Weekly Market Wrap: The Bears are Back in Full force!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

After the rate hike last week, and the continued hawkish tone of the Fed, the market bears are now back in full force!

As we mentioned in our video last week, the long-term trend is still bearish, so the short-term rebound of the market was an excellent shorting opportunity.

And those shorts have paid off, when markets plunged after the FOMC, and all shorts are deeply in the money now. If the markets continue to fall, this could end up being our most profitable month this year!

Next week, the strategy largely remains the same, which is to accumulate more short positions on any pullbacks.

Stay tuned for more profitable trading opportunities in our Daily Trading Signals Telegram channel!

[Photo: Melbourne, Australia – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (17 September 2022)

? High CPI numbers bad for risk assets

? FOMC on 21 Sept – more rate hikes coming

? Long-term bearish for stocks, crypto, REITs, commods, etc

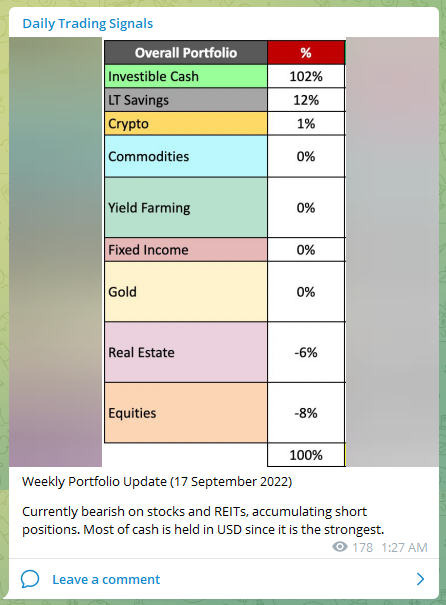

Weekly Portfolio Update

Weekly Portfolio Update (17 September 2022)

Currently bearish on stocks and REITs, accumulating short positions. Most of cash is held in USD since it is the strongest.

Forex & Commodities Market Highlights

AUDUSD Crossing 0.66701

Aussie vs. US Dollar

Break new lows!

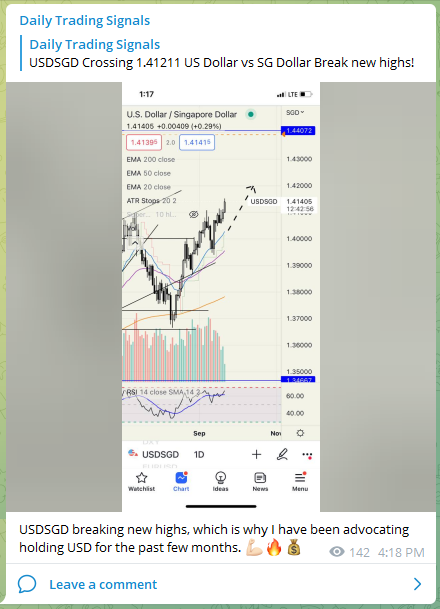

USDSGD Crossing 1.41091

US Dollar vs SG Dollar

Break new highs!

USDSGD breaking new highs, which is why I have been advocating holding USD for the past few months. ????

Like I mentioned many times before, EURUSD is a good short on pullbacks.

US Dollar Index (DXY) poised to continue heading up, as markets eye the FOMC tonight.

Stock & Bond Market Highlights

U.S. investment-grade bond yields are the highest since 2009, at an average 5.14%. pic.twitter.com/XIuQELONAY

— Lisa Abramowicz (@lisaabramowicz1) September 19, 2022

Crypto Market Highlights

ETHUSD Crossing 1350.76

Ethereum

Break swing low

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!