions.

You can also choose to label your thought process directly on your chart.

So for example, if you choose to make your journal soft chart-based, then you could also record down most of the information directly on your chart, and then you’ll save a screenshot of it.

It might be easier for you to reference. All you have to do is just look through all the different charts, compilations. All the information is already on the chart.

However, it will not allow you to effectively analyze the data.

If you record it on a spreadsheet instead, then it’s easier if you want to do analytics to review the numbers and your profits.

This is a trade-off. Or you can do both if you have the time.

But the bare minimum you should have is to at least have an attached chart so that when you look at the chart, you can remember what this trade was about.

Trading Journal #4 Record Your Emotions

Lastly, the most important thing is to record down in your trading journal is your emotions throughout the trade.

Many traders tend to neglect this aspect because they think that they just want to record the hard data, so they don’t really record down how they were feeling or why they made this decision.

But trading is an emotional activity.

It’s largely psychological, but your emotions still do play a big role.

A large part of trading is how well you can effectively manage this emotion.

So the first step to understanding or managing the emotions, is to be able to record it down.

For example, when you were taking this trade,

- Were you feeling fear?

- Were you afraid that you might miss out the trade or feeling greedy?

- Or were you feeling hopeful or hesitant because maybe you were previously been burned in your last trade?

All these emotions are very important because subconsciously, they may affect your decision-making.

Trading Journal #5 Review Your Trades

The next segment is how to use these data that you have collected from your trading journal to improve your trading results.

The frequency at which you do your review will depend on your trading style.

If you are doing swing trading, then maybe you can do a review at the end of every week; if you are day trading, then you could do it at the end of every day.

The main point of this review is to look for areas of improvement.

What are some of the things that you should be looking out for?

- Did you follow your trading plan?

You should have a trading plan before you even start trading, so you can compare the before and after, (your trading plan versus your trading journal), how closely do they match up? - If you deviated from your trading plan, why did it happen?

Was it because of certain emotions or was it some impulse? - So with that, then you need to decide whether it is the plan needs to be improved or whether it is you who needs to improve so that you can be more disciplined to follow the trading plan.

The next level is to go down to each individual trade, for example, for every trade:

- Why was it a winning trade?

- Why was it a losing trade?

Just because a trade is a winning trade doesn’t necessarily mean that it was a perfect trade or you did everything correctly because there’s an element of chance.

Even if you broke all your trading rules and you traded horribly, there’s still a chance that you might end up with a winning trade, but that doesn’t necessarily reflect your ability to trade.

And it definitely doesn’t mean that you should replicate this behavior in the future.

It’s important to not just see the trade as winning trade equals good trade and losing trade equals bad trade, but to understand the underlying reasons for why it was a winning trade and why it was a losing trade.

For losing trades, was it due to poor execution or was it due to market conditions?

So similar to the idea put forth earlier, just because a trade was a losing trade doesn’t necessarily mean that it was a bad trade because you can do everything perfectly and executed everything according to plan and it could still turn out to be a losing trade simply because no trading strategy is 100%.

Even if your trading strategy is 70%, there is still a 30% chance that the trade will be a losing trade, even if you did everything correctly.

The key thing is to see how closely you follow your plan, whether you execute everything according to your plan.

As I said earlier, it’s a matter of reviewing everything and seeing whether the plan needs to be improved and changed, or whether it is you who needs to improve your discipline, such that you can be less emotional and be able to execute the plan which you have come up with.

And that is the key to being a good trader.

Summary of Trading Journal

So to sum up, I’ve shared with you 2 main segments of the trading journal.

The first was all the things that you need to record in your trading journal. (Parts 1 to 4).

That’s how you can create a good trading journal.

The second part is how you actually use this information to improve your trading results. (Part 5).

So remember that all successful traders, even professionals, they keep a trading journal.

And in fact, this is quite a standard practice for many of the funds and financial institutions, especially for some that I used to work at.

It was common practice that they want all the traders to have a trading journal so that when you are reviewing it with your manager or your bosses, there’s a record and it actually helps them understand your trading style and your trading decisions on a day-to-day basis.

Even if you are trading on your own, it’s actually very important to have this trading journal because you will be able to better understand yourself as well.

Only you will be able to figure out your strengths and your weaknesses.

So having this trading journal gives you a window into your own trading psyche and allow you to fine tune your trading strategies and thus, improve your trading results.

For all new traders out there, do you currently have a trading journal and for seasoned traders, how useful is a trading journal when you were starting your trading journey?

Let me know in the comments below!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!