Subscribe for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Market Recap & Upcoming Week

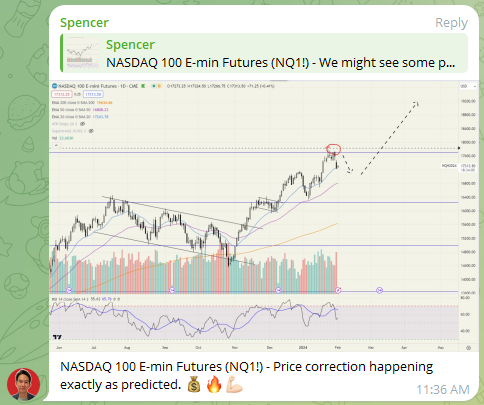

The past week saw continued momentum in the stock market, with the S&P 500 marking notable gains and several global indexes hitting all-time highs, reflecting robust market confidence.

Despite a rise in rates, equities showed resilience, buoyed by strong Q4 corporate earnings, AI enthusiasm, and solid economic growth indicators.

However, the bond market experienced losses, adjusting to renewed rate hike expectations and economic data suggesting a moderated yet persistent inflation path.

The market’s performance underscores opportunities for diversified investment strategies, focusing on sectors poised for growth as the Fed’s policy shifts.

This week, the focus shifts to a mix of political events and economic indicators that could sway market dynamics.

The political arena will be highlighted by the President’s State of the Union address, Federal Reserve Chair Jerome Powell’s congressional testimony, and the Super Tuesday primary elections, each potentially offering new directions or insights into policy and economic forecasts.

These political milestones are complemented by crucial economic updates, with Friday’s jobs report spotlighting February’s employment trends, closely preceded by data on private sector payrolls and job openings.

In the corporate world, the week is rich with earnings reports from key players across various sectors.

Retail giants Target, Costco, and Ross Stores are scheduled to unveil their earnings, providing a glimpse into consumer spending trends.

Additionally, the tech sector will also be under the microscope, with CrowdStrike and Broadcom among the companies reporting their financial performance.

These reports, coupled with the week’s political and economic events, could offer investors valuable indicators of market health and consumer confidence.

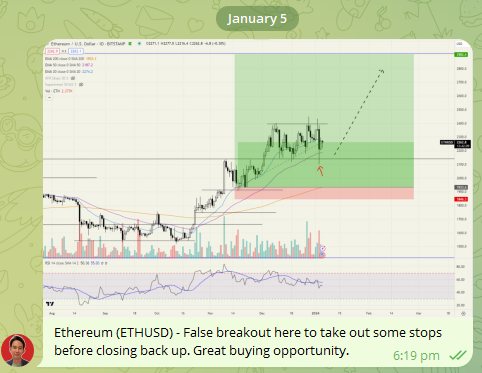

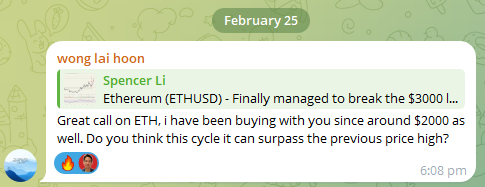

Daily Trading Signals (Highlights)

Bitcoin (BTCUSD) – Bitcoin is also on a strong upward trajectory, easily clearing the $55k level and a good chance it will hit the $60k level soon, which will put it near the previous ATHs of $69k. 🔥

Congrats! Yup $225 does sound like a good price target.

Join our community for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.