Why Paper Trading is a Waste of Time (And What are Better Alternatives?)

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

You probably have heard of paper trading, but do you know that most people are doing it wrongly and it ends up being a waste of time?

As a new trader, does it make sense to start off with paper trading and what is the correct way to do it?

In this blog post, I’m going to talk about paper trading, the correct way to do it, and discuss whether it is worth your time doing it.

If you would like to learn all the essential elements to kickstart your trading journey, also check out: The Beginner’s Guide to Trading & Technical Analysis

Table of Contents

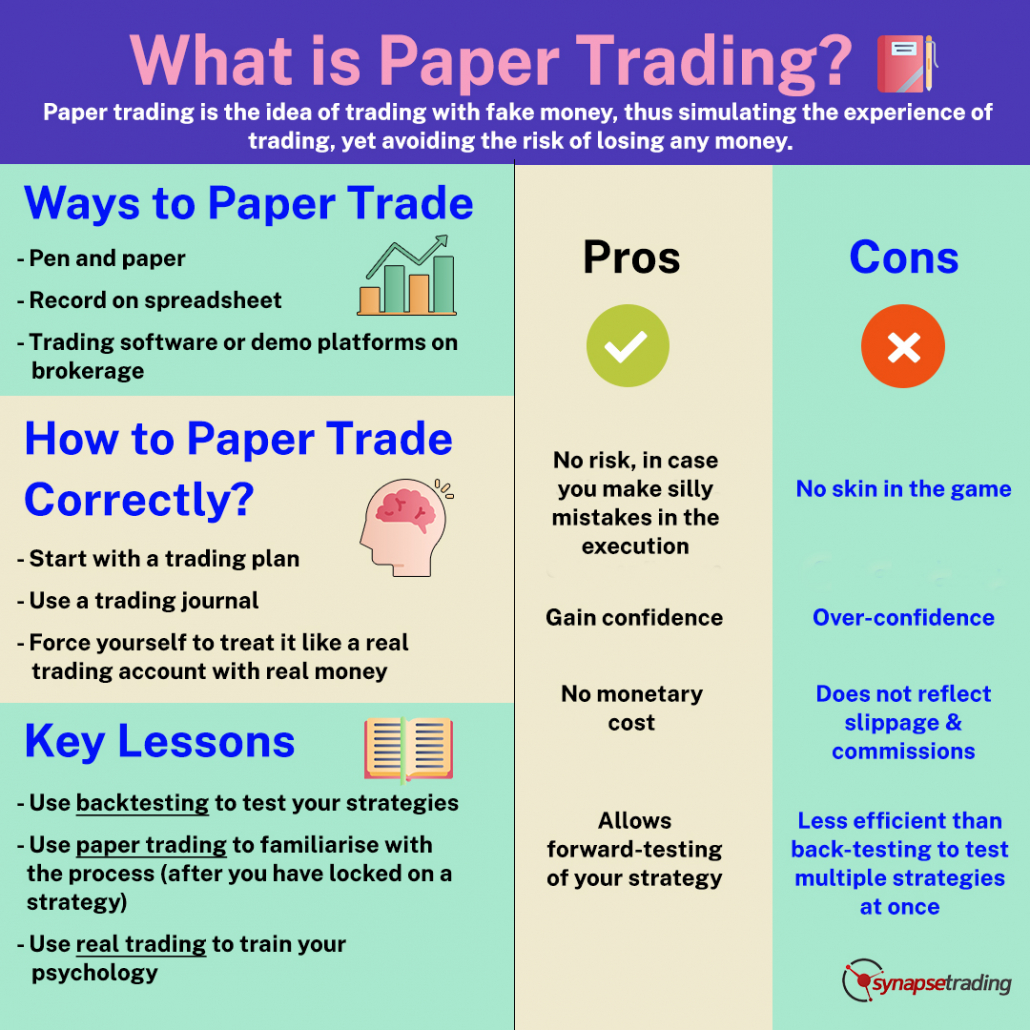

What is Paper Trading?

Firstly, what is paper trading?

Paper trading or demo trading or virtual trading, is the idea of trading with fake money, thus simulating the experience of trading yet avoiding the risk of losing any money.

Basically what this means is that you use a virtual account or a demo account and this simulates trading but you are not actually using any real money to trade.

So, in this sense, you do not actually lose any money.

When you are starting out, it makes sense to start with less capital or fake money, and focus first on honing your trading skills.

You can then always scale up or use real money as your skill gradually improves.

This makes sense because for new traders, most of the mistakes are made when you are starting out and so the idea is for you to minimize the cost of those initial mistakes by using fake money.

This can be a good idea for the first 10 to 20 trades where you just want to get an idea of how to execute the trades and the process of managing those trades, however the main problem with paper trading is that you cannot learn any real trading psychology if you just do paper trading.

Because if you recall, the mindset or trading psychology is a major factor in trading success.

Imagine playing poker with fake money. Is it still the same experience? Definitely not.

Because trading similar to poker in many ways, test your ability to make good sound decisions under the stress of having money at stake.

Without any skin in the game or any real money at stake, the experience is just not the same.

Ways to Paper Trade

What are some of the ways that you can paper trade?

The easiest way is to simply use pen and paper or a spreadsheet to record your trades.

For example, if you’re browsing the charts and you spot a good opportunity, and you decide “I’m going to buy x number of lots at this price” and you record down the trade, then as the price progresses you can record down “I’m going to exit at this price”, and whether you made a winning trade, how much you made, etc.

This is a more manual way of recording your trades.

But now with a lot of software available in the market, such as Tradingview or if you are using any brokerage platforms, they usually provide you with a demo trading account, so this allows you to trade on the products that are available on the platform where you can buy and sell the products using a demo account and all the transactions will be recorded.

It’s easy for you to refer back to all the transactions and trades that you have made.

These are the 2 easiest ways of paper trading.

How to Paper Trade Correctly?

Next, how do you paper trade correctly?

Earlier on, I mentioned that many people are doing it wrongly and hence it ends up being a waste of time.

If you want to get the most out of your paper trading, there are 3 important things that you need to take note of.

The first is you need a trading plan, like I mentioned in my previous videos.

Check out: How to Craft a Winning Trading Plan (The 7 Key Ingredients)

Before you place any trades, whether it’s on a real account or demo account, you need to plan out the trade fully.

You need to know what strategy, what time frame, what product, where you’re going to enter and exit your trade.

You need to have everything planned out before you even take the trade, because if you’re going into paper trading and you’re just randomly buying and selling, then there is no learning

or experience at all because you don’t even know what you are doing, so whether you win or you lose, at the end of the day, you have no idea whether what you did was right or wrong.

The second thing that you need to have is the trading journal.

Check out: How to Create a Trading Journal (And Discover Your Edge in the Markets)

Basically, you want to record down the whole process of your decision making, your buying and selling, what emotions are involved, the decisions that you made, why you made all these

decisions, because all these data from your trading plan and your trading journal will help you formulate and improve your strategies such as when you go to real trading.

The last thing which is the most important, is to treat your paper trading account or your demo account as if it is a real trading account.

This is the closest thing you can get to simulating the trading psychology, because if you treat your fake money as real money, then at least when you make the decisions, you will apply your proper money management and risk management rules.

Pros & Cons of Paper Trading

What are the pros of paper trading?

Firstly, there is no risk involved because you are using fake money on a demo account so even if you make a lot of beginner mistakes, for example you you accidentally key in the wrong orders,

or you press the wrong buttons, it doesn’t matter because you can then reset your account and do it properly the next time.

In a way, it’s a cost-free way of learning and making mistakes.

The next thing is to gain confidence because as you familiarize with the platform and the ways of executing the trade, you also gain confidence in your strategies and at the same time, you are also testing out whether the strategies work.

This works best if the demo platform you are trading on is the same as the actual platform you will be trading on once you move into live trading.

After paper trading for a period of time, if you are actually making good profits, it means that your trading strategy probably should work in the real market as well.

The third point is that in a way, it is also forward testing your trading strategy because after deciding what the strategy is in your trading plan, you are now testing it forward as opposed to back-testing.

What are the cons of paper trading?

The most obvious one like I mentioned before is that there’s no skin in the game, so it is hard to learn trading psychology when real money is not involved.

The next risk is overconfidence because you might think that you know you are doing very well on paper trading, only to realise it is not the same when it comes to real money.

This phenomenon is something I frequently noticed when I was trading professionally at hedge funds.

A lot of people do well on the demo account or the paper trading phase, but when it comes to real money, they somehow lose that confidence or they become too overconfident and thus, they

tend to blow their accounts.

The next point is slippage and commissions.

When you are trading with paper trading or demo accounts, it may not necessarily accurately reflect any slippage or commissions, which are the transaction costs that are involved in real trading, so you might want to take note of that, especially if your trading strategy involves a lot of transactions, then this could become significant.

The last disadvantage for paper trading is if you are just looking for a way to see if your strategy works, then back-testing does a much better job that paper trading.

You can test easily 10 to 20 strategies, by computerizing it so that you can test multiple strategies at one time before you even start trading.

Hence, back-testing is way more efficient if you are looking for a way to see if your strategy works.

Summary of Paper Trading

In conclusion, my advice to new traders is to start off with paper trading for about 10 to 20 trades, then move on to trading a small account with real money.

You can get used to being able to execute trades when you are doing the paper trading phase, but eventually when you move on to the real account, then you can see how their trading psychology is like when there’s real money at stake, so it doesn’t matter how small you start with as long as it’s real money, then you can slowly scale up and gain confidence trading real money.

To sum up, what I would recommend is to:

- Use back-testing to test your strategies and once you have a good strategy, then you

- Use paper trading to familiarize with the process and after that once you are familiar with the process, then you

- Move on to real trading to train your trading psychology.

That is the whole flow and the process of progression in trading.

So now that I’ve shared the correct way to do paper trading, do you still think paper trading is useful and have you tried it out for yourself?

Let me know in the comments below!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!