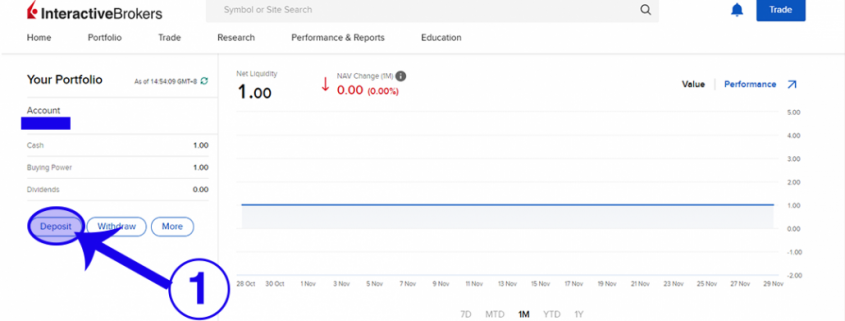

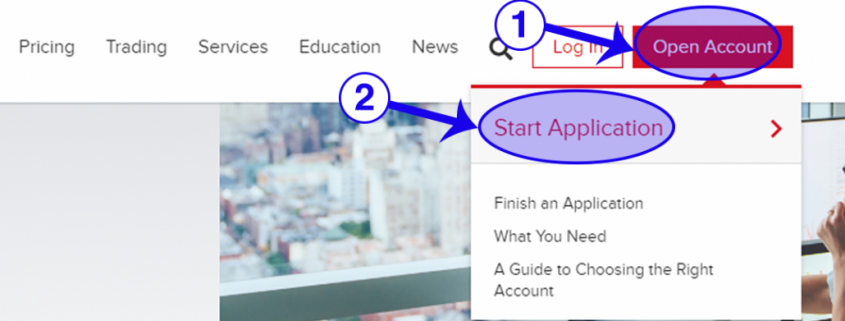

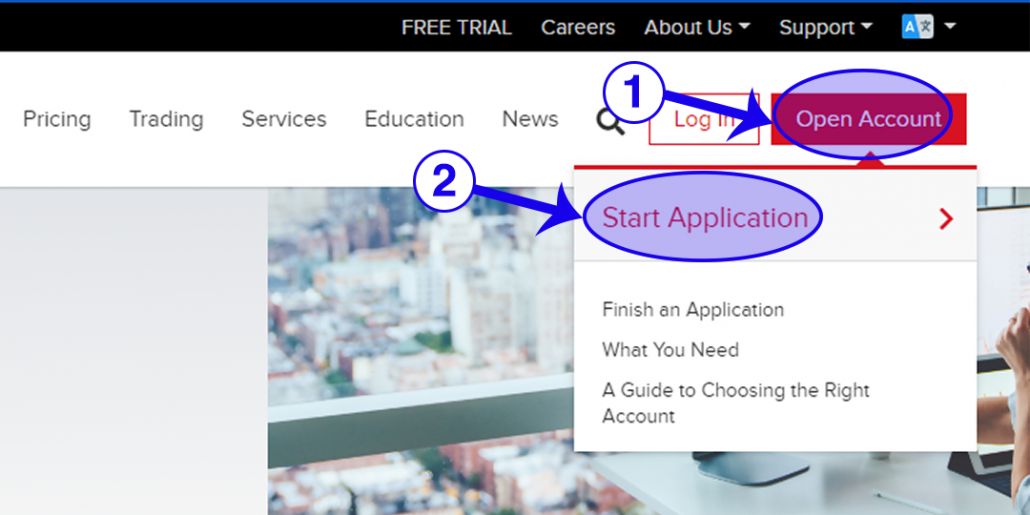

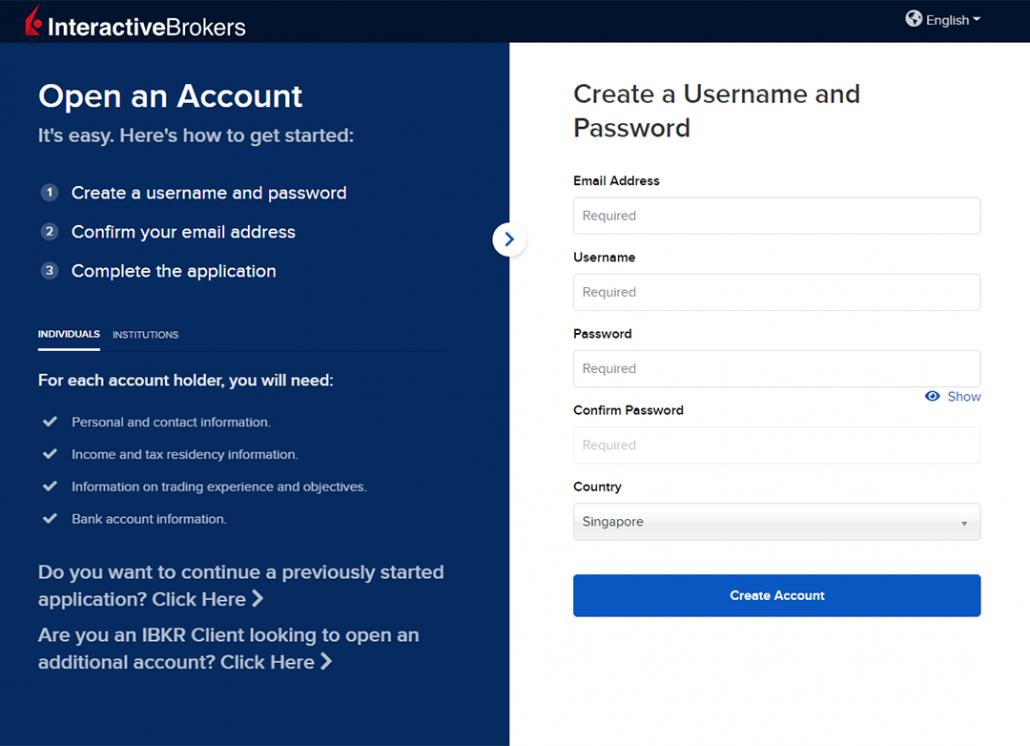

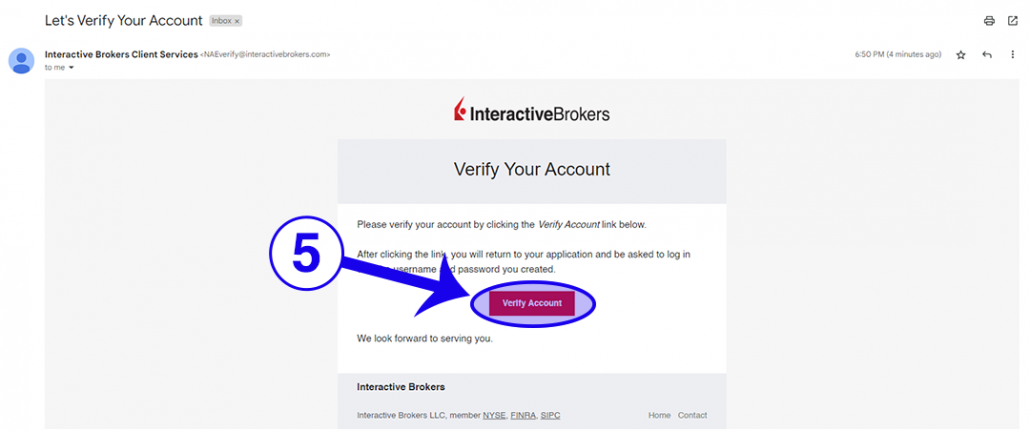

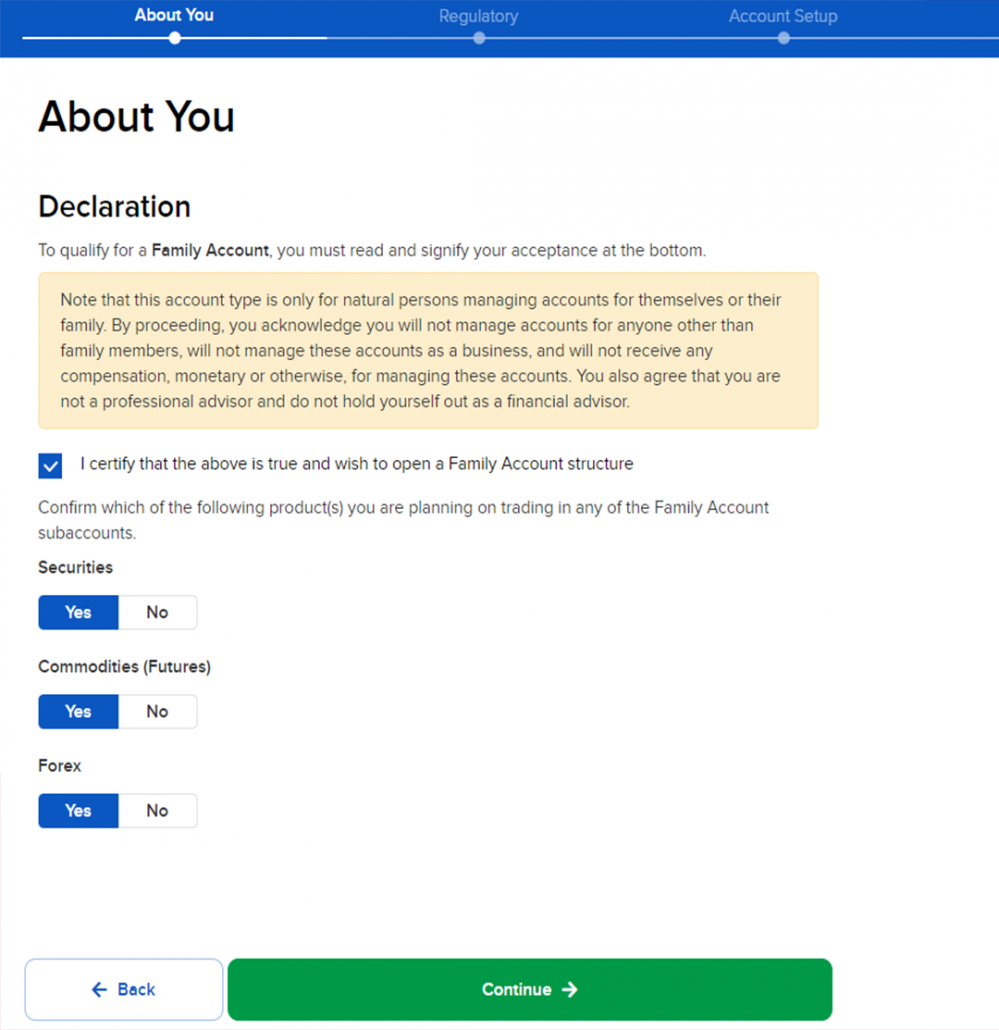

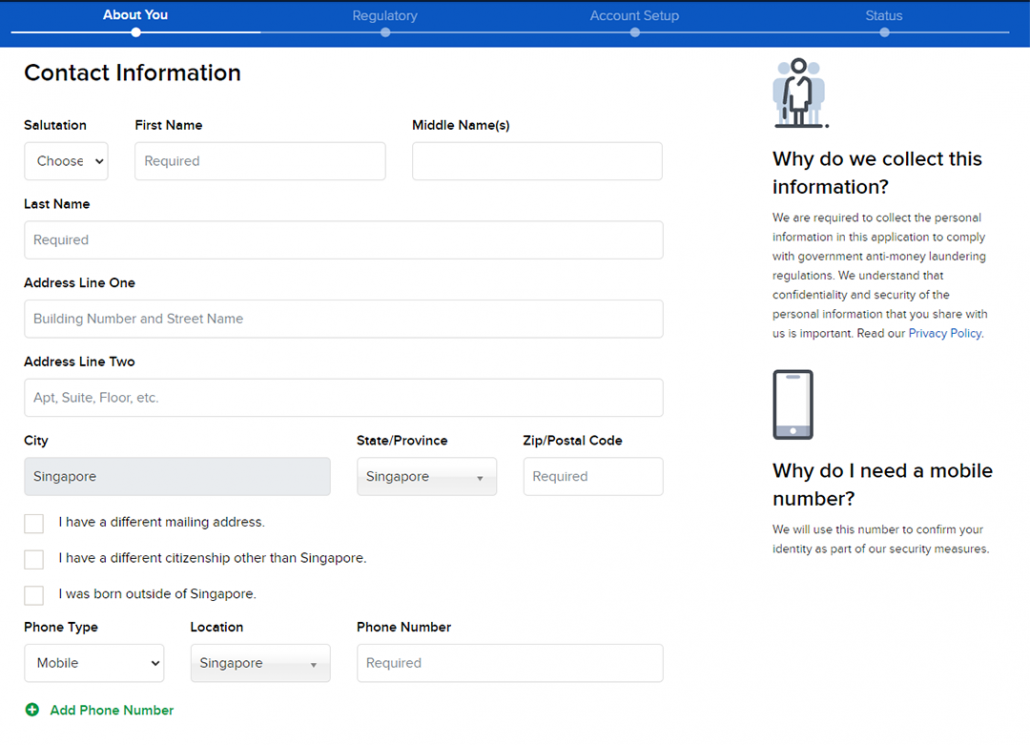

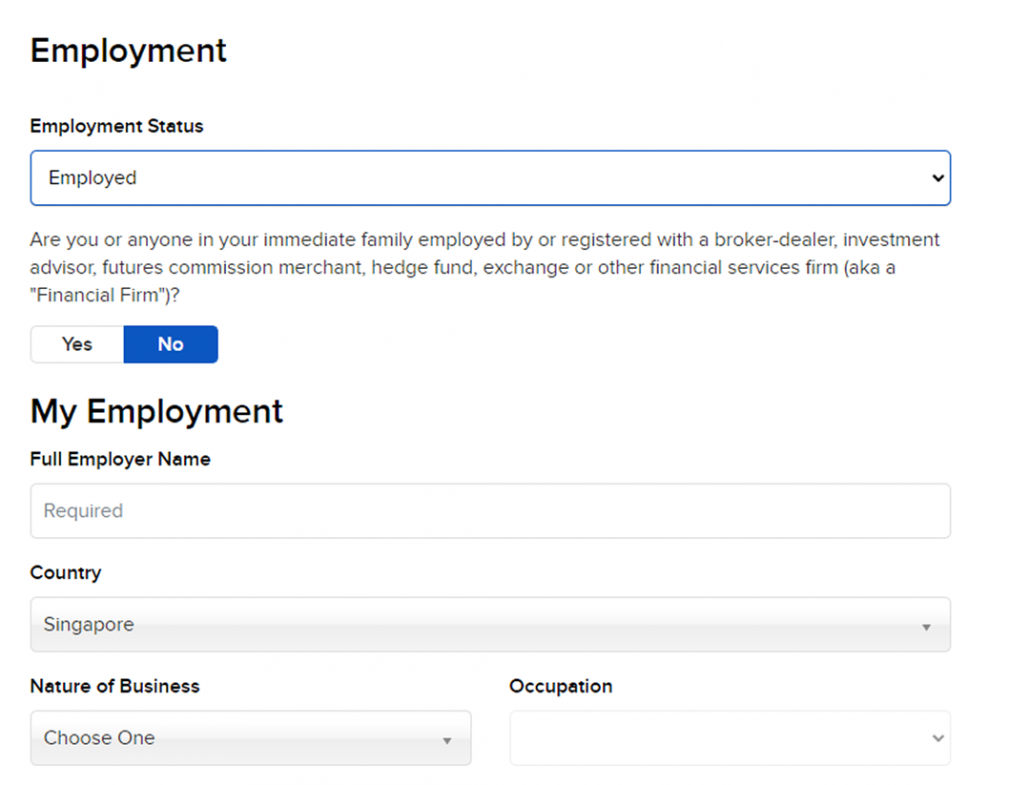

Before reading this guide, the first thing you will need to do is to open an Interactive Brokers (IBKR) account, before you can start trading.

Investing in the stock market can be an excellent way to grow your wealth over time, but it can also be costly if you’re not careful. One of the biggest expenses when investing is trading costs, such as commissions and fees. Fortunately, there are ways to minimize these costs, and choosing the right online broker is an important part of the equation.

When comparing online brokers, you’ll want to look at a variety of factors, such as account minimums, investment options, and customer service. But one of the most important considerations should be trading costs.

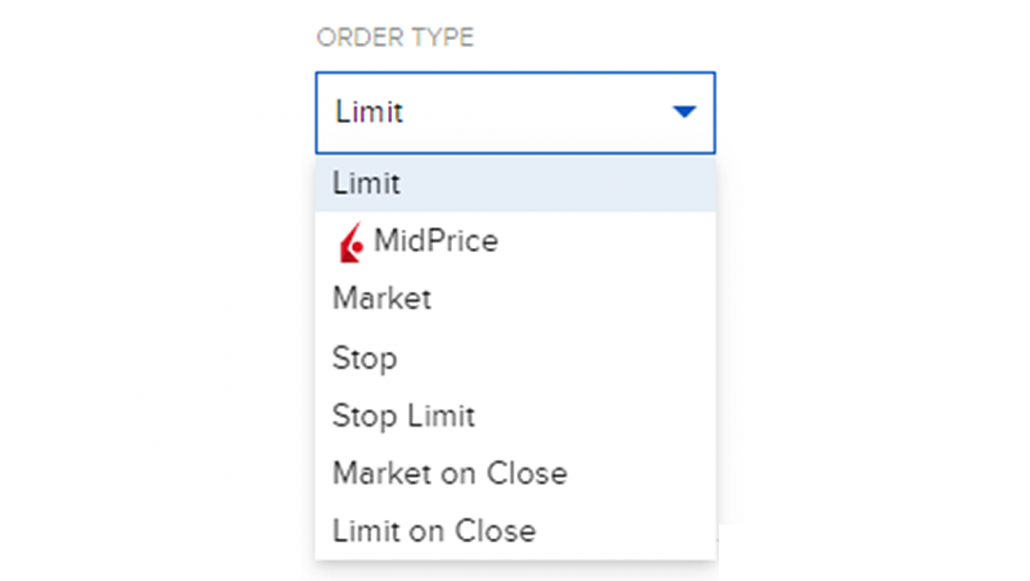

Some online brokers charge flat fees for trades, while others charge a percentage of the trade’s value. Depending on the size and frequency of your trades, one option may be more cost-effective than the other.

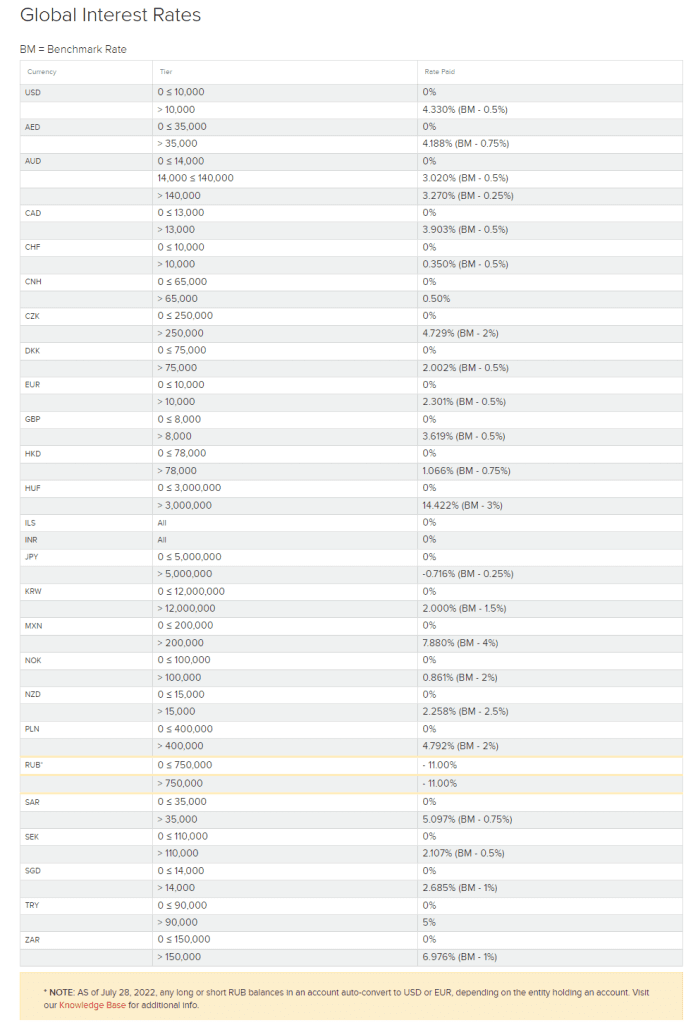

Another cost to consider is margin fees. Margin trading can be a powerful tool for experienced investors, but it can also come with high fees. Interactive Brokers is one online broker that stands out in this regard.

According to a recent report from StockBrokers.com, Interactive Brokers has the lowest margin fees of any online broker. Margin fees can add up quickly, especially if you’re making frequent trades, so this can be a significant advantage for traders looking to keep their costs low.

But low margin fees aren’t the only thing to consider when choosing an online broker. You’ll also want to look at other factors like account minimums, investment options, and customer service.

For example, some online brokers require a minimum balance to open an account, while others have no minimums. If you’re just starting out as an investor, a low or no minimum balance requirement can be a big advantage.

Investment options are another important consideration. Some online brokers offer a wide range of investment options, including stocks, bonds, mutual funds, and more. Others may specialize in a particular type of investment, such as cryptocurrency.

Finally, customer service can make a big difference when it comes to choosing an online broker. You’ll want to look for a broker that offers responsive customer support, preferably 24/7. You should be able to get help when you need it, whether you have a question about your account or need technical assistance.

In conclusion, if you’re looking to invest in the stock market, it’s important to choose the right online broker to minimize your trading costs.

Interactive Brokers is one option to consider, as it offers some of the lowest margin fees in the industry.

If you found this guide useful, you might also want to check out our full list of guides for Interactive Brokers!

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.