Market Analysis – Which Tech Stocks to Buy? (Shopping List)

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

As tech stocks continue to surge, while the S&P 500 and the general economy lags behind, it is important to select the right sectors and stocks to invest in.

Also, as the US gradually opens its economy and talks of a new potential vaccine surfaces, will these be able to boost the V-shaped recovery of the stock market?

And more importantly, which specific stocks are the best to invest in?

Join our FREE Telegram channel for daily trading tips:

?? https://t.me/synapsetrading

Table of Contents

Market Overview

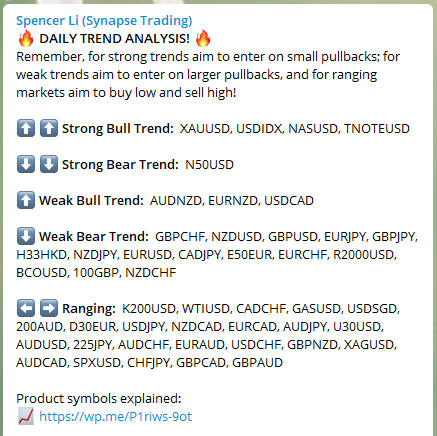

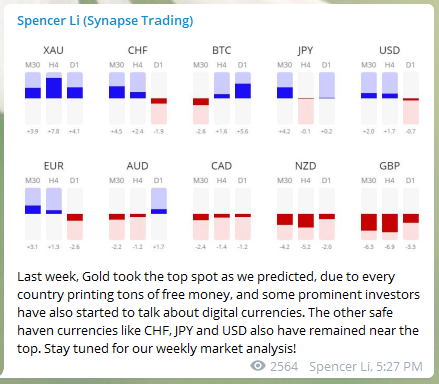

While most of the markets are sideways or in weak trends, we see that a few things continue to remain strong, such as Gold, the US dollar, and the NASDAQ.

Upcoming News for the Week

How is the Economy Faring?

There seems to be a large disparity between various sectors, and last week several famous fund manager like David Tepper and Stanly Druckenmiller said that they feel the market is too expensive at current levels.

Some good news on the virus front, with a potential vaccine being found. It might still take months before we see an end product, but at least this gives us some hope.

As the US gradually reopens its economy, so far we have not seem any sharp spike in cases, so that is a good sign. However, since there is a delay between infections and testing, only time will tell.

Is Gold Starting a New Super Trend?

We have been getting some solid buy signals for Gold, and the charts show that it has potential to break new highs.

NASDAQ vs. S&P 500

There is a curious divergence on the NASDAQ versus the S&P 500, which is due to the fact that tech stocks have fared much better and recovered faster than the rest of the economy.

Since this divergence could persist or even widen, it makes sense that we should continue focusing our investments in tech counters.

Since my visit to Silicon Valley and various offices there in 2018, I have been very bullish on the tech sector.

Choosing the Right Sectors to Invest In

Looking at where the big money is flowing, Warren Buffett is selling off the airlines and financial stocks, while the Saudi sovereign fund is buying up huge chunks of US stocks.

Best Tech Stocks to Invest In

Here is the shopping list of my favourite tech stocks, which I plan to buy and hold for the long-term.

- Alibaba (BABA)

- Tesla (TSLA)

- VISA (V)

- Mastercard (MA)

- Facebook (FB)

- Amazon (AMZN)

- Mircrosoft (MSFT)

- Apple (AAPL)

- Google (GOOG)

- Disney (DIS)

- Nvidia (NVDA)

- Shopify (SHOP)

- Paypal (PYPL)

- Salesforce (CRM)

Start Your Trading Journey Today!

If you are interested to start your journey with our closely-knit community, click here: https://synapsetrading.com/the-synapse-program/

Here is some feedback from our students:

“Spencer has simplified a system which allow us to identify trade opportunities from the chart. The step by step identifying the market and setups helps making technical analysis simpler to understand.” – Siong Boon

“You make it so easy to trade, just by following the 4 setups.” – Tan Jiansen

“Course is awesome with key examples and setups to start trading!” – Robert Tan

“Gd. Anyone who want to trade profitably should attend this program.” – Jason Tan

“I learn how to read charts more accurately without tedious drawing of charts and proper money management techniques. 2 thumbs up!” – Joel

To read feedback form all our past students, click here: https://synapsetrading.com/testimonials/

See you on the inside! ?

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!