Will the Stock Market Crash or Continue Going Up for Another 10 Years?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

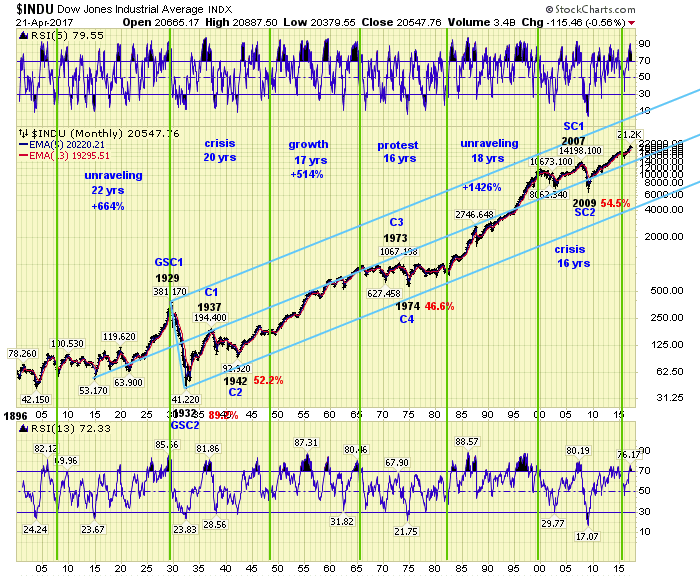

Since the crash of 2008, and the recovery which started in 2009, the stock markets (especially the US markets), have been on a steady uptrend.

Chart: S&P 500 index (weekly chart)

Chart: S&P 500 index (weekly chart)

Many of us have heard about the 10 year cycle, where the market is supposed to crash once every 10 years, for example the Asian markets during the 1997 currency crisis, and the global markets in 2007 during the subprime crisis.

However, in 2017, we did not see any significant crash or correction, which have led many analysts to rethink the theory.

So, in 2019-2020, should we be expecting a delayed crash, or are we experiencing a structural change in the markets?

If we observe the supercycles of major human technological innovations, we see that each major wave of progress is driven by a major technological innovation, such as the steam engine in the 1700’s or the internet and IT advancements in the 1900’s.

And based on the cycles, we could be in the early stages of the 6th wave, which is going to be driven by the upcoming huge advancements in applications of big data, artificial intelligence, virtual reality, augmented reality, internet of things, and blockchain technology.

Source: The Market Oracle

Source: The Market Oracle

This means that we could be on the cusp of a super bull market, if these technological advancements are able to create a quantum leap in productivity for businesses and a huge jump in the standards of living across the globe. All these would translate into stronger stock prices, which instead of crashing the market, would propel it to new heights.

However, there are also major concerns:

- Unequal gains across companies: the major tech companies may soon dominate all industries via the application of new technologies.

- High unemployment: If machines take all the jobs, what are humans going to do?

- High debt and leverage of US and European economies

- Political risks: clash of superpowers (US and China)

In summary, many retail investors are wary of entering the stock market now because it is at all time highs and has already “gone up a lot” since 2009, hence they are waiting for a “big crash” before going in.

However, this big crash may not come if successful widespread application of new technologies and innovation are able to drive a quantum leap in productivity.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!