Weekly Market Wrap: FOMC & NFP This Week!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

For our “Daily Trading Signals”, we have now also included a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technicals, economics, and portfolio management:

Click here for last week’s market report (24 April 2023)

Click here to subscribe for the latest market report (31 April 2023)

Click here to see the archives of all our past market reports

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

Market Recap & Upcoming Week

Last week, the potential of generative AI technology to boost revenues for tech giants like Amazon, Microsoft, and Alphabet created a buzz in the market. Despite the growth slowdown in their cloud-computing services, shares of these companies have outperformed the S&P 500 and Nasdaq Composite. Microsoft’s plans to adopt OpenAI’s ChatGPT technology, Alphabet’s share increase, and Amazon’s AI plans announcement contributed to their stock performance.

On the other hand, Moody’s Investors Service downgraded 11 regional banks, highlighting the increased instability in the banking sector due to higher interest rates and recent bank failures. This exposed weaknesses among regional banks and raised concerns over the commercial real estate market.

In the stock market, S&P 500’s trading at 18 times its 12-month forward P/E estimates has led institutions to reduce exposure to economically-sensitive sectors in anticipation of a potential U.S. recession. Insider buying in the financial sector signals optimism, but analysts urge caution as other factors can influence stock performance. As the first quarter US earnings season unfolds with mixed results, hedge funds have increased their net short position in S&P 500 index futures, showing skepticism about Wall Street’s recovery. However, some analysts argue that equities still offer better returns than bonds and have the potential for earnings growth.

This week, as earnings season marches on, investors will keep a close eye on reports from major companies such as Pfizer, Starbucks, Uber Technologies, AMD, Qualcomm, Apple, Royal Dutch Shell, BP, and ConocoPhillips. Additionally, Berkshire Hathaway’s annual shareholders’ meeting in Omaha, Nebraska, will draw attention to Warren Buffett’s insights and investment strategies.

In terms of economic indicators, updates on the labor market will come in the form of the Job Openings and Labor Turnover Survey (JOLTS), ADP’s National Employment Report, and the April nonfarm payrolls report.

In addition, central to financial discussions this week will be the Federal Reserve’s two-day Federal Open Market Committee (FOMC) meeting, commencing on Tuesday. Market participants will be eager to learn the outcome of Wednesday’s interest rate decision, which is anticipated to be the final rate hike in the current tightening cycle. As these events unfold, investors will be looking for hints on how companies and the economy will navigate the ongoing challenges posed by inflation, interest rates, and potential slowdowns in growth.

Daily Trading Signals (Highlights)

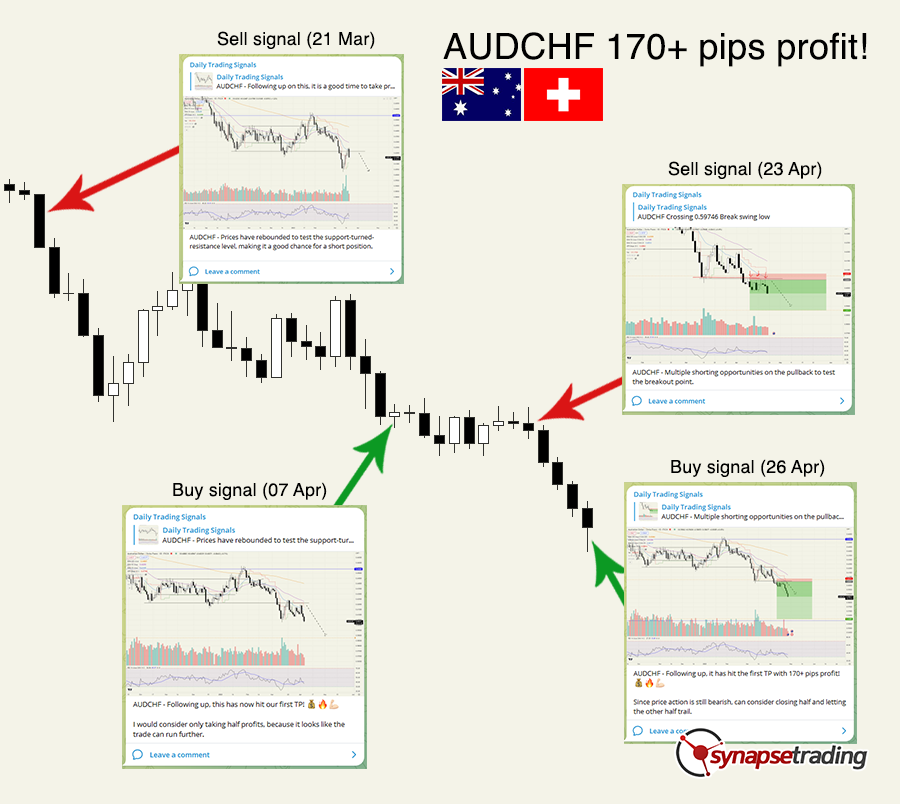

AUDCHF – Following up, it has hit the first TP with 170+ pips profit! 💰🔥💪🏻

Since price action is still bearish, can consider closing half and letting the other half trail.

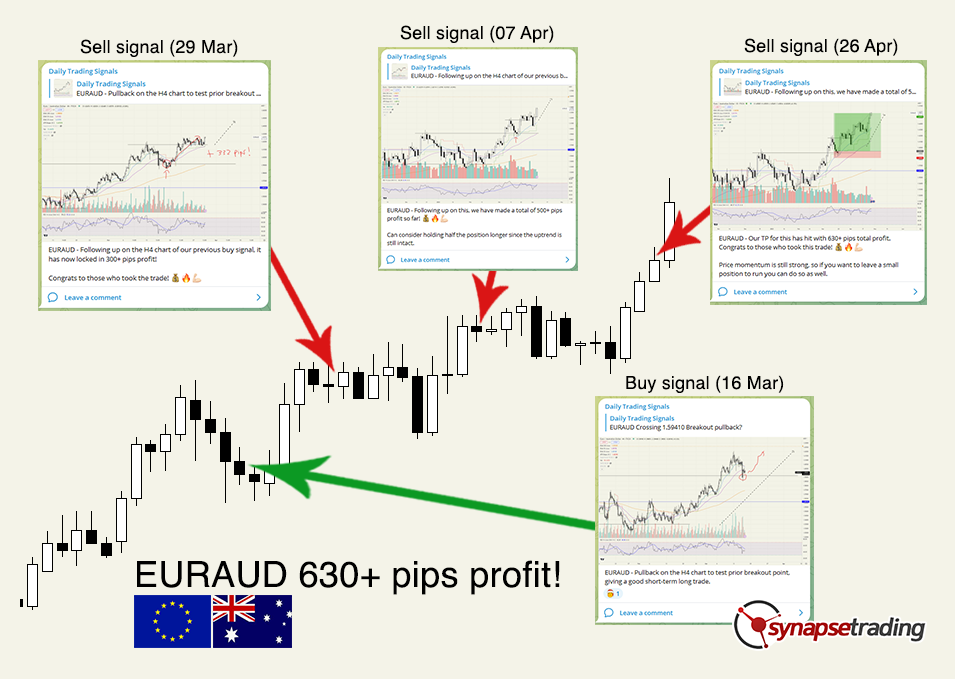

EURAUD – Our TP for this has hit with 630+ pips total profit. Congrats to those who took this trade! 💰🔥💪🏻

Price momentum is still strong, so if you want to leave a small position to run you can do so as well.

GBPCAD – Prices resuming upward move, let’s see how far it can go!

GPBUSD – Following up, prices are starting to head up after consolidating for the past month or so.

Dow Jones Index (US30) – Good low risk high reward shorting opportunity near the top of the price channel.

Crude Oil (WTICOUSD) – Since it failed to hold new highs, prices might come back to test the bottom of the range.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

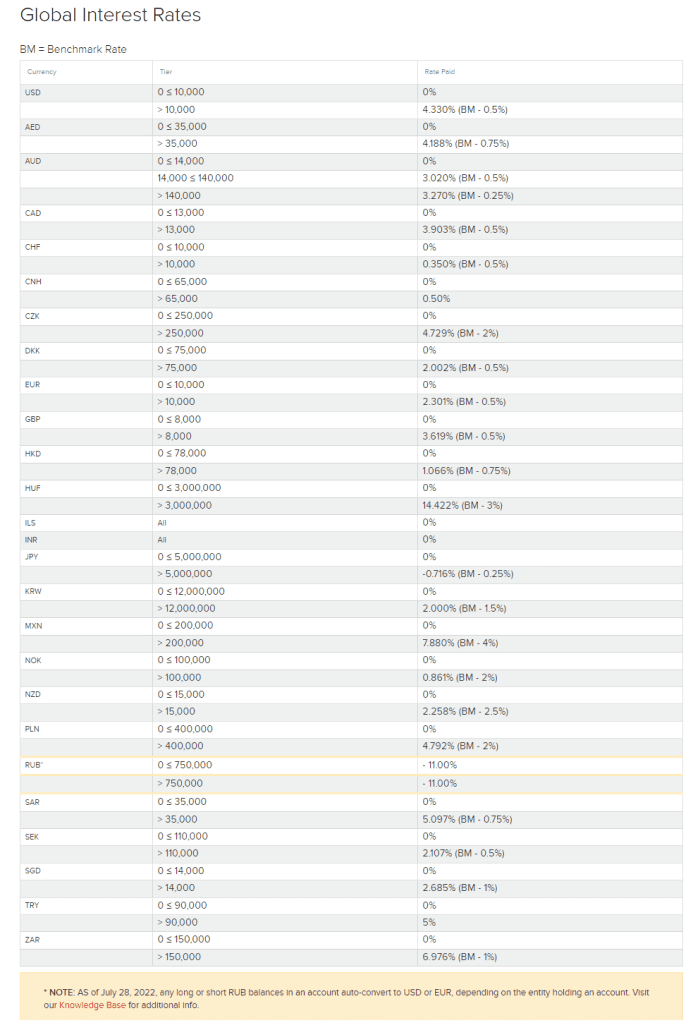

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!