Weekly Market Wrap: How Will Financial Markets Fare in 2024?

Join our Telegram channel for daily market analysis & trading tips: t.me/synapsetrading

Subscribe for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Market Recap & Upcoming Week

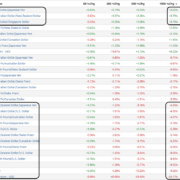

2023 closed on a high note for investors, with all 11 asset classes tracked in a common framework showing positive returns, a stark contrast to the previous year when cash was the only positive asset class.

Bonds, despite a turbulent year, have surged in the past couple of months, offering both attractive income and the potential for more price gains.

This upswing serves as a lesson on the benefits of staying invested, regardless of sometimes grim headlines.

Looking to 2024, the market may face various challenges, but optimism is warranted.

There’s a consensus that interest rates have reached their zenith, with the Federal Reserve setting the stage for potential rate reductions. Inflation appears to be easing, corporate profits are on the mend, and, except for the big gainers of the year, valuations are generally sensible.

As investors return from the New Year’s Day holiday, they face a packed week of economic data releases and a fresh round of corporate earnings.

The Atlanta Federal Reserve’s GDP projection will set the tone, complemented by insights from construction spending and factory orders.

The FOMC minutes release is highly anticipated, offering a deeper dive into the rationale behind the Fed’s latest interest rate decision, which could sway market sentiments.

The week’s highlight is Friday’s employment report, expected to draw significant investor focus, while additional labor market details will emerge from job openings, initial jobless claims, and private-sector employment data.

On the earnings front, Walgreens Boots Alliance, Conagra Brands, and Constellation Brands stand out as major companies reporting this week, potentially impacting market movements.

Daily Trading Signals (Highlights)

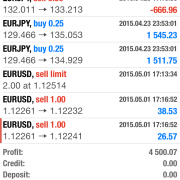

Solana (SOL) – Following up on this trade, we bought at around $58, and now it is around $113, giving up a +93% profit in just one month! Congrats to all subscribers who took this trade! 👏🔥📈

For those who missed this, the good news is that the crypto season is just getting started, and many more great opportunities will be coming in 2024.

GBPCHF – Following up on this trade, it managed to hit our first TP of 250 pips profit in just a few days, and went on to 350 pips! (for those who took half profits and used a trailing stop.)

Congrats to those who took this trade! 👏🔥💪

Join our community for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for the best trading opportunities every day across various markets, and don't want to spend hours doing the research yourself, check out our private Telegram channel!

If you're looking for the best trading opportunities every day across various markets, and don't want to spend hours doing the research yourself, check out our private Telegram channel!

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!