Weekly Market Wrap: Market Rebound is Currently Overbought?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

The United States is considering sanctions on Chinese firms for their involvement in Iran’s surveillance buildup.

Despite international sanctions, Chinese state-owned companies have been shipping navigation equipment and jamming technology to Russian government-owned companies.

The United States and Brazil are joining India’s efforts to increase demand for biofuels.

Elon Musk was found not liable in a trial over his tweets about taking Tesla private, and the Federal Trade Commission is preparing a potential antitrust suit against Amazon.

Disney plans to cut 7,000 jobs and $5.5 billion in costs. Commodity trader Trafigura faces a $577 million loss after uncovering nickel fraud.

Adani plans to repay a $1.1 billion loan, while the United Kingdom’s National Health Service is in crisis due to budget cuts and the impact of Covid-19.

Chinese tech giant Alibaba is working on a rival to OpenAI’s ChatGPT.

Apple is promoting its high-end iPhones and there are signs that a stronger rebound in China will boost oil prices.

Stay tuned for more real-time updates in our “Daily Trading Signals” Telegram channel!

[Photo: Fann Mountains, Tajikistan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (05 February 2023)

Explained more about the 4 main data points:

📌 Interest rates (FOMC)

📌 Jobs data (NFP)

📌 Inflation (CPI)

📌 Company earnings

Portfolio Highlights

Weekly Portfolio Updates (05 February 2023)

Added the breakdown for stocks.

Positive numbers are net long and negative numbers are net short. I have a mix of both to provide some hedging.

Forex & Commodities Market Highlights

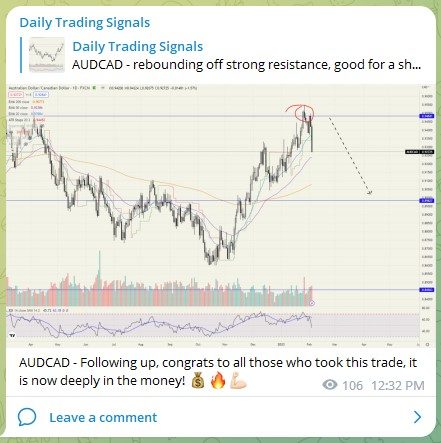

AUDCAD – Following up, congrats to all those who took this trade, it is now deeply in the money! 💰🔥💪🏻

CADJPY – Watch to see if any setups develop here.

CHFJPY – Watch to see if any setups develop here.

USDSGD (weekly chart) – Rebound off strong support after heading into oversold zone on the weekly chart.

Good reward/risk ratio to go long here.

Gold (XAUUSD) – Strong selldown after the recent NFP jobs report, and the short-term momentum has swung to the bearish side.

Not advisable to go long now, as there might be a second leg of selldown.

Stock & Bond Market Highlights

Apple (AAPL) – After its poor earnings last week, the fundamentals show a decline in revenue for the first time in many years.

Can consider taking a medium/long-term short position and scale in.

NASDAQ 100 (US100) – Currently in the overbought zone based on RSI, so it is not a good time to be buying now.

Will be expecting some correction or pullback next week.

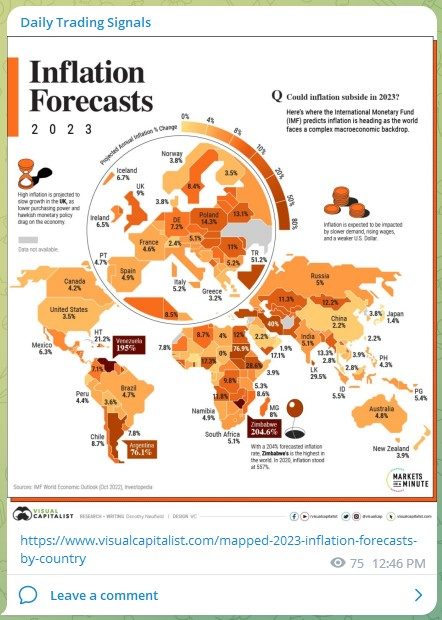

Inflation Forecasts 2023

The chart above shows the TMC’s Market Regime Scrutinizer.

It measures the market-implied odds assigned to a US recession, soft landing or strong growth regime ahead.

It is derived by scrutinizing option markets in fixed income, equity, and currencies and blending the resulting market-implied probabilities in this flagship TMC indicator.

Look for stocks to lose 30% from here, says strategist David Rosenberg. And don’t even think about turning bullish until 2024.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!