Weekly Market Wrap: Tech Stocks Continue to Break New Highs!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Subscribe for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Market Recap & Upcoming Week

The past week mirrored a scene from “Braveheart,” with the Federal Reserve’s (Fed) decision to hold rates steady, echoing a strategy of careful timing.

Chair Jerome Powell signaled patience in rate adjustments to ensure inflation is thoroughly subdued before potentially easing rates to prevent a recession.

Markets responded positively, achieving an all-time high, appreciating the stable economy and the prospect of a cautious Fed.

The labor market’s robust performance, with substantial job additions, has given the Fed room to maneuver without immediate rate cuts.

The S&P 500 remained relatively unchanged despite swings, indicating that while the Fed’s policy shift is anticipated to be favorable, the transition may see moments of market turbulence.

Upcoming employment reports and tech earnings will be closely monitored for further economic insights.

Investors will be tuned in to speeches from over half a dozen Federal Reserve officials this week, seeking clarity on the central bank’s future monetary policy following the Fed’s recent rate decision.

Treasury Secretary Janet Yellen is also slated to discuss U.S. financial stability before Congress, adding to the week’s financial discourse.

The earnings season rolls on, with an array of companies across various sectors like consumer goods, healthcare, and energy sharing their quarterly results.

Key reports from Unilever, McDonald’s, PepsiCo, Ford, and Honda will offer a glimpse into consumer spending and the automotive sector’s health.

Pharmaceutical giants Eli Lilly, Amgen, and AstraZeneca, alongside oil firms ConocoPhillips and BP, will also disclose their financials.

Economic data will be lighter but still informative, with the Senior Loan Officer Opinion Survey shedding light on banking conditions, while the end of the week brings potential revisions to CPI data following an annual update.

Daily Trading Signals (Highlights)

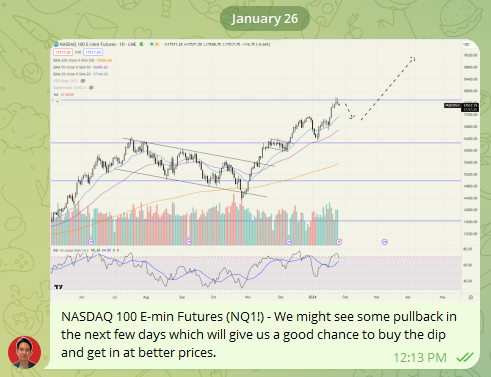

Jan 26 2024: NASDAQ 100 E-min Futures (NQ1!) – We might see some pullback in the next few days which will give us a good chance to buy the dip and get in at better prices.

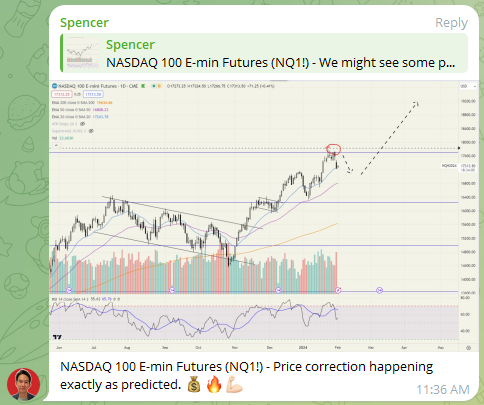

01 Feb 2024: NASDAQ 100 E-min Futures (NQ1!) – Price correction happening exactly as predicted. 💰🔥💪🏻

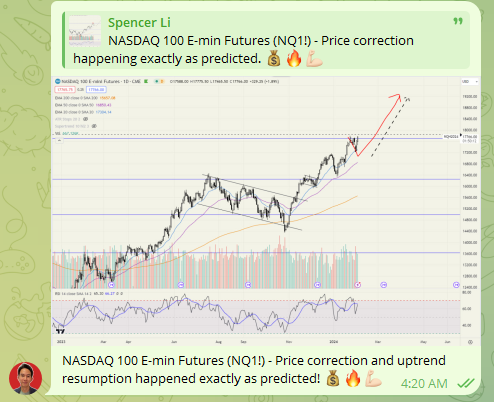

03 Feb 2024: NASDAQ 100 E-min Futures (NQ1!) – Price correction and uptrend resumption happened exactly as predicted! 💰🔥💪🏻

Join our community for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!