Weekly Market Wrap: Markets are Optimistic, but Inflation Still a Concern

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Subscribe for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Market Recap & Upcoming Week

Last week marked a significant milestone with the S&P 500 crossing the 5,000 threshold, signaling a robust market despite recent economic uncertainties.

This achievement reflects a market that has shown remarkable resilience and strength, moving beyond the recession fears that dominated headlines a year ago.

The surge in interest for “Taylor Swift” over “recession” in financial search trends illustrates a shift in public focus, underscoring a more optimistic growth and inflation outlook.

Despite the Fed’s aggressive rate hikes, the consumer sector has remained vibrant, supported by strong discretionary spending, although there are emerging signs of consumer fatigue.

The overall economic environment suggests a slowdown but not a downturn, with sectors like housing and manufacturing showing signs of recovery as the Fed prepares to pivot towards rate cuts.

The job market’s robust performance, highlighted by unexpected payroll growth, further supports the narrative of a resilient economy.

This labor market strength, coupled with a decline in consumer credit growth and a normalization in mortgage-delinquency rates, paints a picture of a healthy but cautious consumer backdrop.

This week promises to offer crucial insights into the state of inflation and consumer spending in the U.S. economy.

The spotlight will be on the Consumer Price Index (CPI) release on Tuesday, which could influence Federal Reserve decisions if inflation shows signs of persisting or declining.

Additionally, Thursday’s retail sales data will provide a glimpse into consumer behavior at the start of the year, reflecting on the broader economic health.

The homebuilder confidence index will also be released, offering further indications of the housing market’s momentum amidst ongoing economic shifts.

On the corporate front, a series of earnings reports are anticipated, with market participants keenly awaiting figures from major players such as Coca-Cola Co., Cisco Systems Inc., and Stellantis NV.

These reports could not only shed light on individual company performances but also provide broader insights into various economic sectors.

As these developments unfold, investors and analysts will be closely analyzing the data to gauge the potential impact on market trends and monetary policy decisions.

Daily Trading Signals (Highlights)

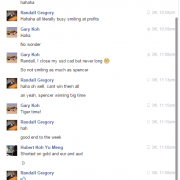

Coinbase (COIN) – Following up on this trade, we are currently up +20% profit!

Congrats to those who took this trade with us! 💰🔥💪

Cloudflare (NET) – Following up on this trade call, we are now up over +40% profit!

Congrats to those who took this trade with us! 💰🔥💪

Join our community for real-time alerts and weekly videos:

👉🏻 https://synapsetrading.com/daily-trading-signals

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!