Weekly Market Wrap: Adding on to Profitable Shorts!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Now that the bears are back in action, the market has switched from “potential reversal” mode back to “risk off” mode, and the stock market has resumed its decline.

In last week’s market outlook video, we mentioned that the best trading opportunities will be shorting the stock/REITs market.

Over the past 2 weeks, we have seen some stock indices drop by more than 10%.

Will we see new lows before the year is over?

We will be adding more shorts on any pullbacks, but doing it in a way to maximise returns and minimise risk.

Want to join us in our big short of the year?

Check out out “Daily Trading Signals” private Telegram group for real-time entry signals!

[Photo: Hagia Sophia, Turkey – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (18 December 2022)

After the false breakout for stocks on the bullish CPI data, prices made a U-turn back down.

During the FOMC, the Fed hinted that a pivot is not so soon, which added to the bearishness.

There is a good chance of seeing new lows in the stock market.

Portfolio Highlights

Weekly Portfolio Updates (18 December 2022)

Added more short positions for stocks, and will continue adding more next week on any pullbacks.

Forex & Commodities Market Highlights

AUDCHF – Price is moving in our favour, can continue to hold for more downside! 💰🔥💪🏻

AUDJPY – Wow we did not expect it to hit our target in one day with 300+ pips profit! Congrats! 💰🔥💪🏻

CADJPY – Strong downside breakout!

Headlines: “Nikkei 225 falls more than 2% after Bank of Japan widens yield target range, yen strengthens”

Can consider going long on NZDCHF during a tight stop below the 2-bar reversal.

Crude Oil (WTIUSD) on a long-term downtrend, and now has a pullback shorting opportunity.

Stock & Bond Market Highlights

The long-awaited breakdown for Global REITs (REET) finally came as well, after running into the top of the trend channel.

It also formed a rising wedge just before the breakdown, which added to the bear conviction.

Congrats to those who joined in the shorts! 💰🔥💪🏻

I will be continuing to add more shorts, hopefully prices break new lows by the end of the year.

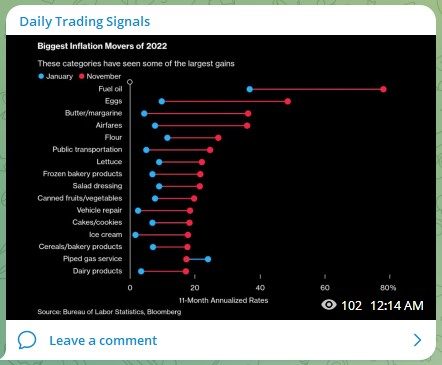

Biggest inflation movers of 2022.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!