Weekly Market Wrap: Taking Profit on Short Positions!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last week, we saw the bearish trend continue for stocks, crypto and REITs, as well as the bullish trend for USD.

Since we have been holding these positions for quite a while, and they are all deeply in the money, I have decided to close these positions and take profits.

Some of these positions were also getting a bit overbought/oversold, and some were nearing support/resistance, so I thought it would be a good idea to take profits and stand aside to see if there is any rebound, where we can re-enter the market at a better price.

This month has been one of the most profitable for our portfolio, and there is a good chance that the long-term trends will continue till the end of the year.

Want to know when to re-enter the market?

Join our Daily Trading Signals Telegram channel for real-time market updates and the best trading opportunities!

[Photo: Desert Safari, Dubai, UAE – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (23 September 2022)

? Rates went up by 0.75% during FOMC on 21 Sept – more rate hikes coming!

? Long-term bearish for stocks, crypto, REITs, commods, etc. Deeply in the money now, continue to add more short positions on pullbacks.

? Long-term bullish for USD

Portfolio Highlights

Weekly Portfolio Update (23 September 2022)

Still bearish on stocks, REITs, and crypto, accumulating short positions. Almost all of cash is held in USD since it is the strongest.

Forex & Commodities Market Highlights

Now that the second target for USDSGD has been hit, it might be a good idea to take profits since it is at the top of the large trading range.

Following up on USDSGD, it has exhibited 2 bearish pin bars. Likely to have a correction soon.

Parity with USD next?

https://twitter.com/thestalwart/status/1574203631456292864

Stock & Bond Market Highlights

https://www.wsj.com/articles/mortgage-rates-rise-to-6-7-highest-since-2007-11664460015

For those still short on the NASDAQ 100 (US100), might be a good idea to take some profits since prices have dropped a lot in a short period of time, and a rebound is likely.

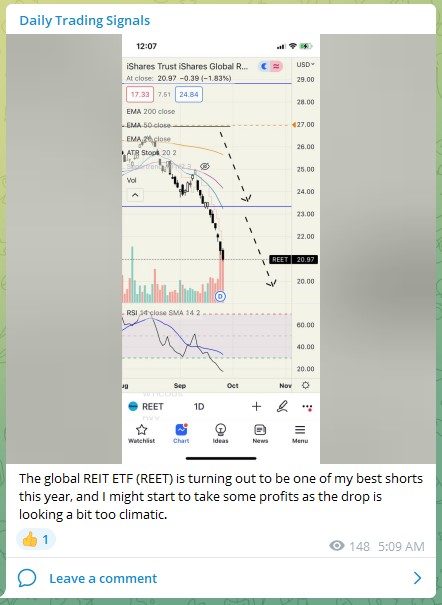

The global REIT ETF (REET) is turning out to be one of my best shorts this year, and I might start to take some profits as the drop is looking a bit too climatic.

https://finance.yahoo.com/news/goldman-sachs-cuts-2022-target-091339381.html

Crypto Market Highlights

Looks like a good time to take some shorts on Ethereum (ETHUSD), after prices tested the resistance level and rejected it with a pinbar.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!