Weekly Market Wrap: Time for a Stock Market Reversal?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Click here to receive all these signals in real-time for only $67 a month! You will get several signals a day, and even taking just 1 trade the whole month can easily cover the fee, so what are you waiting for?

Forex Market Highlights

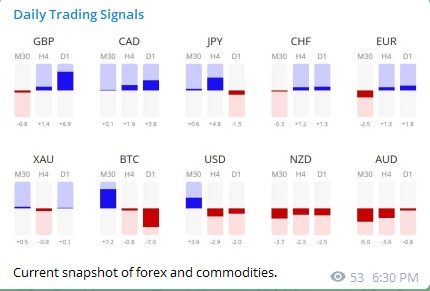

Current snapshot of forex and commodities.

CHFJPY – pullback to support level

EURCHF – this looks like the potential start of a new trend, best to wait for a pullback for a low-risk entry.

Following up on GBPUSD, it has hit the profit target at the top of the channel, good time to take profits, and wait to see how price reacts upon hitting the channel line. Ka-ching! ????

Following up on NZDUSD, it has started to move up as predicted. Continue to hold for more profits. ????

Stock Market Highlights

Once again, the trend channel of the NASDAQ has acted as support for price movements.

After breaking the trendline earlier in the day, we saw it recover and close back above the trendline by the end of the day.

However, I will be a bit weary of going long, because:

1. The short-term price action is still very much bearish, so it might be better to wait for a mini double-bottom of sorts

2. The market breadth for yesterday shows that 385 stocks made new lows while only 151 stocks made new highs.

At this point for the NASDAQ, the market seems to have found support at the trendline, but fundamentals and market breadth are not very bullish.

My strategy remains the same – buying those stocks/ETFs which have already fallen a lot, while swing trading medium-term price movements.

Following up on the NASDAQ, it will be crucial to see what happens here.

Though the trend is not that obvious for Visa (V), overall it is tending more towards the bearish/sideways direction.

One of the tech giants, Amazon (AMZN). It has been a while since it tested/broke the major trendline.

Keep watch for the next few bars within the highlighted zone.

Following up on Snowflake (SNOW), it has hit our TP, so we will now wait to see if it rebounds for another short opportunity. Congrats! ????

Crypto Market Highlights

After falling about 40% from ATHs, we can except some kind of rebound on Bitcoin (BTC).

Cosmos (ATOM) might be breaking new ATHs soon.

Fantom (FTM) also looking to break new highs.

NEAR Protocol (NEAR) breaking to new highs.

Click here to receive all these signals in real-time for only $67 a month! You will get several signals a day, and even taking just 1 trade the whole month can easily cover the fee, so what are you waiting for?

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!