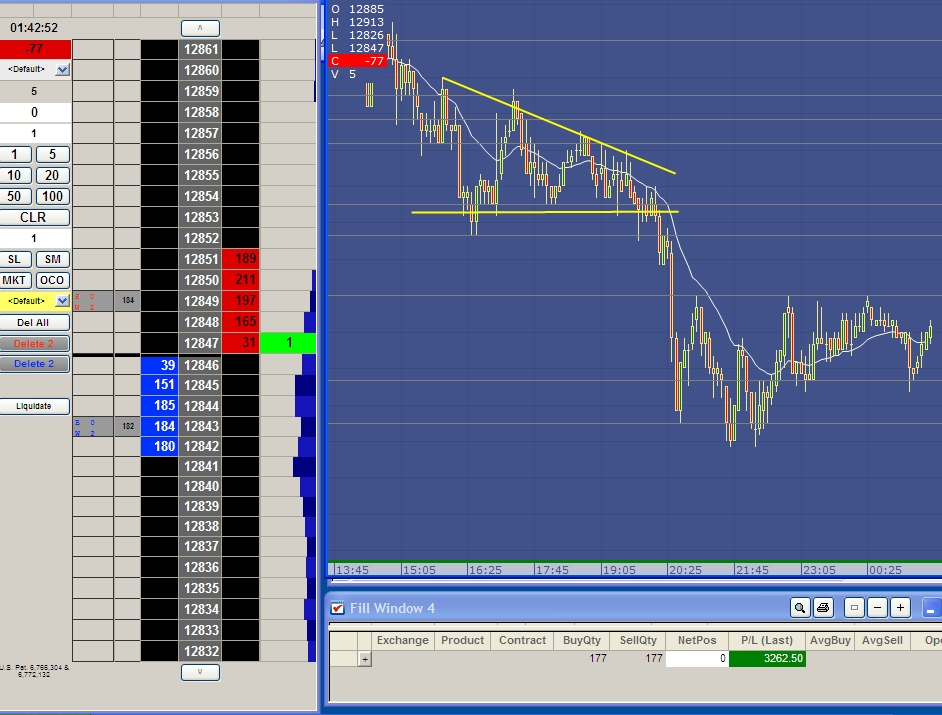

Today, it was an easy day to trade, since the trend was clearly down, and there was an excellent SPZ entry at around 2230, where price tested the EMA and trendline. The EMA was tested again at around midnight, providing another chance to short. I think the rest of the day is likely to be ranging or a slight upward retracement. Calling it a day for now.

Spent the night scalping the EUR/USD for a couple of hours, and the best trading opportunities were centred around the obvious descending triangle, which broke out strongly and went past the traditional target projection.

The old problems in Europe are starting to surface again, putting pressure on the stock indices, as well as the EUR/USD. Overall trend is bearish.

Described in simple terms, hindsight bias is the impulse that insists: “I knew it all along!” Once an event has elapsed, people afflicted with hindsight bias tend to perceive that the event was predictable – even if it wasn’t. This behaviour is precipitated by the fact that actual outcomes are more readily grasped by people’s minds than the infinite array of outcomes that could have but didn’t materialize.

Therefore, people tend to overestimate the accuracy of their own predictions. This is not to say, obviously, that people cannot make accurate predictions, merely that people may believe that they made an accurate prediction in hindsight.

This affects future forecasting, because a person subject to hindsight bias assumes that the outcome he or she ultimately observes is, in fact, the only outcome that was ever possible. Thus, he or she underestimates the uncertainty preceding the event in question and underrates the outcomes that could have materialized but did not.

One detriment of hindsight bias is that it can prevent learning from mistakes. People with hindsight bias connected to another psychological bias, anchoring, find it difficult to reconstruct an unbiased state of mind, simply because it leads people to exaggerate the quality of their foresight.

When hindsight-biased traders have a winning trade, they tend to rewrite their own memories to portray the positive developments as if they were predictable. Over time, this rationale can inspire excessive risk-taking, because they believe they have superior predictive abilities.

Hindsight-biased traders also “rewrite history” when they fare poorly and block out recollections of prior, incorrect trades in order to alleviate embarrassment. This form of self-deception, in some ways similar to cognitive dissonance, prevents traders from learning from their mistakes.

What is the best solution for this?

In order to overcome hindsight bias, it is necessary, as with most biases, for the trader to understand and admit their susceptibility. One way to face the facts is to keep a trading journal, and use it to record your analysis and reasons for every trade, as well as the thought-process and emotional swings that went with the whole trade. This will be useful when you look back to the past after the event, and will prevent any disillusioned thinking.

“You didn’t know it all long; you just think you did.”

– James Montier

If you would like to learn more about trading psychology, also check out: “The Complete Guide to Investing & Trading Psychology”

NEW YORK (MarketWatch) — The euro on Monday tumbled to its lowest level versus the dollar since January and remained under pressure after European voters rejected pro-austerity candidates in weekend elections, calling into question the region’s control over its sovereign-debt crisis.

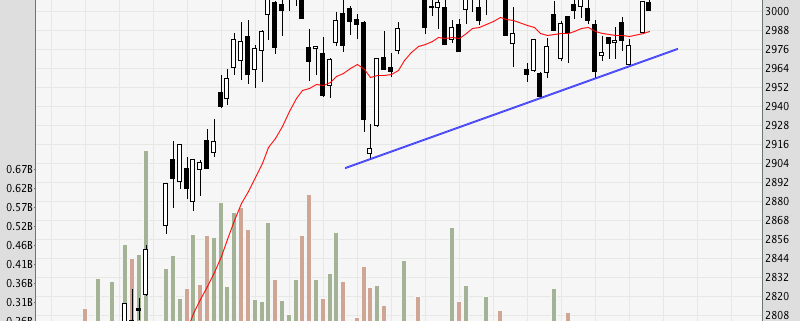

This is the 5-min chart of the EUR/USD. After the large gap down in the Euro, it has trended upwards in a trend channel, providing many trading opportunities. This channel could be a bear flag on a larger timeframe, heralding further downside.

Today, we gave an exclusive seminar to the members of TRT (Traders Round Table), where we focused more on trading psychology since the audience consisted of mostly experienced traders. We also had time to go through some candlestick patterns from a psychological perspective, and some examples to illustrate the limitations of candlesticks in price action trading.

Due to time contraints (the talk stretched over 2.5 hrs) , we did not have much time to discuss the markets, but below is a snippet of the Singapore markets.

Ascending triangle spotted on the Straits Times Index. Is it going to be “sell in May and go away”, or a breakout to new highs? Let’s keep a close watch on that key level, and watch for a major pivot which could start the new big move.

Thanks for the support, and stay tuned for our future seminars!

Sign up for our mailing list to keep updated of the latest workshops and seminars!

For program enquiries, please email info@synapsetrading.com

Latest Blog Posts

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm

Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

Contact Us

Synapse Trading Pte Ltd

Registration No. 201316168H

FB Messenger: synapsetrading

Telegram: @iamrecneps

Email: info@synapsetrading.com

Disclaimer

Privacy policy

Terms & Conditions

Contact us (main)

Partnerships