Is It Time to Start Buying the Stock Market Crash? (My Current Trades)

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

Last week, we saw the stock market decline for every day of the week, crashing about 15% from all-time highs, making it the sharpest decline in history.

This huge spike in volatility was excellent for short-term traders, and might also be an opportunity for bargain hunters looking to buy stocks cheaper.

I also made a short video talking about the different approaches to tackle the market crash:

Table of Contents

The Start of the Decline

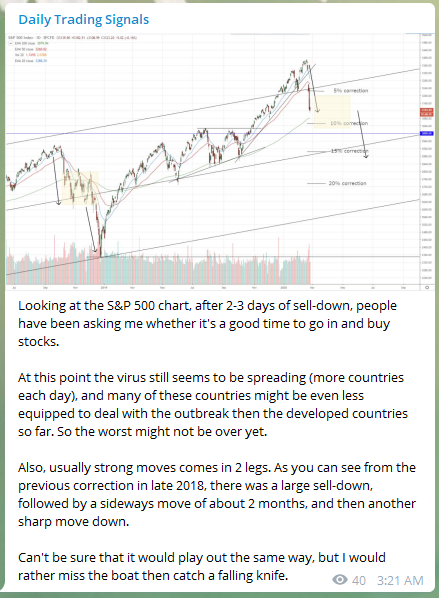

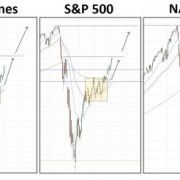

The first 2-3 days of decline was sparked after fears of a worldwide contagion of the Covid-19 virus, which saw a gap down on the S&P 500.

I started to post warnings about not trying to pick the bottom or to start buying, because I knew that a larger move was likely to come.

How Far Can this Crash Continue?

As the crash continued, I consulted my charts to plot a possible long-term roadmap, which would see a continued decline to about 15-20%, followed by a rebound and period of consolidation.

If there is a strong second wave of selling, we could see a larger sell-off to the bottom of the trendline, or the 200-moving average of the weekly chart.

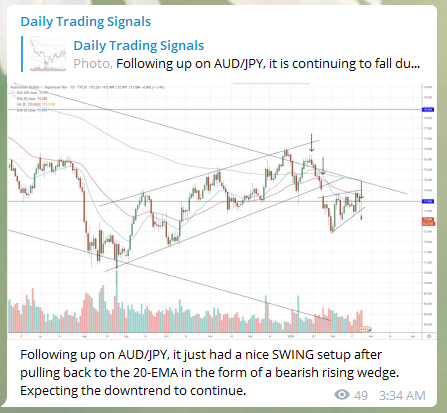

At the same time, we also started initiating short positions on Crude Oil and AUD/JPY.

How to Catch a Falling Knife (Successfully)

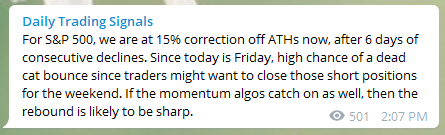

On Friday, I predicted that there would be a rebound towards the closing, since there was no meaningful pullback after 6 consecutive days of selling, and also traders would likely close their short positions going into the weekend.

So I started accumulating long positions as the market tested new lows, and true enough, there wasn’t much further decline and even had a bullish surge into the closing minutes.

I took the chance to liquidate some of my positions to lock in my profits for the weekend.

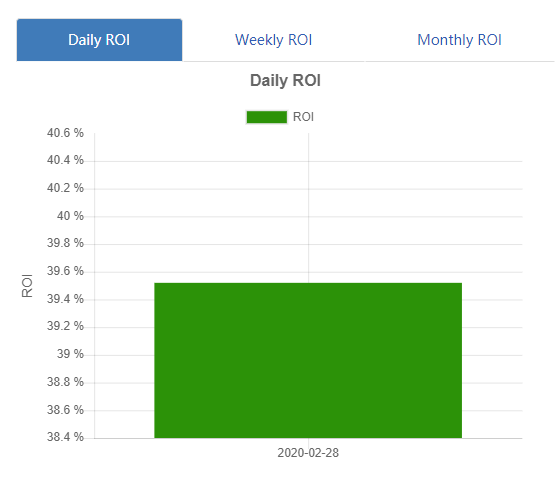

Overview of Trading Results for Friday

Overall, it was a once-in-a-lifetime exciting chance to trade such volatility, and also a great learning experience for my students as we got to observe and discuss it together in real-time.

My trading portfolio booked a net 39.52% gain, with most of the profits coming from just 3 positions:

- Short on AUD/JPY

- Short on Crude Oil

- Catching the bottom of S&P 500

Going forward, next week is going to be an excellent week for bargain hunting, and I have already posted my target portfolio allocation for my students so that we can be on the lookout for buying opportunnities.

If you would like to avoid missing out on any of such awesome trades (which we deliver on a daily basis), then you should definitely check out our training program & trading signals bundle:

https://synapsetrading.com/the-synapse-program/

See you on the inside!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!