Last week, the biggest news dominating the headlines is the depegging of UST and the crash of Terra LUNA token, which went from a high of $100+ to almost $0 in a few days.

This caused a lot of funds as well as retail investors to lose significant sums of money, especially since many were staking UST on Anchor protocol for 20% APY, which seemed like a very good deal.

I mentioned during my last Skillsfuture course that the risk of depeg was real, and they should either hedge it (by shorting the UST perp futures), or switch to some better yield farming strategies with much better returns and lower risk. Hence, I managed to dodge this bullet by not having any exposure to UST or LUNA.

Overall, I have the bulk of my portfolio in cash, with a net short position on equities.

For the week ahead, I have posted in my “Daily Trading Signals” some potential buying opportunities in the stock market.

[Photo: Yellowstone National Park, Wyoming, USA – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

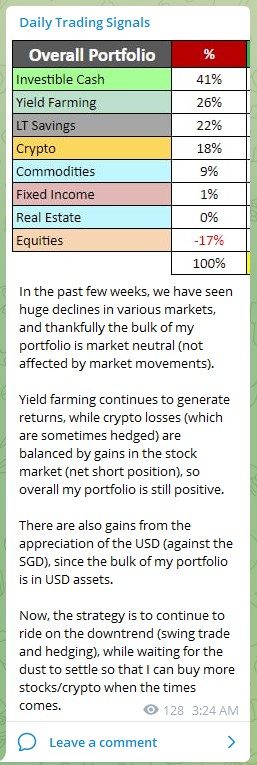

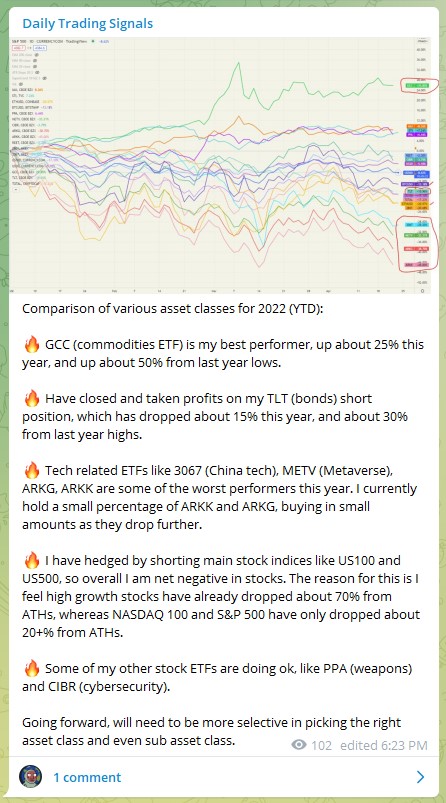

Portfolio Highlights

In the past few weeks, we have seen huge declines in various markets, and thankfully the bulk of my portfolio is market neutral (not affected by market movements).

Yield farming continues to generate returns, while crypto losses (which are sometimes hedged) are balanced by gains in the stock market (net short position), so overall my portfolio is still positive.

There are also gains from the appreciation of the USD (against the SGD), since the bulk of my portfolio is in USD assets.

Now, the strategy is to continue to ride on the downtrend (swing trade and hedging), while waiting for the dust to settle so that I can buy more stocks/crypto when the times comes.

Forex Market Highlights

USD remains on top, as it is viewed as a safe haven when everything else is crashing.

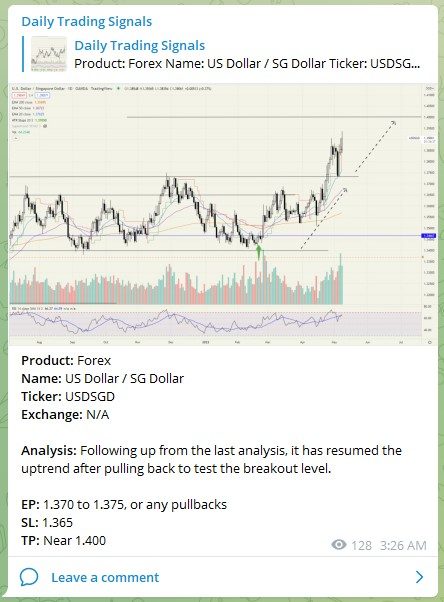

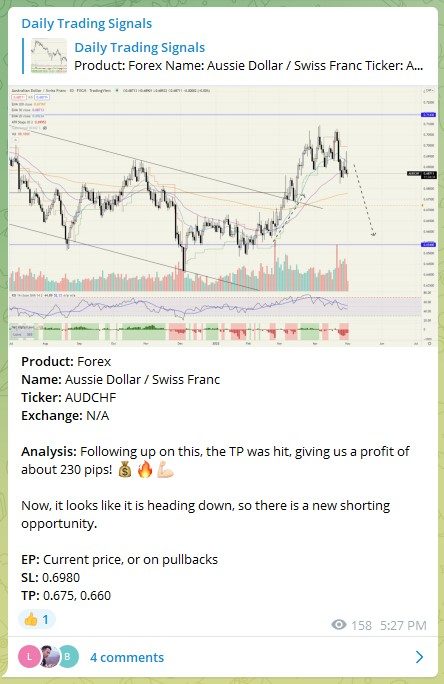

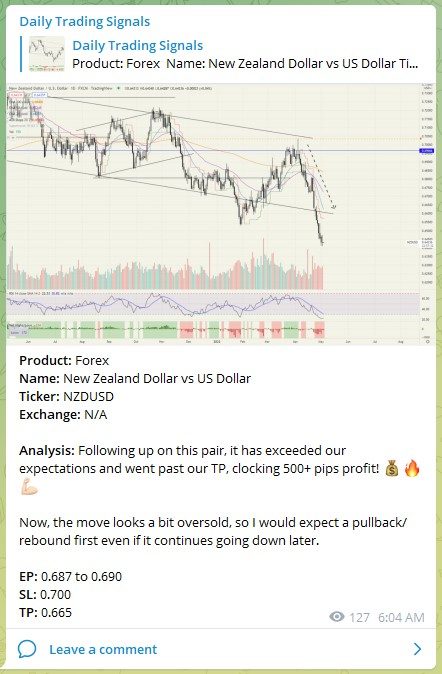

Product: Forex

Name: US Dollar / SG Dollar

Ticker: USDSGD

Exchange: N/A

Analysis: Following up from the last analysis, it has resumed the uptrend after pulling back to test the breakout level.

EP: 1.370 to 1.375, or any pullbacks

SL: 1.365

TP: Near 1.400

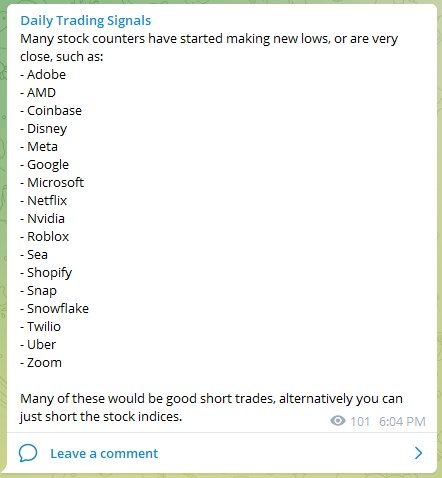

Stock & Bond Market Highlights

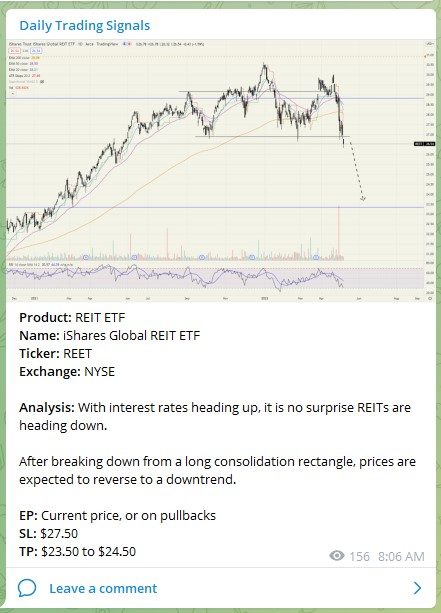

Product: REIT ETF

Name: iShares Global REIT ETF

Ticker: REET

Exchange: NYSE

Analysis: With interest rates heading up, it is no surprise REITs are heading down.

After breaking down from a long consolidation rectangle, prices are expected to reverse to a downtrend.

EP: Current price, or on pullbacks

SL: $27.50

TP: $23.50 to $24.50

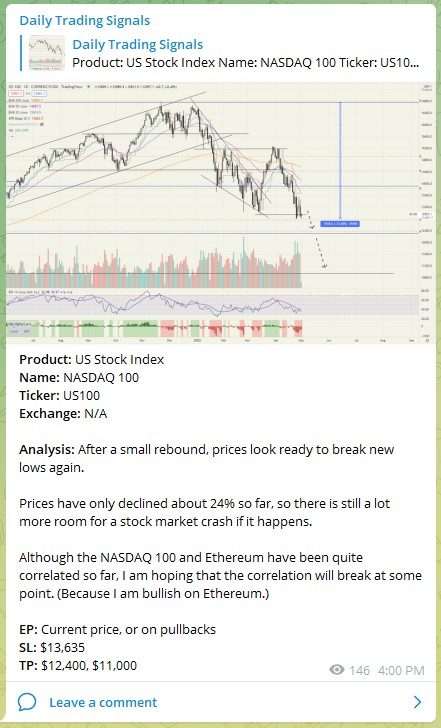

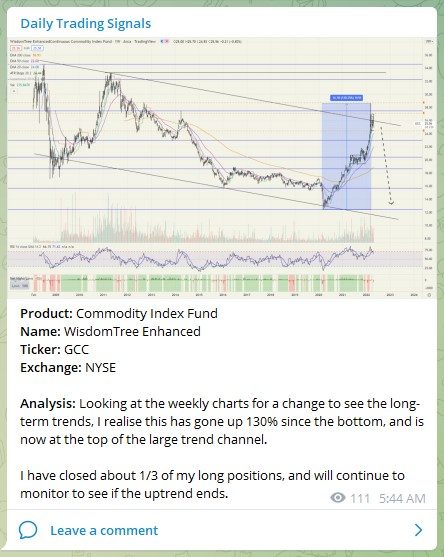

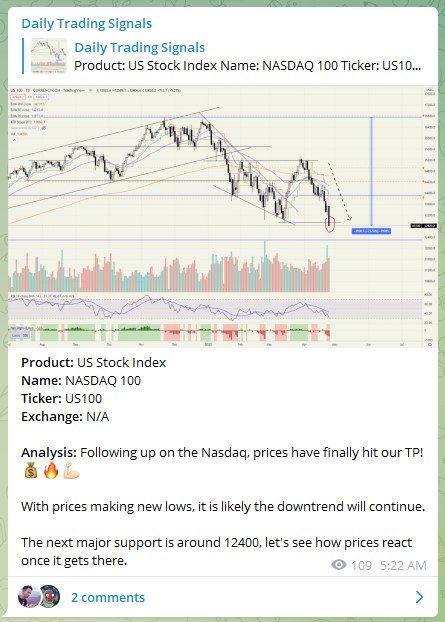

Product: US Stock Index

Name: NASDAQ 100

Ticker: US100

Exchange: N/A

Analysis: Following up on this, last night it broke new lows and continued heading down as predicted. Getting pretty close to the first TP.

EP: Current price, or on pullbacks

SL: $13,635

TP: $12,400, $11,000

Product: US Stock Index

Name: NASDAQ 100

Ticker: US100

Exchange: N/A

Analysis: Following up on this, the first TP has been hit! ????

Now, it looks like it can continue heading downwards to get to the 2nd TP.

EP: Current price, or on pullbacks

SL: $13,635

TP: $12,400, $11,000

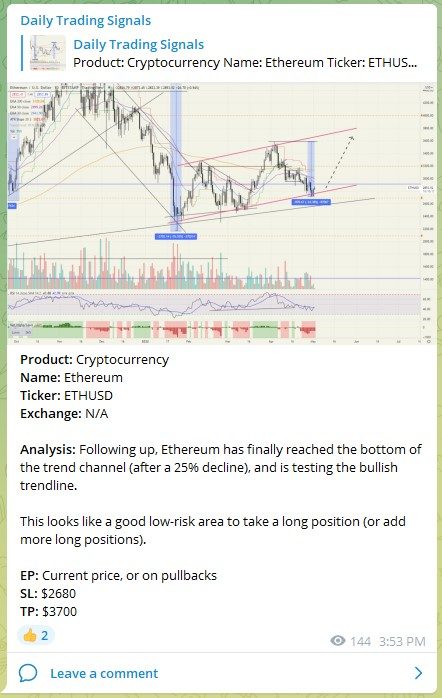

Crypto Market Highlights

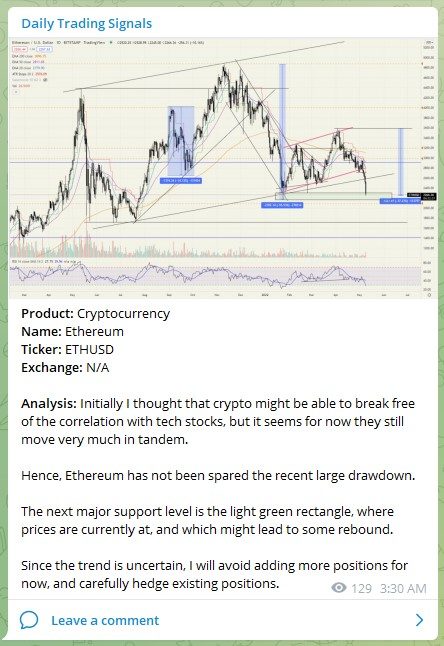

Taking some profits from Ethereum (ETH) hedging short positions! ????

Product: Cryptocurrency

Name: Ethereum

Ticker: ETHUSD

Exchange: N/A

Analysis: Initially I thought that crypto might be able to break free of the correlation with tech stocks, but it seems for now they still move very much in tandem.

Hence, Ethereum has not been spared the recent large drawdown.

The next major support level is the light green rectangle, where prices are currently at, and which might lead to some rebound.

Since the trend is uncertain, I will avoid adding more positions for now, and carefully hedge existing positions.

A few hours ago started hearing that the Luna fundraise had fallen apart.

Difficult to imagine any firm would put their reputation on the line back this dumpster fire.

It's over.

(deleted original tweet about this to not jump the gun, but now it seems clear)

— mhonkasalo (@mhonkasalo) May 11, 2022

Sorry for the multiple articles on UST and Luna, it is currently the biggest news in the Crypto market and has large ramifications. Many retail investors became broke overnight.

Here is one of the best overview explanations: https://newsletter.banklesshq.com/p/ust-luna-meltdown-what-happened?s=r

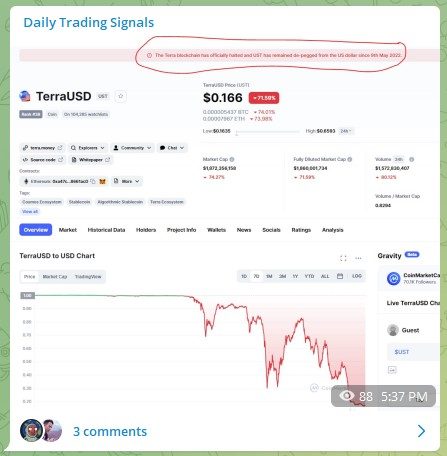

The Terrablock has officially halted and UST has remained de-pegged from the US Dollar since 9th May 2022.

Good luck, and may next week bring more excellent profits!

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.