Cup and Handle Pattern Trading Strategy Guide (Updated 2025)

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

The cup and handle is an accumulation buying pattern, which is found during long periods of consolidation, and can lead to powerful explosive moves once the pattern is fully completed.

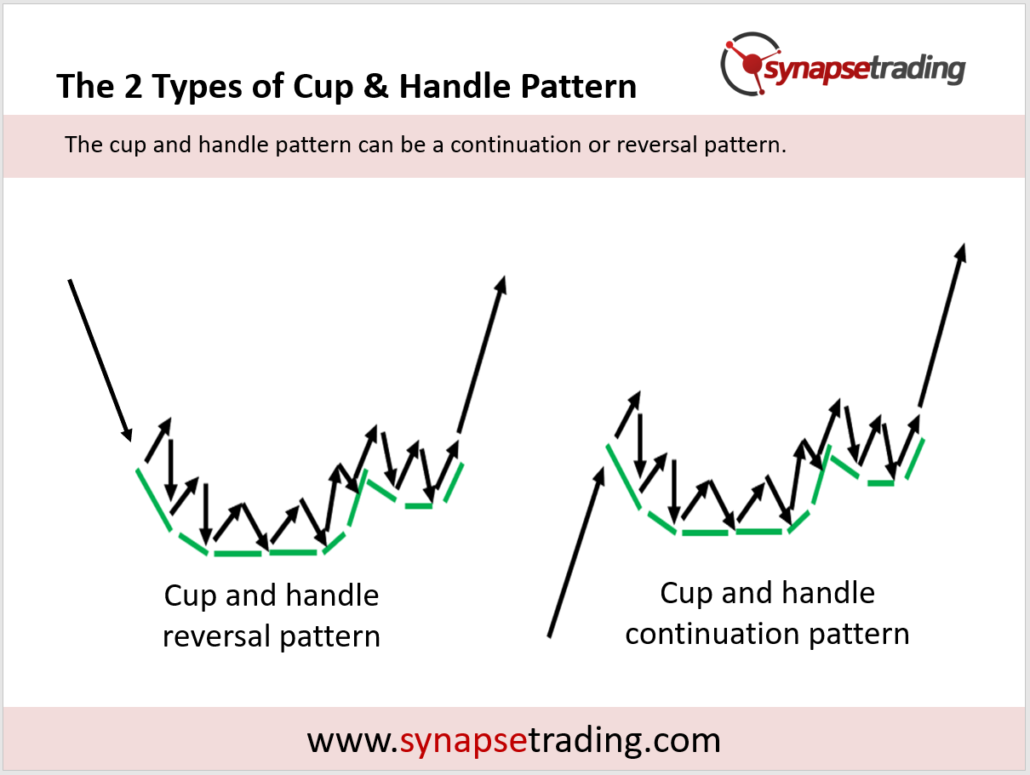

There are 2 main varieties of this pattern – the cup and handle reversal pattern, and the cup and handle continuation pattern.

In this post, I will show you how to take advantage of the cup and handle pattern to trade breakouts, how to avoid false breakouts, and the best trading strategies for this price pattern.

Table of Contents

What is a Cup and Handle Price Pattern?

The cup and handle is an accumulation buying pattern, which is found during long periods of consolidation, and can lead to powerful explosive moves once the pattern is fully completed.

In the diagram below, you can see that the price pattern consists of a larger accumulation base (the cup), before forming a smaller accumulation base (the handle), before finally leading to a breakout.

From a practical viewpoint, we will usually start to notice the pattern only when it starts forming the “cup” part of the pattern, which is quite identifiable by the smooth gradual curve upwards of trending swing counts of higher highs and higher lows on the chart.

The confirmation will come from the “handle” part of the price pattern, which is like a small pullback before the price explodes upwards. You can think of it as pushing down on a loaded spring, to build up more pressure just before the release.

The 2 Types of Cup and Handle Patterns

Unlike other chart patterns, the cup and handle pattern does not work equally for both the bullish and bearish scenario, as it is almost exclusively found in the bullish scenario only. Hence, we don’t hear people talking about “bullish cup and handle” or “bearish cup and handle”, because when they say “cup and handle”, it is understood to refer to the bullish version.

Based on the 2 main categories of chart patterns (continuation vs reversal), most people tend to classify the cup and handle pattern under the “Reversal Patterns” category, however I feel that the cup and handle can be both a reversal or continuation pattern.

In the diagram below, I illustrate the 2 different types of cup and handle patterns.

a) Cup and Handle Reversal Pattern

In the reversal cup and handle, prices start off in a prolonged downtrend, where they gradually lose momentum and become more sideways. Prices start to bottom out and form a reversal base, before leading to a change in direction.

b) Cup and Handle Continuation Pattern

In the continuation cup and handle, prices are on an existing uptrend, and when the trend loses some steam or takes a pause, prices start to move sideways. The cup and handle pattern helps to buy up more buying pressure, before prices break to new highs and resume the uptrend.

In both scenarios, the context is very different, but the pattern is the same, and can be traded in exactly the same way.

Cup and Handle Pattern Psychology

In the cup and handle pattern, as the downtrend starts to weaken (less bears/sellers), the bulls/buyers start trying to take control from the bears, by gradually accumulating long positions.

As they build up their positions, we start to see a wide U-shape bottom (the cup), where bulls and bears are almost balanced. This suggests that the bears are no longer in control, and the downtrend has been neutralized.

In the final stage, where the handle forms, this is where the final battle of the bulls and bears take place.

By this time, the bulls have the upper hand as they have been accumulating positions during the cup formation, which in turn attracts more buyers.

Once the last bears are killed, bulls take full control, and the explosive price breakout takes place.

Cup and Handle Pattern Trading Strategies

There are 2 main strategies, which focus on the final battle between the bull and bears, because that is usually the tipping point where large explosive moves happen once the bears give up and get overwhelmed by the bulls.

- Pre-Breakout Entry: Enter before the breakout

- Pullback Entry: Wait for a pullback after the breakout

Since the cup and handle is inherently a bullish pattern, the basic idea is to look for low risk buying opportunities to enter.

Looking at the diagram above, you might think that the best place to enter a trade is during the cup phase, because you can get the best entry price.

However, during the cup phase, the odds are 50-50, and there is no real edge, because the market is still sideways at that point of time.

In addition, the cup phase might last a really long time, and may not lead to a handle.

Hence, it makes more sense to make good use of your trading capital, and only enter the trade as the action is about to start.

The first opportunity would be to enter during the handle phase before the breakout, but if you miss that, they next best chance is to enter on the first pullback after the breakout.

Now, let’s go through each strategy in greater detail.

Trading Strategy #1: Pre-Breakout Entry

Our first strategy for the cup and handle price pattern is to enter just before the completion of the pattern, during the handle formation.

During the cup formation, buyers would have been accumulating long positions and building bullish pressure, with the occasional test of the resistance level by trying to break out.

As the handle forms, it is very close to the breakout happening, and this provides a good low-risk opportunity to enter the trade just before the action begins.

Once the breakout happens, the price and volume is expected to surge, which would make it more challenging to enter a position, hence it is recommend to take a position before that.

For trading, we would look to enter during the handle formation, which would be very close to the resistance level.

We can then place a stoploss below the handle, and since the handle is usually pretty small relative to the pattern, the risk will not be very high.

Trading Strategy #2: Pullback Entry

Our next strategy for the cup and handle pattern is to enter on the first pullback after the initial breakout.

As covered in the previous setup, one of the ways to trade the cup and handle pattern is to enter just before the price breaks out of pattern.

However, sometimes the breakout might be too fast, or you might have missed the breakout opportunity.

After such a long build-up (the cup and also the handle), it is very likely that any resulting move up would have more than 1 leg, so the first pullback/pause is a good place to enter because there is a high chance of a 2nd leg after the trend resumes.

In the example above, we see prices surge after the initial breakout, followed by a small pause which looks like a bull flag, before prices continue to surge again after breaking out from the flag pattern.

That small pause (in this case the bull flag) gives us a good low risk opportunity to get into the trade to ride the next wave of uptrend. Do note that the pause may not always be a flag, sometimes it might take other forms, but the idea is the same.

For trading, we would look to enter during the pause (formation of the small flag), when the risk and volatility is low. The bottom of the pullback pattern would be a good place to put your stoploss.

If you have already taken a position using Strategy #1 on the pre-breakout, you can also use Strategy #2 to add more positions on the first pullback.

Profit Target for the Cup and Handle Pattern

Once the cup and handle pattern is identified, you can use the completed pattern to do a price projection, which can serve as a good estimate for a target profit for your trade.

To measure the target price, take the maximum height of the cup, and project that distance from the breakout point.

In the chart above, the maximum height of the cup is indicated by the blue rectangular box, which is then used as a price projection at the breakout point.

The black horizontal arrow indicates the price level which serves as the minimum profit target for the cup and handle pattern breakout.

To get an added layer of confirmation, you can look for confluence with with tools and methods, such as support and resistance levels.

Tips from the Trading Desk

- For cup and handle continuation, look to trade with the trend, especially if the trend is strong.

- For cup and handle reversal, look for a strong accumulation base to build the move.

- Look for multiple attempts to break the resistance, but also avoid the false breakouts!

As you can see from the chart above, a key component of the cup and handle pattern lies in the resistance level, because in a sense the whole build-up during the cup and the battle during the handle is an attempt to break though this level.

Hence during the build-up phase, we should look out for attempts to break the resistance levels, and it is expected that the first few attempts will fail, so do not try to trade those breakouts.

These “false breakout” attempts are more to probe for weaknesses, and the chances of a successful breakout at this point of time is low because there is insufficient build-up, which usually takes the form of the handle.

Hence, it is more prudent to only enter this setup during the handle formation, especially if previous attempts have been made to break the resistance.

Now that I have shared the various trading strategies for the cup and handle price pattern, which is your favourite strategy?

Let me know in the comments below.

If you would like to learn all the different price chart patterns, also check out: “The Definitive Guide to Trading Price Chart Patterns”

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Personally I feel that this pattern is not useful at all. So hard to apply in real life.

This pattern is not that common, but when you do find it, is a pretty reliable pattern, and provides a strong move.

Not to put the strategy down. It’s so rare that this pattern happen and I am a pips trader.

For a moment, I thought you are sharing to us to “note” the strategy down ?

Yes, it is more rare, but the returns are awesome once you find it!

Is this the least important strategy to remember? I am a bit overwhelmed by all the patterns IMHO.

Heard of this pattern but I never used it myself.

Time to try it out!

Yup usually not into patterns.

There is no ranking of importance for the different patterns. You can start off by mastering 1-2 patterns before moving on to the rest.

One of the most detailed and easy to understand guide I have seen here! ?

You’re welcome!

Is this pattern more applicable to long term trends?

I think they can be found in short-term and medium-term trends as well.

Interesting pattern. Will use it when the chance arises!

It’s harder than you think! Not as easy to implement!

This pattern is complex and tricky to identify and trade. I hope newbies know what they are doing and have enough experience and practice with this pattern. Recommend you guys to start with other patterns first instead of this.

useful to determine if the sideway trend is going to break using this pattern

I will like to share some of the charts for cup and handle. But I don’t think we can attach our charts in the postings.

How do we determine the actual stoploss price for the handle? It seems so gray to me.

I use Fibonacci retracements in my trading.

Quite an advance pattern to understand. just doesn’t come intuitively to me.