Firstly, what is Bitcoin and how does it work?

In simple terms, Bitcoin is a cryptocurrency, which is essentially a currency that is not owned by any particular group or person. It allows fast and cheap transactions, and the more people start to use it, the more its value increases. In fact, if you had bought $5 worth of Bitcoins 7 years ago, it would now be worth $4-5M.

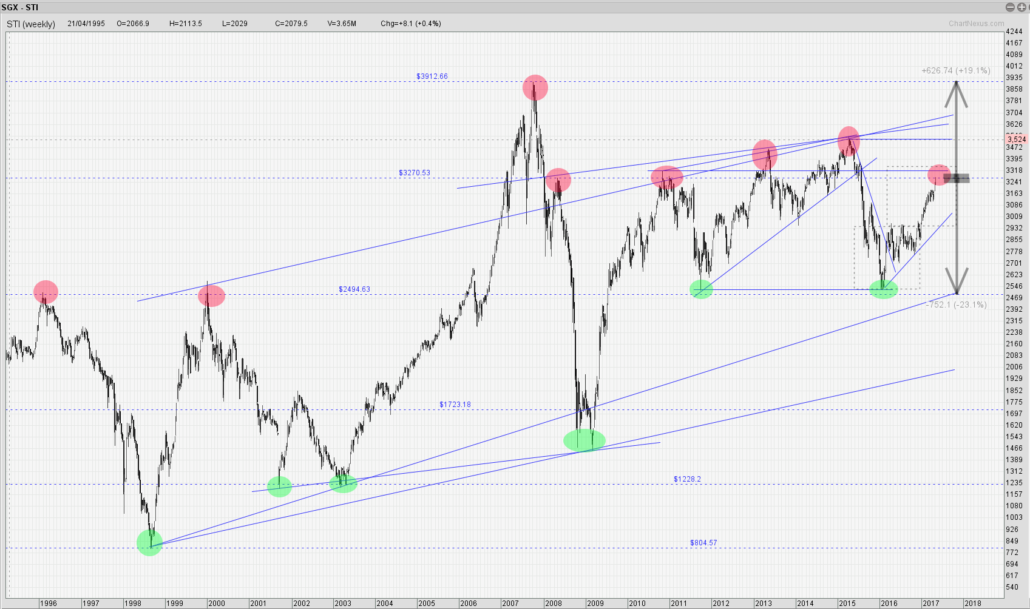

And bitcoin could still be in its infancy, since its number of transactions are only a fraction of what the banks and other financial institutions are currently doing. Which means there is a huge potential for more upside. So, how can we get a share of the pie?

1. Investing in Bitcoins

This is the most common way for retail investors to get in on the action, by simply opening an account and purchasing the coins. Some of the common platforms are Coinbase and Coinhako, and it is not hard to open an account and take a nibble. The challenge here is making sure you do not end up buying at the high, so take advantage of price dips (usually happens when there is some negative news about cryptocurrencies) to accumulate more coins.

2. Trading Bitcoin Derivatives

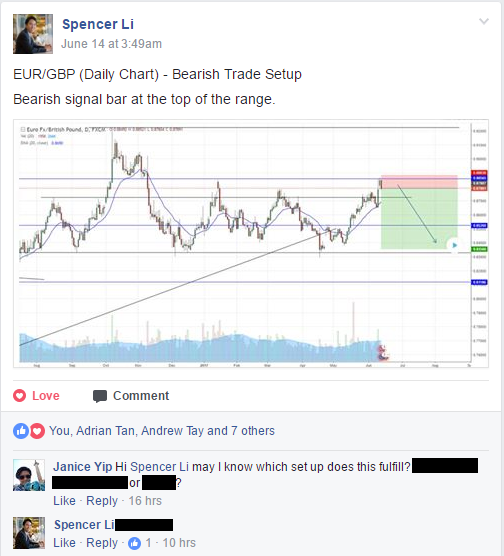

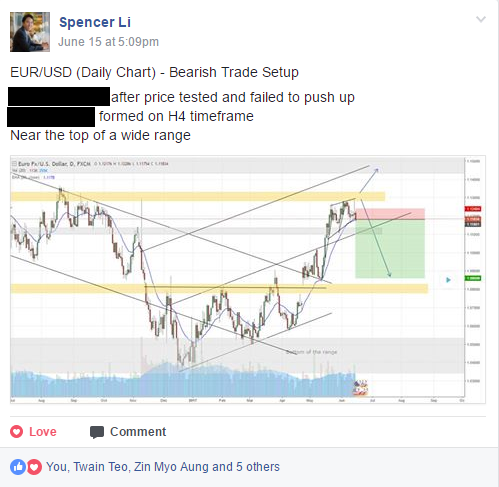

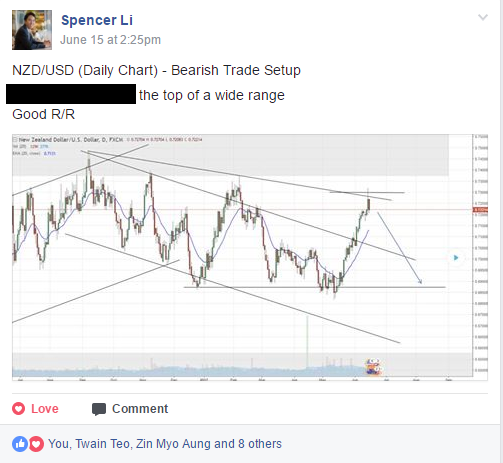

If you are more interested in profiting from the short-term movements in Bitcoin, then you can use derivative instruments that track the price of Bitcoin, for example products like CFDs (contract for differences). The price of the derivative will track the price of Bitcoin, moving up and down in sync with the actual price of Bitcoin, so by buying or selling the derivative, you can profit from the price moves in Bitcoin without actually buying or owning Bitcoin. To do this well, you will need to know how to read charts and price action.

3. Lending out Bitcoins

Lending is perhaps the oldest way to use money to make money. Basically, you loan out money to a relevant party and they pay you back, with interest. Interest rates will vary with the risk involved. If you get collateral in exchange for your loan, interest rates will be low. No collateral means higher risks, but it also means higher interest rates. So if you have already purchased some Bitcoins, you can loan them out for some extra interest instead of just keeping them in your account.

4. Bitcoin Mining

Bitcoins are created through solving complex algorithms that create blocks that are added to the public ledger. The public ledger is the history of all transactions conducted through bitcoin. Basically, miners build the public ledger and allow the whole bitcoin system to function. As they create new blocks, miners are rewarded with new Bitcoins. This encourages more miners to get in on the action, which allows the Bitcoin community to grow. In the past, people could use their home computers to mine Bitcoins, but over time mining has become more difficult as the algorithms have become more complex. Now, you’ll either have to buy a specially built mining rig, or join up with a Bitcoin mining pool that harnesses the power of multiple computers.

5. Bitcoin Arbitrage

This is perhaps the least common way of making money from Bitcoins due to its difficulty level. If you have started dabbling in Bitcoins, you might have noticed that the prices of Bitcoins can vary a lot across different exchanges. For example, if the Bitcoins in Singapore are cheaper than the ones in China, you could buy some Bitcoins here, transfer them to China, and cash them out over there. The challenge however would be bringing your money back to Singapore, and also you would need a bank account in China. But some people have managed to come up with creative solutions around theses problems.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.