Weekly Market Wrap: Will We Be Seeing New Lows Very Soon?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

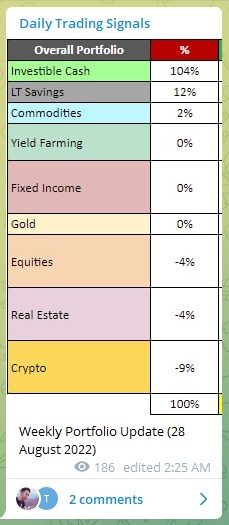

As I mentioned in my “Weekly Market Outlook” video for subscribers, almost every asset class is very bearish, as you can see from my “Weekly Portfolio Update” snapshot.

This bearishness can be observed in various price patterns, as well as technical indicators and market psychology.

Every week, I publish my full portfolio allocation so there is 100% transparency on my positions and holdings.

At that point, I was short on equities, REITs, and crypto, and all these have plunged a lot since the Fed announced that it will continue to fight inflation (aka. hike rates).

As we continue to stack positions, this could turn out to be the biggest trade of the year if prices continue to drop and hit new lows. I will be monitoring and placing alerts for new shorting opportunities.

Stay tuned in our “Daily Trading Signals” Telegram channel!

[Photo: Tokyo, Japan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (28 August 2022)

? Inflation target of 2%

? CHFJPY – bullish

? GBPCHF – bearish

? EURUSD – bearish

? Commodities – neutral/bullish

? Stocks – bearish

? Crypto – bearish

Weekly Portfolio Update

Weekly Portfolio Update (28 August 2022)

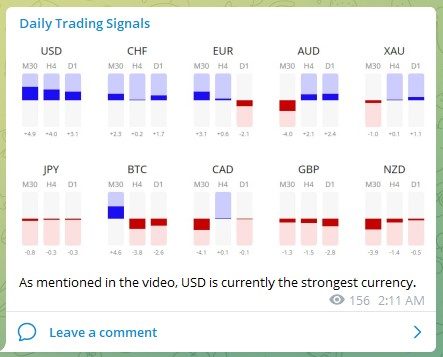

Forex & Commodities Market Highlights

As mentioned in the video, USD is currently the strongest currency.

Following up on the US Dollar Index (DXY), it is forming a small bullish base, getting ready to push new highs.

Following up with the H4 chart of GBPCHF, we can see that shortly after our short entry, prices started to fall.

We are nearing TP1 soon, which is at the prior swing lows, after which we can close half and hold the remaining half for TP2.

Following up on the USDSGD, it has hit our TP level, and for now, we can either stay out or stay short, since the short term price momentum is bearish.

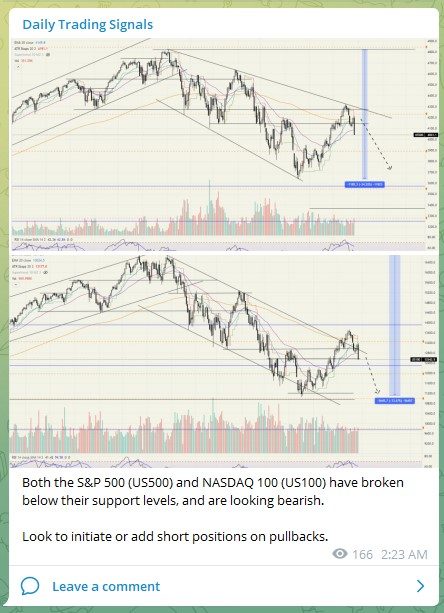

Stock & Bond Market Highlights

Both the S&P 500 (US500) and NASDAQ 100 (US100) have broken below their support levels, and are looking bearish.

Look to initiate or add short positions on pullbacks.

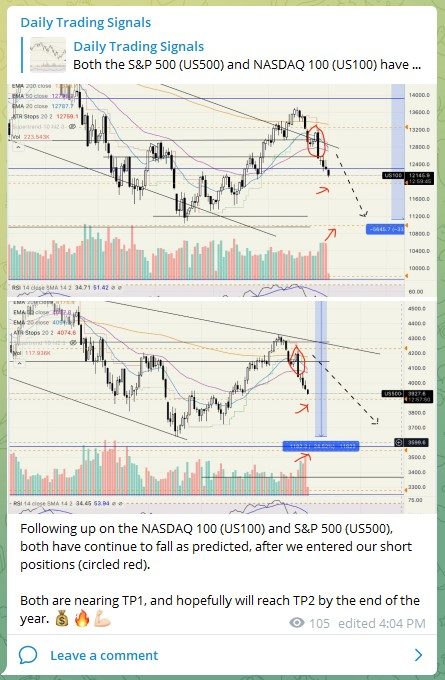

Following up on the NASDAQ 100 (US100) and S&P 500 (US500), both have continue to fall as predicted, after we entered our short positions (circled red).

Both are nearing TP1, and hopefully will reach TP2 by the end of the year. ????

Stocks plummeted Friday after Federal Reserve Chair Jerome Powell said in his Jackson Hole speech the central bank won’t back off in its fight against rapid inflation.

https://www.cnbc.com/2022/08/25/stock-market-futures-open-to-close-news.html

Crypto Market Highlights

Taking profit on my Bitcoin (BTCUSD) shorts to wait for the next pullback to short again! ????

Taking profit on my Ethereum (ETHUSD) shorts to wait for a next pullback to short again! ????

After a long wait on Ethereum (ETHUSD) and Bitcoin (BTCUSD), it finally broke out of the bear flag pattern and made new swing lows.

Will it head all the way down to test new lows? I will continue holding my short positions, and add more as price continues to decline.

Looks like it will be an exciting weekend! ????

In last week’s market outlook video, I mentioned that Crypto was very bearish, and I had huge short positions on Ethereum (ETHUSD) and Bitcoin (BTCUSD).

It was followed by a huge crash, which I took profits and posted the screenshots.

Now, we are seeing some bearish pin bars, but I will wait for prices to break below yesterday’s low before initiating new shorts.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!