Image source: Mediacorp

During this year’s National Day Rally, Prime Minister Lee Hsien Loong talked about how Singaporeans will have to make some lifestyle changes and adapt to ease the pressures of the high cost of living in Singapore, as well as some of the government initiatives to help citizens cope.

Here are some of the major issues:

1. Cost of Housing

- Currently, 80% of Singaporeans live in HDB flats, of which the downpayment can be made using CPF, making it affordable for most people to own a house.

- The Home Improvement Programme aims to improve flats when they are about 60-70 years old, and will be extended to 230,000 flats in various estates. The new scheme is designed to make it easy for authorities to redevelop old estates over a long period, by subsidizing maintenance and repair costs for aging flats.

- Owners of older HDB Flats will also get an opportunity to go en bloc before their leases run out as part of a new scheme dubbed Voluntary Early Redevelopment Scheme (VERS). Eligible residents will have a chance to decide whether the government can take back their flats once the leases clock the 70-year mark. This will allow the government to buy back their flats earlier, which can then be redeveloped, and the owners can use the cash from the sale to purchase a new house.

- A 99-year HDB lease is long enough for flats to retain substantial value, and act as a good retirement nest egg for most Singaporeans.

- For HDB owners whose lease has ended, the government will help them get a new one. Some of the oldest flats are more than 50 years old, which means that there is still 40+ more years before the lease expires.

- Cooling measures have been taken to prevent excessive speculation of property prices in the private property market.

2. Cost of Healthcare

- There will be a new health care package that will cater to the needs of people born in the 1950’s. Dubbed ‘The Merdeka Generation’ Package, the new scheme will cover areas such as outpatient subsidies as well MediSave top-Ups, payouts on long-term care and subsidies for MediShield Life.

- The Community Health Assist Scheme (CHAS) which provides health care services for middle and lower income people will now also cover chronic medical conditions.

- There will be new polyclinics in Sembawang, Eunos, Kallang and Bukit Panjang by 2020; and in Nee Soon Central, Tampines North by 2023

3. Cost of Utilities

- With regard to the recent price hikes in electricity, the current prices are actually still lower as compared to 10 years ago.

- As Singapore is not an oil producing country, fixing electricity tariffs may incur more cost in the long-run, hence is not a viable solution.

- Instead, government initiatives such as U-Save will help lower-income Singaporeans with their utility bills.

- Water prices are not expected to increase as ties with Malaysia are good and the ‘1962 Water Agreement’ remains in place

4. Cost of Food

- The government is planning to increase the number of hawker centres, which is currently the main source of affordable meal options

- In recent years, there have been 7 new hawker centres built, and we can look forward to 13 more in the coming years.

- Will there be a new generation of hawkers to take over from the old retiring hawkers?

According to the EIU annual ranking, Singapore has been dubbed the world’s most expensive city to live in (for expats) for the fifth year running.

This could mean a stable economy and high standards of living, but it could also represent income inequality and a struggling lower income demographic.

It is a good sign that the government does not shy away from discussing such issues, and actively comes up with schemes to help citizens cope.

But the bigger question is whether such initiatives solve the root problem, or are merely stop-gap measures.

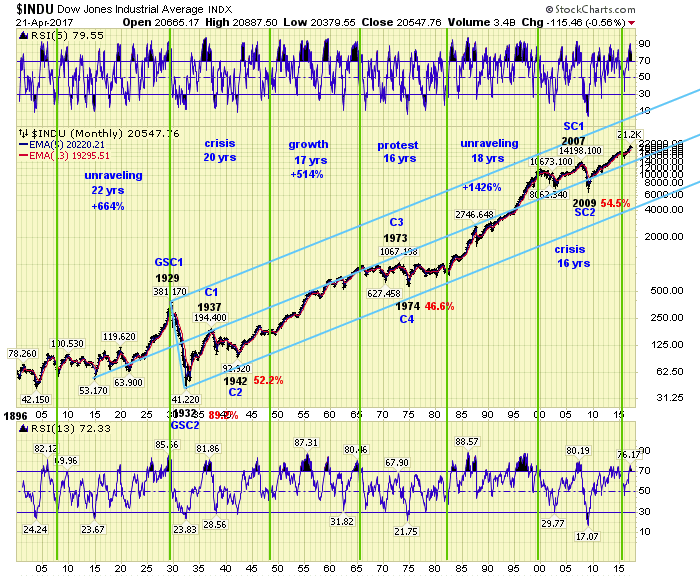

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Chart: S&P 500 index (weekly chart)

Chart: S&P 500 index (weekly chart)

Source: The Market Oracle

Source: The Market Oracle