Hook Reversal Pattern

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Table of Contents

What Is a Hook Reversal?

A hook reversal is a short-term candlestick pattern that predicts a reversal in the trend’s direction.

The pattern occurs when a candlestick has a higher low and a lower high than the previous session’s candlestick.

This pattern differs from engulfing patterns in that the size difference between the first and second bar’s body can be relatively small.

Key Characteristics of a Hook Reversal

– Hook reversals are short-term candlestick patterns that predict reversals in trends’ directions.

– The pattern occurs when a candlestick has a higher low and a lower high than the previous session’s candlestick.

– Unlike engulfing patterns, the size difference between the first and second bar’s body can be relatively small.

Understanding How a Hook Reversal Works

Hook reversal patterns are popular candlestick patterns among active traders since they occur fairly frequently and are relatively easy to spot due to the change in color of the second candlestick.

The strength and reliability of the pattern often depend on the strength of the uptrend or downtrend that preceded it.

Most traders use other candlestick patterns, chart patterns, or technical indicators as confirmation of a reversal.

This is important because the pattern occurs relatively frequently, leading to many false positives that must be discounted.

Hook reversal patterns are often classified as a type of harami or engulfing pattern because the real body of the second candle forms within the body of the previous candle.

They are also similar to dark cloud cover patterns where both real bodies are of similar length.

The key difference is that hook reversal patterns only require a small size difference, whereas harami and engulfing patterns emphasize large differences in sizes between candlesticks.

In general, harami and engulfing patterns tend to be less common and more accurate than hook reversal patterns in predicting a trend reversal.

Examples of Hook Reversals

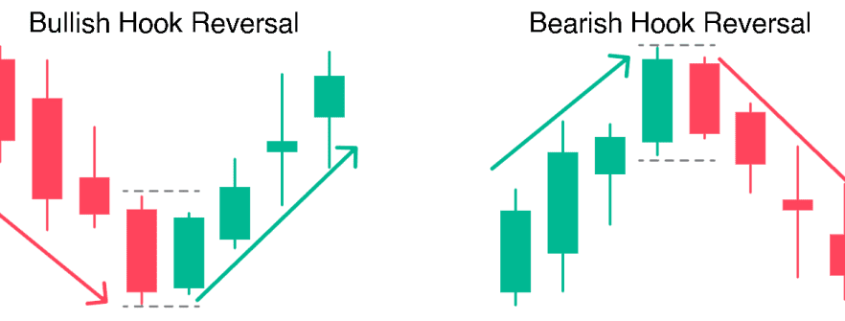

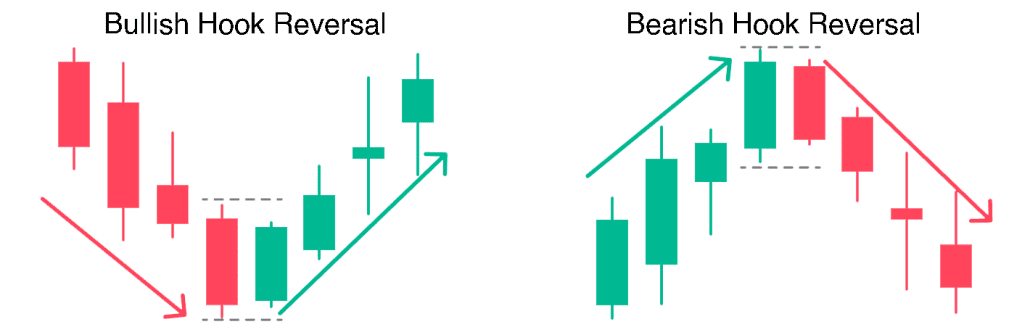

Hook reversal patterns can be either bullish or bearish reversal patterns:

– Bearish Hook Reversals: These occur at the top of an uptrend when the open of the second candle is near the high of the first candle, and the close of the second candle is near the low of the first candle. In this scenario, bulls are in control of the market early on before bears regain control and send the price sharply lower during the session.

– Bullish Hook Reversals: These occur at the bottom of a downtrend when the open of the second candle is near the low of the first candle, and the close of the second candle is near the high of the first candle. Here, bears are in control of the market early on before bulls regain control and send the price sharply higher during the session.

Traders should set take-profit and stop-loss points for these reversals based on other technical indicators or chart patterns, as hook reversals only indicate that a potential reversal is about to take place without providing insight into the magnitude of the reversal.

Concluding Thoughts

Hook reversals are relatively common and easy-to-spot candlestick patterns that signal potential trend reversals in the market.

While they offer traders a quick indication of a possible change in trend direction, they are less accurate compared to other patterns like harami or engulfing patterns.

For this reason, traders are advised to use hook reversals in conjunction with other technical indicators or chart patterns to confirm the signal and determine the magnitude of the reversal.

Proper risk management, including setting stop-loss and take-profit points, is crucial when trading based on hook reversal patterns.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

The Synapse Network is our dedicated global support team, including event managers, research teams, trainers, contributors, as well as the graduates and alumni from all our previous training program intakes.

Leave a Reply

Want to join the discussion?Feel free to contribute!