Weekly Market Wrap: Picking the Crypto Bottom!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

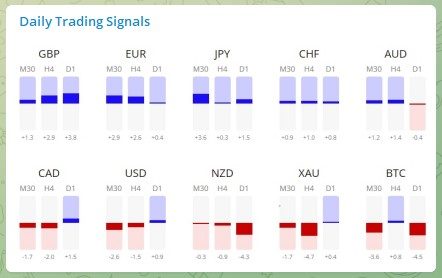

Forex Market Highlights

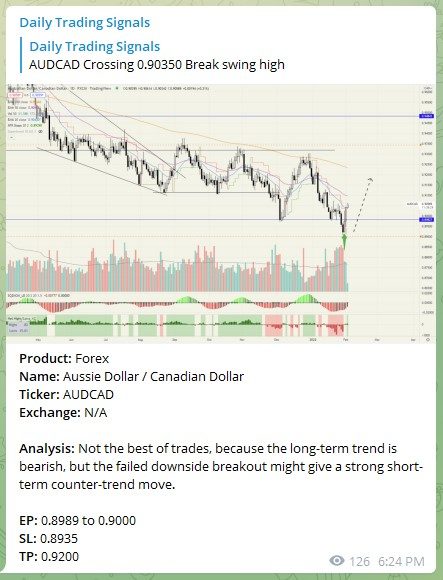

Product: Forex

Name: Aussie Dollar / Canadian Dollar

Ticker: AUDCAD

Exchange: N/A

Analysis: Not the best of trades, because the long-term trend is bearish, but the failed downside breakout might give a strong short-term counter-trend move.

EP: 0.8989 to 0.9000

SL: 0.8935

TP: 0.9200

Product: Forex

Name: Swiss Franc / Japanese Yen

Ticker: CHFJPY

Exchange: N/A

Analysis: Low-risk trend channel trade with price pulling back to the bottom of the channel.

EP: 124 to 125

SL: 123.50

TP: 127 to 128

Product: Forex

Name: British Pound / Aussie Dollar

Ticker: GBPAUD

Exchange: N/A

Analysis: Failed to cross resistance at top of the range, may test the bottom of the range again.

EP: 1.92 to 1.895, or any pullbacks

SL: 1.9233

TP: 1.8577 to 1.82

Product: Forex

Name: US Dollar / Swiss Franc

Ticker: USDCHF

Exchange: N/A

Analysis: Buying low and selling high within a trading range.

EP: 0.930 to 0.935, or any pullbacks

SL: 0.938

TP: 0.910 to 0.902

Stock Market Highlights

Following up on the NASDAQ 100 (US 100), it is nearing a crucial point in the market.

While i have closed all my shorts for this (and made a decent amount) and even bought more tech stocks this week, I do think that the market is still bearish long-term.

Hence I am looking at potential areas to short again, either within the yellow zone, or near the previous highs.

Will post again when price reaches the yellow zone.

Speculation on the NASDAQ 100 (US 1000) possible paths. I currently do not have any positions in this.

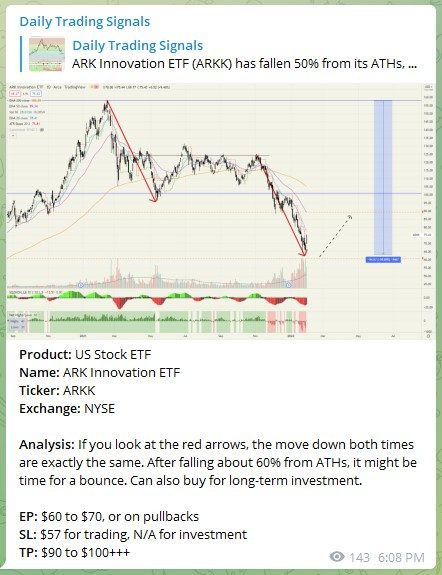

Product: US Stock ETF

Name: ARK Innovation ETF

Ticker: ARKK

Exchange: NYSE

Analysis: If you look at the red arrows, the move down both times are exactly the same. After falling about 60% from ATHs, it might be time for a bounce. Can also buy for long-term investment.

EP: $60 to $70, or on pullbacks

SL: $57 for trading, N/A for investment

TP: $90 to $100+++

Product: US Stocks

Name: Coca-Cola

Ticker: KO

Exchange: NYSE

Analysis: Surprisingly this counter has barely any correction during the recent market correction. If it breaks a new high, it could continue its uptrend.

EP: $60 to $61.50

SL: $59.50

TP: $64++

Meta Platforms (FB) gapping down 26% after poor earnings, and breaking previous swing lows.

Crypto Market Highlights

Product: Cryptocurrency

Name: Ethereum

Ticker: ETHUSD

Exchange: N/A

Analysis: After correcting more than 50% from its ATHs, we can try to do a bit of bottom-picking. This is somewhat of a higher risk trade, so take a smaller position size. Also suitable for people looking to accumulate some for long-term investment.

EP: 2000 to 2300

SL: 1900

TP: 4000+

Following up on Ethereum (ETHUSD), it is up more than 20% since we picked almost the exact bottom! ????

Overall, we were wrong on our Bitcoin analysis, but correct on Ethereum and Luna.

Product: Cryptocurrency

Name: Terra Luna

Ticker: LUNA

Exchange: N/A

Analysis: After dropping almost 60%, it might be possible for a rebound or resumption of trend.

EP: $44 to $55

SL: $42.5

TP: $66+++

Click here to receive all these signals in real-time for only $67 a month! You will get several signals a day, and even taking just 1 trade the whole month can easily cover the fee, so what are you waiting for?

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!