Weekly Market Wrap: Strong Rally in the Stock & Bond Market!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

For subscribers of our “Daily Trading Signals”, we now also include a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technical, economics, and portfolio management:

Click here for last week’s market report (30 October 2023)

Click here to subscribe for the latest market report (6 November 2023)

Click here to see the archives of all our past market reports

Market Recap & Upcoming Week

Stocks saw a significant uptick last week, driven by encouraging economic indicators and a change in the Federal Reserve’s tone, which led to a dip in interest rates. The Federal Reserve, as anticipated, did not alter interest rates at its recent meeting, but communicated a more measured approach to future rate changes. This stance aligns with our belief that the Fed may conclude its cycle of rate hikes.

The most recent jobs data also gave investors reason to be optimistic, suggesting that the labor market is cooling just enough to further reduce inflation while remaining strong enough to sustain consumer spending and stave off a deep recession.

Although the path ahead may not be entirely without obstacles, the combination of recent market adjustments, positive economic signs, a potentially steady Federal Reserve, and traditionally strong seasons for stocks lead us to believe that there is a strong argument for the markets to gain traction as we approach the end of 2023 and look ahead to 2024.

Goldman Sachs’ revised inflation predictions hint at a silver lining with lower expected core CPI and PCE inflation rates by December 2024. These forecasts, converging with the Federal Open Market Committee’s estimates, suggest that inflationary pressures might ease, with slowing wage growth and a significant projected decrease in shelter inflation. As a result, the Fed seems poised to maintain its fed funds rate until late 2024.

These developments, paired with last week’s market rebound led by the tech sector and investors’ keen focus on Treasury yields and forthcoming policy announcements, paint a complex picture of the current economic landscape, where optimism in certain quarters is tempered by caution in others.

In the coming week, investors should brace for a flurry of earnings reports from major players across various industries. Notable companies such as Uber Technologies, UBS, and Occidental Petroleum are slated to release their financials, providing insight into sectors from tech to banking to energy.

Automotive enthusiasts will be watching Honda Motor Company and Rivian Automotive, while media and entertainment sectors will be eyeing the earnings from The Walt Disney Company and Warner Bros. Discovery. The performance of these companies could signal broader economic trends and potential shifts in market dynamics.

Economic indicators will also be in the spotlight, with the New York Fed’s quarterly report on household debt and credit shedding light on the financial health of American consumers. This report, due Tuesday, is particularly pertinent as it reflects the state of U.S. households in the face of current inflationary pressures.

At week’s end, the University of Michigan will offer a more immediate pulse on consumer mood with the release of its Consumer Sentiment Index for November. This data is crucial as consumer confidence levels have a direct impact on spending behavior and, consequently, the overall economic outlook.

Daily Trading Signals (Highlights)

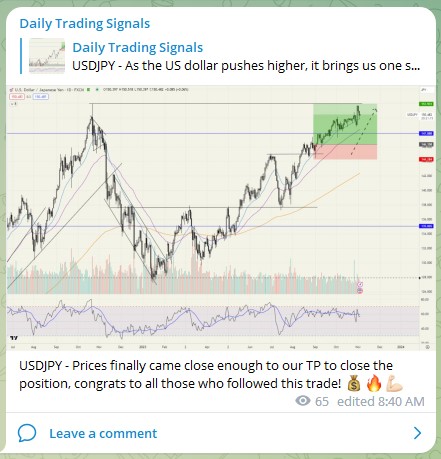

USDJPY – Prices finally came close enough to our TP to close the position, congrats to all those who followed this trade! 💰🔥💪🏻

S&P 500 (US500) – Prices have rebounded from the bottom of the price channel, and is now at a crucial level of many confluences:

1. all 3 EMAs

2. down trendline

3. support-turned-resistance level

Will wait on the sidelines to see which way the breakout happens.

20-year Treasury Bonds ETF (TLT) – Could this finally be the turning point?

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!