Weekly Market Wrap: Will Banks Runs Cause the Market to Crash Next Week?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Silicon Valley Bank’s recent troubles have highlighted the risks posed by exposure to mortgage-backed securities. The bank purchased over $80 billion of these securities with deposits, but as interest rates rose, the value of the securities plummeted. The bank recently announced it had sold $21 billion of its Available For Sale securities at a $1.8 billion loss, sparking a wider selloff of banking stocks.

The failure of Silicon Valley Bank could impact the US Federal Reserve’s ability to raise interest rates and withdraw stimulus measures. The failure of a major bank could cause the Fed to rethink its policy, potentially preventing a recession. However, other experts warn that the failure of the bank could have broader implications for the US economy, with potential knock-on effects for businesses and entrepreneurs.

The Japanese yen is expected to continue to depreciate against the US dollar in the coming months. This is due to the expectation of continued divergence in monetary policy between the Bank of Japan and the US Federal Reserve.

Oil prices remain largely unchanged, with concerns over interest rate hikes dampening sentiment. The Federal Reserve is expected to raise interest rates, which could reduce demand for oil and lower prices. Despite this, prices remain supported by ongoing supply cuts by OPEC and its allies.

The upcoming week is expected to be critical for economic data, with a number of key reports scheduled for release. These include CPI, retail sales, industrial production, and housing starts. Analysts will be closely watching these figures to assess the health of the economy and to gauge the likelihood of a recession. The Federal Reserve’s rate decision on March 15 will also be closely watched, with expectations of further rate hikes.

Stay tuned for more real-time updates and trading opportunities in our “Daily Trading Signals” Telegram channel!

[Photo: Lake Aydarkul, Uzbekistan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Portfolio Updates (05 March 2023)

📌 Not much changes from last week

📌 Some of the T-bills will be expiring this or next month, so will be rolling them over into new 6-month positions at 5+%

Portfolio Highlights

Weekly Market Outlook (05 March 2023)

📌 USD remains strong

📌 Weakness on AUD & NZD

📌 Equities & crypto mixed

📌 NFP and FOMC coming up

Forex & Commodities Market Highlights

AUDCHF – Following up on this trade, we managed to catch the top and get a good entry, and now it is 200+ pips in the money!

Congrats to those who took this trade! 💰🔥💪🏻

AUDUSD – Following up on this short trade, it is 200+ pips in profit, and looks like it can fall a bit more.

Congrats to those who took this trade! 💰🔥💪🏻

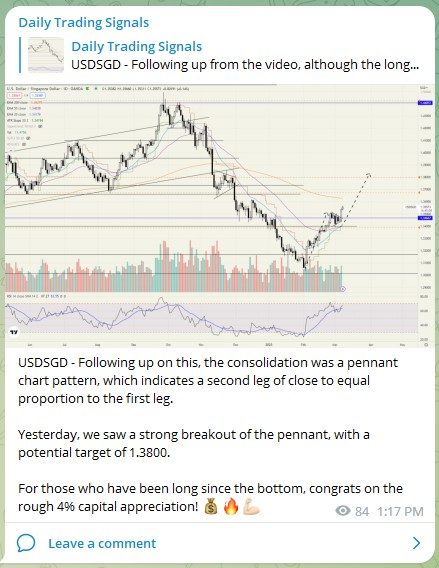

USDSGD – Following up on this, the consolidation was a pennant chart pattern, which indicates a second leg of close to equal proportion to the first leg.

Yesterday, we saw a strong breakout of the pennant, with a potential target of 1.3800.

For those who have been long since the bottom, congrats on the rough 4% capital appreciation! 💰🔥💪🏻

NZDCHF – After retracing to test the breakout neckline, it is now giving us another great shorting opportunity.

NZDUSD – After breaking the support level, it went on to test the support-turned-resistance level, and is now poised to head downwards.

Great low-risk shorting opportunity.

Stock & Bond Market Highlights

NASDAQ 100 (US100) – After several bullish pin-bars, there is some bullish short-term price action (maybe profit-taking?), so we might see a rebound to test the support-turned-resistance level.

Wil watch out at the red circled zone next week.

China tech stocks (3067) – Following up on this, after the decline to support and the bounce, we are expecting another leg down.

We are looking for a potential buying zone for the long-term bull trend, and I have circled that zone.

We will see what happens once price reaches that zone. Stay tuned!

Cos on Twitter some people will be very bullish, some will be very bearish, so good to see both sides what the reasons are.

Total delinquent consumer loans in the United States.

Fed tightening cycles always “break” something.

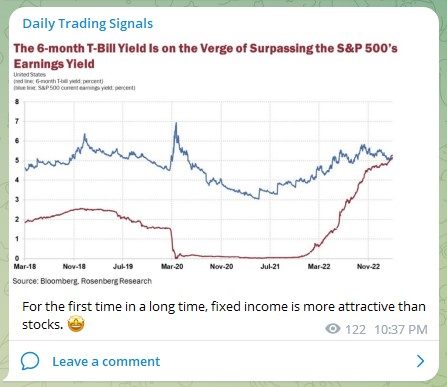

For the first time in a long time, fixed income is more attractive than stocks. 🤩

Short-term US Treasurys climbed to new milestones after Federal Reserve Chair Jerome Powell said that the central bank would likely raise interest rates higher than previously expected and was ready to accelerate the pace of rate increases if necessary.

The yield on the two-year Treasury note had settled at 5.011%, up from 4.892% Monday, and marked its first close above 5% since June 2007.

Traders’ immediate focus is the central bank’s next rate-setting meeting, which wraps up two weeks from Wednesday.

Bets in futures markets now reflect roughly two-thirds odds of a half-point move at the coming meeting, up from about one-thirds odds a day earlier.

Crypto Market Highlights

Bitcoin (BTCUSD) and Ethereum (ETHUSD) – After the testing the previous swing high, they did not manage to break through, but they could be building strength to try again.

You can either accumulate some near the minor support level, or wait for prices to break the prior swing high before going long.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!