Weekly Market Wrap: Large Profits on USD Longs and Stock Market Shorts!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Global markets had a mixed week, as concerns over rising interest rates and inflation continued to weigh on investor sentiment.

Gold prices edged up as the dollar weakened due to rate hike worries, capping off a choppy trading week for the precious metal. The price of gold has been volatile in recent weeks as investors weigh the impact of rising interest rates and inflation on its value.

Meanwhile, the US dollar was steady as investors evaluated the Federal Reserve’s outlook for higher-for-longer interest rates. The yen saw increased volatility as traders digested mixed economic data from Japan.

Oil prices gained on Russian supply cut worries, while higher US inventories weighed on prices. Crude prices rebounded after a six-day losing streak as market participants watched geopolitical tensions and supply cuts.

In Asia, equities were mixed, with US rate hike worries still weighing on the markets. Japan’s Nikkei 225 index closed higher, while China’s Shanghai Composite fell.

Overall, markets continue to face uncertainty over the direction of interest rates and inflation, as well as geopolitical risks, which are likely to lead to volatility in the short term.

Thankfully, over the past week, we have been holding large USDSGD long positions and large short positions on the US stock market, which gave us double gains for our portfolio.

For more market updates and real-time trading opportunities, join our private “Daily Trading Signals” Telegram channel!

[Photo: Charyn Canyon, Kazakhstan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

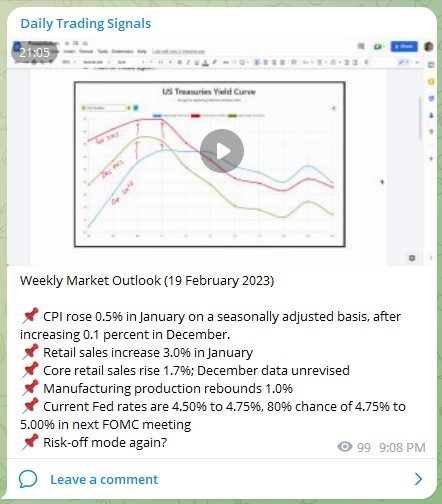

Weekly Market Outlook (19 February 2023)

📌 CPI rose 0.5% in January on a seasonally adjusted basis, after increasing 0.1 percent in December.

📌 Retail sales increase 3.0% in January

📌 Core retail sales rise 1.7%; December data unrevised

📌 Manufacturing production rebounds 1.0%

📌 Current Fed rates are 4.50% to 4.75%, 80% chance of 4.75% to 5.00% in next FOMC meeting

📌 Risk-off mode again?

Portfolio Highlights

Weekly Portfolio Updates (19 February 2023)

📌 Added a bit more T-bills at 5%

📌 Took profit on US tech stocks and REIT shorts

📌 Added a bit more short positions to stocks

Forex & Commodities Market Highlights

USDSGD – Congrats on the 300+ pips profit riding this wave up! 💰🔥💪🏻

Now that it has run into strong resistance, it is a good idea to take half or some profits, and trail the rest.

GBPJPY – As mentioned in the video, this counter is in a long-term uptrend channel, and more recently broke out from an ascending triangle.

Stock & Bond Market Highlights

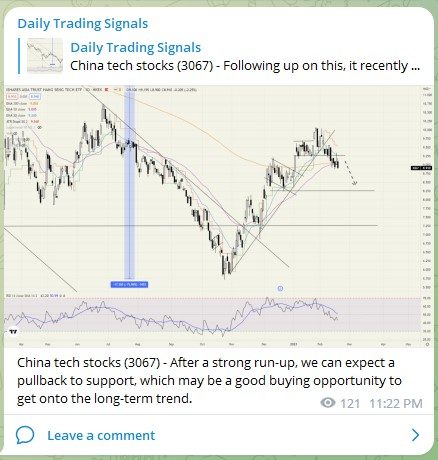

China tech stocks (3067) – After a strong run-up, we can expect a pullback to support, which may be a good buying opportunity to get onto the long-term trend.

NASDAQ 100 (US100) – Currently consolidating at a crucial point, if it breaks lower bulls will give up and bears will jump in again.

If it breaks higher, then bears will wait at the prior swing high (around 13750) to mount another challenge.

Watching this today to see if it breaks to the downside and triggers the price alert.

NASDAQ 100 (US100) – Looking at the 4 hour chart, it has a nice pullback to the breakout neckline. Good chance to add more short positions.

Investors have been hoping for a “soft landing” for the US economy, but the recent spate of strong economic data has worried some that it might not happen.

The fear is that the US economy will continue to heat up, forcing the Federal Reserve to raise interest rates higher than expected for longer, increasing the chances of a sharp downturn that would hit the markets hard. Investors had been hoping that the Fed would be able to rein in inflation without tipping the economy into recession.

The recent strength of the data has led analysts to increase their forecasts for the peak federal-funds rate to around 5.25%, with some warning that such an increase would increase the likelihood of a recession, which the S&P 500 tends to decline in such scenarios.

Crypto Market Highlights

Ethereum (ETHUSD) – Can consider taking a long position with a tight stop, with a potential upside of 15-20% to test the prior swing high.

After a series of high-profile collapses in 2022, cryptocurrencies faced a tough year. However, things may be looking up in 2023 as Bitcoin, Ethereum and other cryptocurrencies have started to rise, suggesting that the dreaded “crypto winter” could be thawing.

Analysts believe that favourable market conditions and the US Federal Reserve slowing its pace of interest rate hikes could be contributing to this rise. Additionally, the upcoming Bitcoin halving event in 2024 could help lift the prices of Bitcoin out of the doldrums, according to historical data.

Furthermore, the development of central bank digital currencies (CBDCs) could give digital assets more credibility. While cryptocurrencies remain volatile, they could continue to be used as a digital currency for transactions in the digital space.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!