Weekly Market Wrap: Stocks & Bonds Continue to Slide

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

For subscribers of our “Daily Trading Signals”, we now also include a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technical, economics, and portfolio management:

Click here for last week’s market report (16 October 2023)

Click here to subscribe for the latest market report (23 October 2023)

Click here to see the archives of all our past market reports

Market Recap & Upcoming Week

Last week, economic stability in the U.S. seemed a facade as consumer sectors, notably staples and discretionary, showed significant declines.

High-profile retailers like Dollar General and Target faced reduced spending, a fallout from inflation and pricier fuel. This downtrend made consumer stocks less attractive, pushing investors towards funds outside the consumer-goods sector.

Despite a few exceptions like Costco and Walmart, the overall retail sector struggled, prompting a cautious sentiment among investors. Consequently, there’s a noticeable pivot towards historically resilient investments, with companies like Nike and Mondelez International coming into focus.

Market volatility defined the week, with Federal Reserve Chair Jerome Powell’s comments stirring confusion among investors regarding monetary policy. This uncertainty, coupled with soaring bond yields and geopolitical stressors like the Israel-Palestine war, led major indices to close in the red.

Mixed Q3 earnings added to the chaos, with Netflix making gains, Tesla taking a dive, and regional banks disclosing higher expenses. Amid this, the market’s narrowness was highlighted — a stark contrast to previous bull markets, with gains heavily concentrated in the largest stocks.

Smaller companies, especially those indexed in the Russell Microcap, continued to underperform, missing the bull market’s benefits. This disparity underscores a growing concern in market health, calling for a more cautious approach in anticipation of potential economic shifts.

The strength of the US Dollar continues to loom over foreign exchange markets, inducing bearish trends in pairs like EUR/USD, while Bitcoin attempts a comeback, diverging from Ethereum’s stagnant momentum. Amidst these chaotic market movements, the spotlight also shines on precious metals, with gold poised as a viable hedge, and commodities, as oil prices aim for new summits.

Parallel to the corporate earnings saga, significant economic indicators are on the horizon. The U.S. Census Bureau’s forthcoming national retail sales data for September will serve as a critical measure of consumer spending resilience.

The housing sector is also under scrutiny with imminent updates on September housing starts, existing home sales, and the NAHB’s Housing Market Index for October.

These revelations will not only paint a clearer picture of the economic recovery but also potentially sway market sentiments. Investors are advised to stay vigilant, balancing their portfolios to navigate the unpredictability, possibly favoring bonds as stocks face downward pressure.

Daily Trading Signals (Highlights)

Bitcoin (BTCUSD) – Following up from this, we have seen Bitcoin rally more than 20% from the swing lows! 💰🔥💪🏻

It has just tested the $30k level, will it be able to break new highs this time?

NZDUSD – Prices are nearing the 2nd TP, which is near the support level, as well as the trend channel bottom. 💪🏻

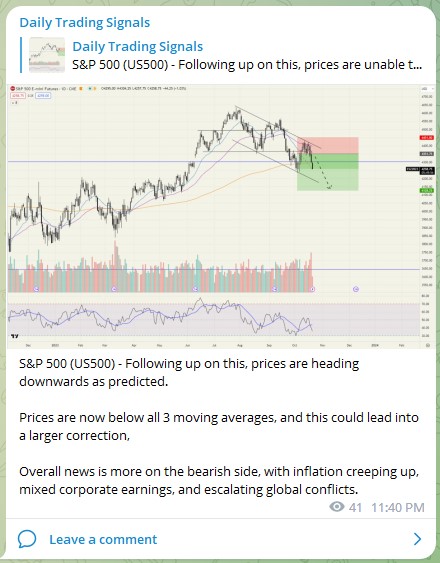

S&P 500 (US500) – Following up on this, prices are heading downwards as predicted.

Prices are now below all 3 moving averages, and this could lead into a larger correction,

Overall news is more on the bearish side, with inflation creeping up, mixed corporate earnings, and escalating global conflicts.

Gold (XAUUSD) – Looking at the weekly chart of Gold, there is a good chance that it is going to continue its uptrend and break to new highs.

Gold tends to perform well in terms of market uncertainty and in times of global conflict and wars.

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!