For subscribers of our “Daily Trading Signals”, we now also include a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technical, economics, and portfolio management:

Click here for last week’s market report (09 October 2023)

Click here to subscribe for the latest market report (16 October 2023)

Click here to see the archives of all our past market reports

Market Recap & Upcoming Week

Last week witnessed significant global developments. In a shocking turn of events on October 7th, Gaza’s militant group, Hamas, launched sudden attacks against Israel, resulting in casualties on both sides. This unexpected assault, coinciding with the Jewish holiday of Simchat Torah, has reignited concerns reminiscent of the unanticipated 1973 Mideast war. The backdrop to this is a tumultuous landscape in Israel, with disputes over the Al-Aqsa Mosque compound and the expansion of Jewish settlements adding to the volatility. Furthermore, this surge in external conflict comes at a time when Israel is already under internal strain due to widespread protests against Prime Minister Netanyahu’s legislative proposals.

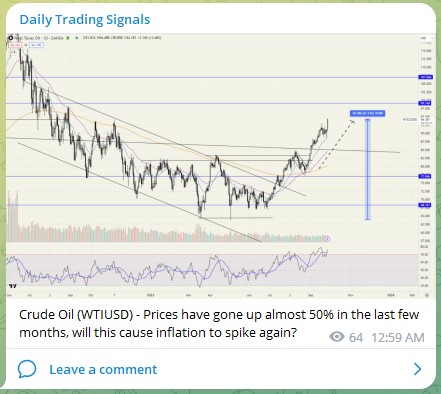

On the economic front in the U.S., a subdued sigh of relief may be in order as data reveals a slowdown in the inflation rate. September’s rate stands at 3.7% year-on-year, and 0.4% from the previous month. The slower pace, however, does not signify an all-clear for consumers. With core inflation up by 4.1% since last September and the Federal Reserve’s anticipated decisions regarding interest rates, there’s an air of cautious anticipation. A particular point of concern is the surge in mortgage rates, hitting a 23-year high, posing potential challenges for home buyers in the near future.

Brace yourselves for a whirlwind of economic updates next week as we dive deep into one of the most action-packed earnings periods of the year. Leading the charge are global titans like Tesla, Netflix, and Johnson & Johnson, followed closely by financial giants such as Bank of America, Goldman Sachs, and Morgan Stanley. Furthermore, with AT&T and Lockheed Martin also unveiling their reports, expect a comprehensive insight into various sectors, shaping the financial narratives for the weeks to come.

In parallel with these corporate disclosures, pivotal economic indicators are set to be unveiled. Tuesday promises to be especially enlightening with the U.S. Census Bureau releasing September’s national retail sales data, offering a snapshot of the health of consumer spending in the country. The real estate enthusiasts should also keep their eyes peeled for the latest figures on September housing starts and existing home sales, not to mention the much-anticipated National Association of Home Builders’ Housing Market Index for October, shedding light on the housing market’s current pulse.

EURCHF – Very nice clean trade with 190+ pips profit, congrats to those who took this trade with us! 💰🔥💪🏻

USDSGD – Nice bull flag forming on top of resistance-turned-support, signalling more upside!

EURUSD – Following up on this, we have increased our target profit to capture more profits for this trade.

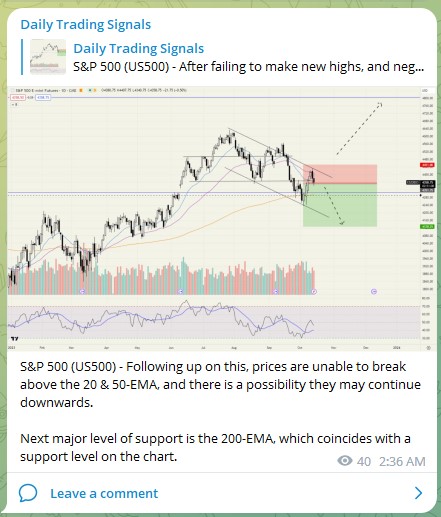

S&P 500 (US500) – Following up on this, prices are unable to break above the 20 & 50-EMA, and there is a possibility they may continue downwards.

Next major level of support is the 200-EMA, which coincides with a support level on the chart.

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.