Weekly Market Wrap: BTC & ETH Breakout, Crypto Season is Back!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

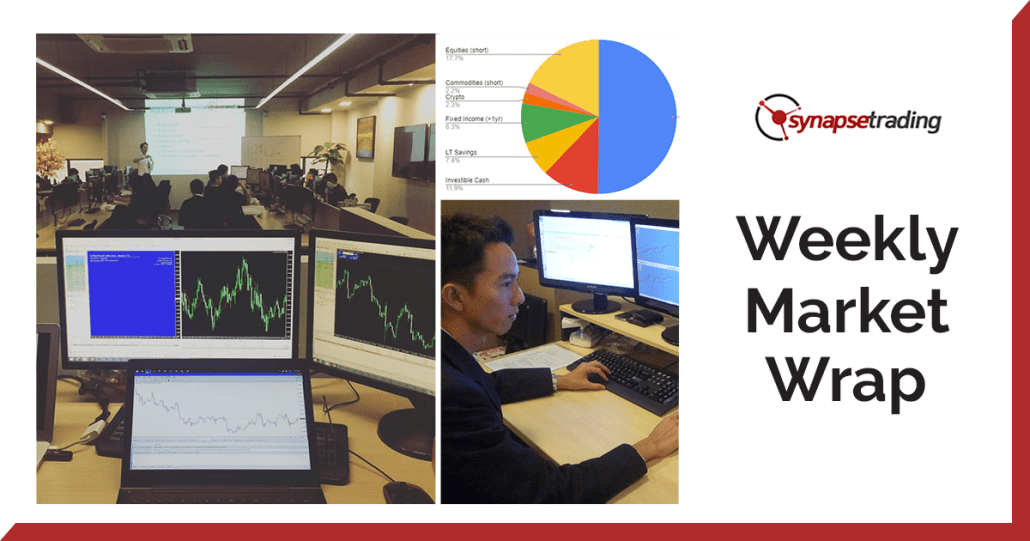

For subscribers of our “Daily Trading Signals”, we now also include a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technical, economics, and portfolio management:

Click here to subscribe for the latest market report (11 December 2023)

Click here to see the archives of all our past market reports

Market Recap & Upcoming Week

As 2023 draws to a close, the financial markets are exhibiting a strong performance, with stocks nearing yearly highs and bonds making a significant recovery after a challenging period.

The positive trend in the markets this year can be attributed to several factors: easing inflation, a resilient economy that has maintained above-average growth without succumbing to a recession, and growing enthusiasm around artificial intelligence (AI). Looking ahead to 2024, investors are hopeful about the Federal Reserve shifting from a restrictive policy to a more neutral stance, potentially leading to rate cuts.

This anticipated policy change is expected to act as a catalyst for further gains in both bond prices and equity markets, broadening market leadership.

In terms of labor market dynamics, there was a mixture of data last week. While the U.S. economy added 199,000 jobs in November, slightly more than expected, the labor market is showing signs of cooling, which could lead to a more balanced demand and supply for workers in 2024.

Inflation rates have also been falling faster than the Fed’s projections, with core personal consumption expenditures index (PCE) already down to 3.5%, below the Fed’s estimated year-end figure.

This deceleration in inflation, combined with the low unemployment rate and strong consumer demand, suggests a potential soft landing for the economy.

As for economic growth, it’s predicted to slow down from its current above-trend pace, influenced by factors like depleted excess savings and higher effective mortgage rates.

The upcoming Fed meeting and economic projections are expected to shed light on future rate paths and could introduce some volatility in the markets.

However, there’s a growing sentiment that 2024 might see the Fed implementing rate cuts to support the economy, potentially leading to the 10-year Treasury yield dropping below 4% by the year’s end.

This week, attention is centered around the Federal Reserve’s interest rate decision on Wednesday, with widespread anticipation that rates will remain unchanged.

The decision will be followed by a press conference with Fed Chair Jerome Powell, offering insights into the central bank’s future monetary policy direction.

Additionally, key inflation data is set to be released, starting with the Consumer Price Index (CPI) on Tuesday, providing a snapshot of price trends.

The Producer Price Index (PPI) will be announced on Wednesday, giving further clarity on business wholesale prices and contributing to the overall picture of inflation dynamics.

In the tech sector, a smaller batch of earnings reports is on the horizon as earnings season winds down.

Oracle’s financial results, due Monday, are expected to shed light on the current demand for cloud and tech products. Adobe’s earnings report on Wednesday is anticipated to reveal how well its new AI products are resonating with consumers.

Meanwhile, Intel is gearing up to unveil its latest AI-focused offerings in a launch event, offering a glimpse into the evolving landscape of chip design for artificial intelligence applications.

Daily Trading Signals (Highlights)

BTCUSD Crossing 40032

First TP of $40,000 hit!

Bitcoin (BTCUSD) – Following up on this trade, it has now broken the $40,000 resistance level, and we are up +60% profit! 💰🔥💪🏻

I have revised the target profit to gun for $50,000 next, given how strong the momentum is.

Solana (SOL) – Prices have gone up about 25% since the breakout, congrats! 💰🔥💪🏻

EURCHF – Target hit with +200 pips profit! Congrats to all those who took this trade! 💰🔥💪🏻

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!