Does an Inverted Yield Curve Lead to Recession, and How to Invest in Such a Market?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Looking to better understand the economy and financial markets?

The yield curve is a must-know!

This powerful tool shows the relationship between bond interest rates and payback times, giving us valuable insights into what people expect for economic growth and inflation.

But that’s not all – the yield curve can also impact financial institutions and even signal potential recessions.

In this blog post, I’m going to talk about what the yield curve is, why an inverted yield curve can lead to recession, and how to invest in such an environment.

Table of Contents

What is the Yield Curve?

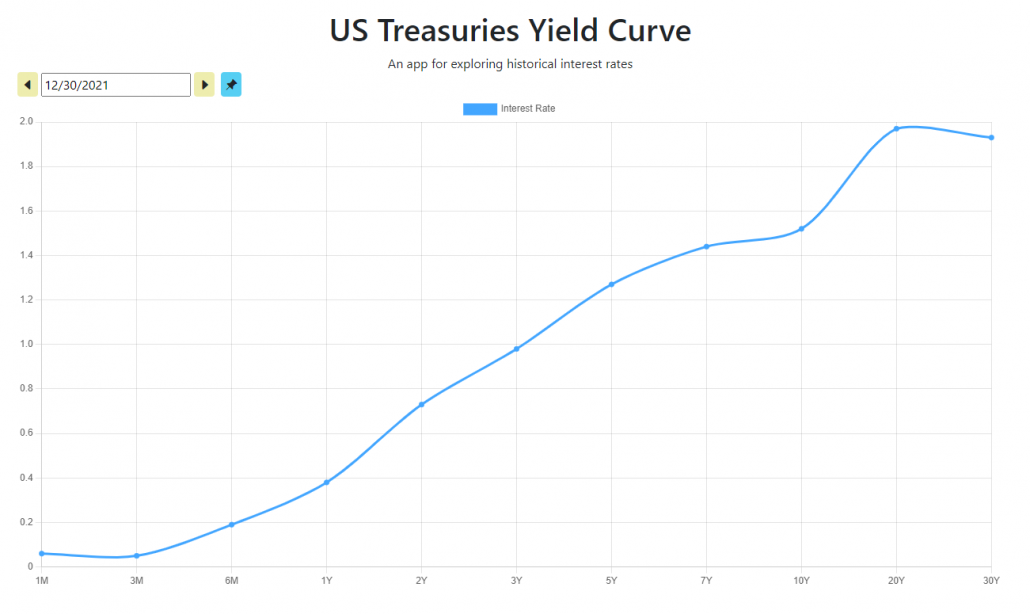

The yield curve is a chart that shows the relationship between the interest rate earned by investors on a bond and how long it will take for the bond to be repaid.

It’s usually plotted on a graph with the interest rate on the vertical axis and the time it takes to repay the bond on the horizontal axis.

When the curve is going up, it means that bonds with longer payback times have higher interest rates than bonds with shorter payback times.

This is called a normal yield curve.

When the curve is going down, it means that bonds with shorter payback times have higher interest rates than bonds with longer payback times.

This is called an inverted yield curve.

What Can the Yield Curve Tell Us?

The yield curve is a really important indicator of what’s going on in the economy because it gives us an idea of what people expect to happen with economic growth and inflation in the future.

A normal yield curve usually means that the economy is doing well and that people expect economic growth and inflation to pick up in the future, which is why they’re willing to accept lower interest rates on long-term bonds.

An inverted yield curve, on the other hand, often means that the economy isn’t doing so hot and that people expect economic growth and inflation to slow down in the future, so they want higher interest rates on long-term bonds.

What Affects the Shape of the Yield Curve?

There are a few things that can affect the shape of the yield curve.

One of the biggest factors is the level of short-term interest rates set by the central bank.

When the central bank raises short-term interest rates, it can lead to an upward sloping yield curve because investors want higher interest rates on long-term bonds to make up for the increase in short-term rates.

When the central bank lowers short-term interest rates, it can lead to a downward sloping yield curve because investors are willing to accept lower interest rates on long-term bonds due to the lower short-term rates.

The supply and demand for bonds can also affect the yield curve.

If there’s a lot of bonds available in the market, it can push down bond interest rates and lead to a downward sloping yield curve.

If there’s not a lot of bonds available, it can lead to higher bond interest rates and an upward sloping yield curve.

The expectations of market participants about future economic conditions can also influence the yield curve.

If people expect economic growth and inflation to pick up in the future, they might be willing to accept lower interest rates on long-term bonds in the hopes of getting higher returns later on.

This can lead to an upward sloping yield curve. If people expect economic growth and inflation to slow down, they might want higher interest rates on long-term bonds to make up for the lower expected returns.

This can lead to a downward sloping yield curve.

How Does an Inverted Yield Curve Lead to Recession?

Okay, so why does an inverted yield curve lead to a recession?

It’s all about how it can affect the behavior of businesses and consumers.

When the yield curve is inverted, with short-term rates higher than long-term rates, it can signal that investors are more worried about the short-term economic outlook.

This can make businesses less likely to borrow money for long-term projects, like building new factories or expanding operations.

And it can also make consumers less likely to take out long-term loans, like mortgages, to buy homes or cars.

When businesses and consumers are less likely to borrow and spend money, it can lead to a slowdown in economic activity, which can potentially turn into a recession.

An inverted yield curve can also affect the way banks and other financial institutions make lending decisions, which can further impact economic activity.

It’s important to note that the yield curve is just one indicator and no single indicator can predict the future with 100% accuracy.

But it can give us an idea of what people are expecting to happen with economic growth and inflation in the future, which can be helpful in understanding the potential risks and opportunities in the financial markets.

How to Invest in an Inverted Yield Curve Environment

So, you’re wondering how to invest during an inverted yield curve environment?

This can be tricky because an inverted yield curve is often seen as a sign of an impending recession, which is generally not good news for the economy.

However, there are a few strategies you can consider.

One option is to focus on defensive investments that tend to do well when times are tough.

These might include stocks in utilities, consumer staples, and healthcare companies, as well as bonds with shorter payback times.

Another strategy is to diversify your portfolio to include a mix of different types of assets.

This could mean stocks, bonds, real estate, and other alternative investments.

Diversification can help to spread out your risk and increase your chances of making some money over the long haul.

It’s also important to think about your investment time frame and risk tolerance.

If you have a longer time horizon and are comfortable with taking on some risk, you might be able to ride out market ups and downs and potentially benefit from a rebound.

But if you have a shorter time frame or are more risk-averse, it might be smart to be more cautious and reduce your exposure to risky assets.

Just keep in mind that investing during an inverted yield curve environment can be complicated and carries its own risks.

Concluding Thoughts

In conclusion, the yield curve is a really useful tool for understanding what people expect to happen with the economy and the potential risks and opportunities in the financial markets.

It’s important for investors, policymakers, and market participants to pay attention to the shape of the yield curve to get a sense of where the economy might be headed and what the potential implications might be.

Now that I have shared all about the inverted yield curve, what do you think are some of the best investment opportunities and strategies to use when the yield curve is inverted?

Let me know in the comments below.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!